[US Stocks] Portfolio as of November 15

Hello, Lehman (@Lehman1980) here.

Two weeks have passed since the last article, and I will write about how unrealized gains and losses have moved.。

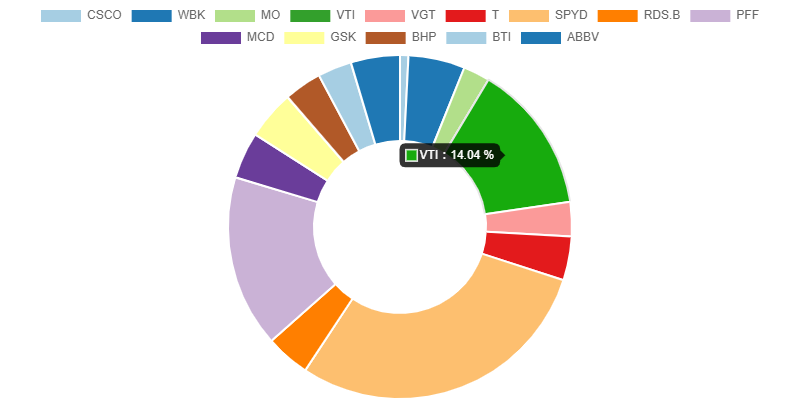

U.S. stock holdings

This is the SBI Securities account summary. (close price on November 15)

In addition to the above, there is about 3,900 USD of buying power remaining.

From late October up to now, these two weeks, the U.S. stock market has been in an uptrend.

The S&P 500 index has hit multiple all-time highs.

(End of day November 1: 3066 points → End of day November 15: 3120 points)

My portfolio has slightly realized some gains as well, updating to a record high unrealized gain of +1950 USD.

Tech and manufacturing have had varied earnings by company,

so I sold all CSCO before its quarterly earnings release.

Then, by chance, the outlook looked poor, and the stock price dropped sharply after the earnings release.

A few days after the earnings release, I repurchased 10 shares.

Also, I started buying a changing ticker, an ETF called VGT.

I was unsure whether to choose MSFT, but for the time being, I opted for the ETF.

On the other hand, WBK, which I held through earnings, is down about 5%.

New purchase: 8 shares of VGT

VGT stands for “Vanguard Information Technology,” a U.S. information technology stock ETF.

Many bloggers have analyzed it, but I will include Yutan’s link.

https://yutan-investment.com/?p=1459

<Features of VGT>

Number of holdings: 336

Top holdings: MSFT, AAPL, V, MA, CSCO, INTL, ADBE

In particular, MSFT and AAPL together account for about 30%.

Since CSCO is included, I think I will eventually consolidate into VGT.

Expense ratio: 0.1%

This week's stock topics

This is a heatmap of S&P 500 constituents for the week (November 8 to November 15). (Source: FINVIZ)

Among my existing holdings, ABBV and MO are doing well. On the other hand, CSCO (-7.6%) has been underperforming.

Among ADRs, GSK is faltering. Replacements BTI and BHP are doing well. WBK has dropped significantly.

Portfolio status

All is visible, so please feel free to compare with other investors’ portfolios.

https://www.portfoliochecker.com/users/397/

Main dividend receipts (after tax)

Finally, I will list the main dividends up to October. They have been increasing smoothly, which is pleasing!

Well then, see you at the next edition!

| Receipt date | Ticker | Amount (USD) |

| 201907 | MO | 28.72 |

| 201908 | BTI | 24.34 |

| 201909 | AGG | 17.06 |

| 201909 | VTI | 25.15 |

| 201909 | SPYD | 77.36 |

| 201910 | MO | 54.47 |