[US Stocks] Portfolio as of November 27

Hello, this is Lehman (@Lehman1980).

About two weeks since the last article, I will again write about how unrealized gains and losses have been moving.。

U.S. stock holdings

This is the SBI Securities account summary. (Closing price on November 27)

In addition to the above, there is about 4,300 USD of buying power remaining.

In the past two weeks, with some adjustments, the major U.S. stock indices have continued to reach all-time highs.

S&P 500 Index

(Close on November 1: 3066 points → Close on November 15: 3120 points → Close on November 27: 3153 points)

Since my portfolio is centered on high-dividend stocks, some unrealized gains have fallen significantly.

Also, WBK declined further because of being charged by Australian authorities for money laundering, making a price reversal difficult.

Some profits were realized in light of the above situation.

https://www.bloomberg.co.jp/news/articles/2019-11-20/Q195L0DWRGG101

Partial sales: ABBV, GSK

Full sale: BHP, CSCO, T

Additional buys: BTI, PFF, VGT, VTI

This Week's Stock Highlights

This week’s heatmap of S&P 500 constituent stocks for the period November 20 to November 27. (Source: FINVIZ)

Among previously held stocks, ABBV recovered after profit-taking and resumed an uptrend. MO has been strong since early November. MO remains solid,

Outside of held stocks, the healthcare sector has been particularly strong.

Among ADRs, BTI is performing well and raised full-year guidance yesterday. RDSB and WBK are down.

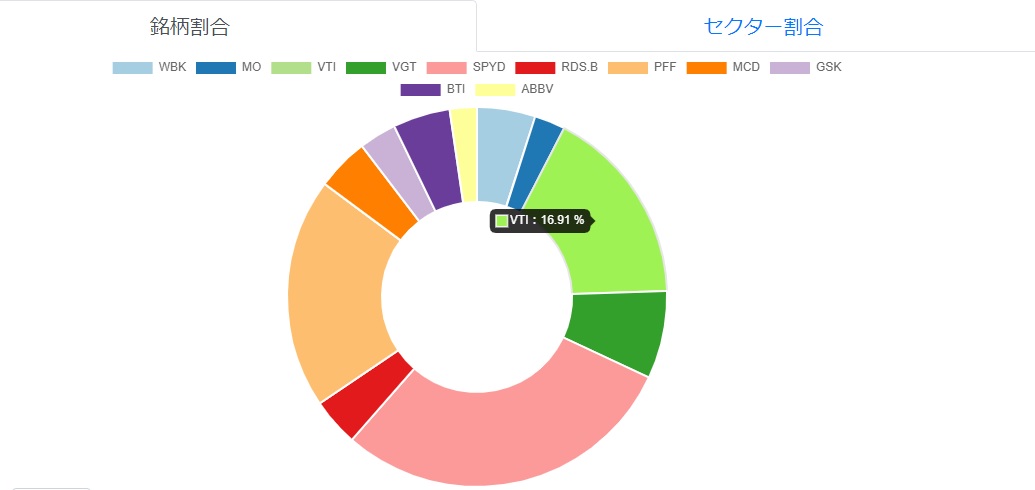

Current portfolio

Main dividend receipts (post-tax)

Finally, I will list the main dividend receipts for November.

Well then, until next time!

| Received Month | Asset | Amount (USD) |

| 201911 | T | 29.40 |

| 201911 | PFF | 28.67 |

| 201911 | ABBV | 26.95 |

The End