Hello, I’m Lehman (@Lehman1980).

It has been about two weeks since the last article, and the market is in a stalemate waiting for catalysts.

US stock holdings status

This is the SBI Securities account summary. (as of close on December 10)

In addition to the above, there is about 7,000 USD of buying power remaining. Since the last article,the balance of holdings has decreased by about $400.

S&P 500 Index

At the beginning of December, it underwent about a 2.5% short-term correction from its all-time high, but rebounded quickly on the 5th, and since thenhas moved in a narrow range of 3100–3150 points.

(Close on November 27: 3153 points → intraday December 3: 3070 points → close on the 10th: 3132 points)

Partial sale: MCD10

Full sale: GSK40

Additional purchases: RDSB10, WBK30

This week’s stock topics

This is the heat map of the S&P 500 index constituents for this week (December 4 to December 10). (Source: FINVIZ)

Among the previously held stocks,MO has been performing well since early November.

Outside of held stocks, technology (excluding networking equipment), financials, and consumer staples sectors are performing well.

BTI, RDSB, and WBK ADRs show only small price Movements.

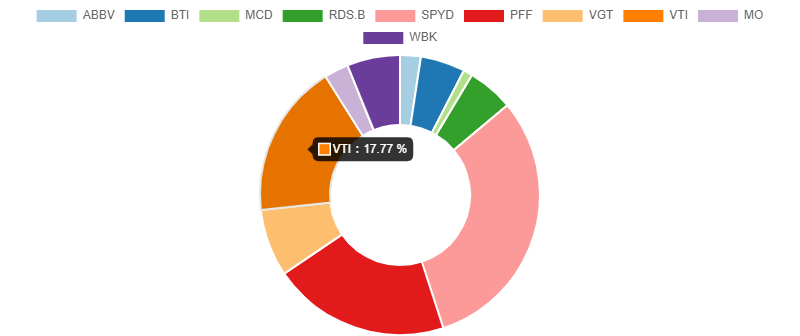

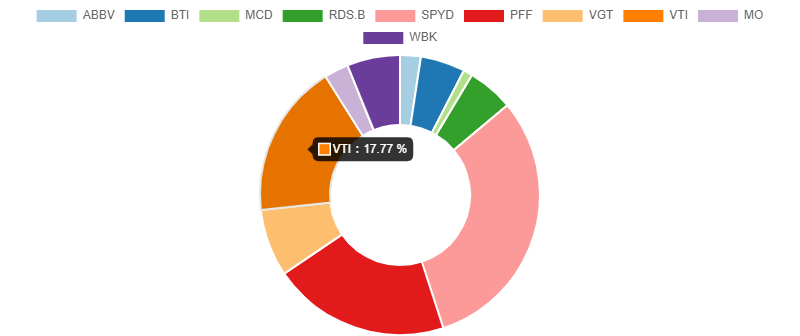

Current portfolio

Because I sold some holdings, the ETF portion has risen to about 77% of the total.

Stocks under consideration for future purchases

In addition to currently held stocks, I would like to target pullbacks in previously held BHP, GSK, KO.

Meanwhile, CSCO has fallen more than 9% in the last month, but it doesn’t seem to have bottomed yet.

T is also still on watch.

As for new stocks, I am considering NGG, QCOM, CMCSA, VZ.

NGG (National Grid - UK ADR - public sector): operates electricity transmission and gas supply in parts of the UK and US.

Price: $58.43 Expected annual dividend: $3.00 Dividend yield: 5.13%

Dividend payout ratio is about 90%. There is little room for earnings growth, but operating margin is kept above 20%.

QCOM (Qualcomm - high-tech sector): world leader in smartphone chipsets. Snapdragon series.

Price: $84.11 Expected annual dividend: $2.48 Dividend yield: 2.94%

CMCSA (Comcast A shares - consumer discretionary sector): engages in CATV and content businesses nationwide. etc.

Price: $42.77 Expected annual dividend: $0.84 Dividend yield: 1.96%

Has been increasing dividend for 10 consecutive years with rising revenues and profits. Payout ratio around 30%, with room for more dividend growth.

VZ (Verizon - high-tech (telecommunications) sector): the second-largest wireless carrier in the US. The largest is AT&T.

Price: $61.23 Expected annual dividend: $2.46 Dividend yield: 4.02%

Similar to KDDI in Japan. Has increased dividends for 12 consecutive years. As a telecommunications infrastructure company, it maintains a high profitability with operating margin above 50%.

The stock price started rising in mid-November after bottoming near $55.

Summary

For now, the market is in a wait-and-see mode, so even with year-end bonuses, it is a time to curb the urge to overtrade and be patient.

Personally, if there is a significant dip due to potential tariffs or other events,

I might buy a little more within the year or convert to dollars, and the stance may remain on hold until the beginning of the new year.

Individual investors do not have to achieve monthly gains every month, so do not push too hard now.

If you really want to buy, consider gradually accumulating ETFs like VTI or PFF to aim for long-term returns!