[US Stocks] Portfolio Review Proposal

Hello, I am Liman (@Lehman1980).

Following the previous article, I purchased ADRs and increased the weight in individual stocks, so I will write about reviewing the portfolio.

Portfolio review

US stock holdings

This is the SBI Securities account summary.

I have swapped the individual stocks as follows.

I limited high tech to CSCO only and sold KO, which had strong earnings.

The five purchased stocks are all high-dividend ADRs, with a current dividend yield over 4.5%.

Also, BHP (mining), RDSB (oil), WBK (bank) are sectors I am holding for the first time.

Note that from October 14 to 18, there was a rise in stock prices, and the closing price shows an unrealized gain of about 0.8%.

Previously: ABBV, CSCO, KO, MO, MSFT, PYPL, T, V

Currently:ABBV,BHP,BTI, CSCO,GSK, MO,RDSB, T,WBK (new stocks are in bold)

(Banks that reported strong results this week such as JPM, KO rose. Meanwhile tech, JNJ, BA fell. Image: closing price on October 18. Source: FINVIZ)

Current portfolio and balance review

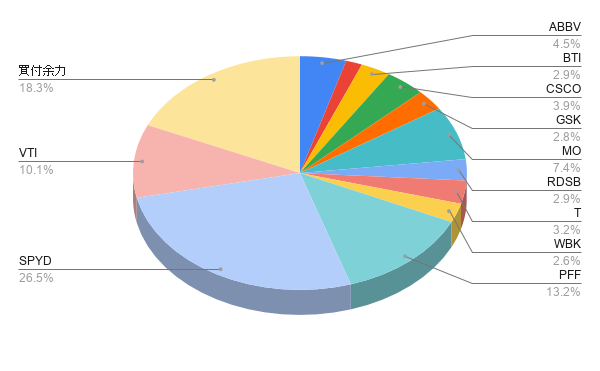

This is a pie chart of the above holdings. Over the past two weeks, I have been conducting rebalancing in parallel.

In the first article, I wrote about the core-satellite ratio, and I have decided to revise it this time.

Core: ETF trio (85% → 60%)Satellite: 10 individual stocks (6 → 10 stocks, 40%)

For the next year or so, the US stock market is expected to be more risky, so I will increase high-dividend individual stocks.

(As of October 20, 2019)

Core consists of VTI (20%), SPYD (25%), PFF (15%), and the mix has been adjusted.

Satellite comprises ABBV, BHP, BTI, CSCO, GSK, MO, MSFT, NGG, RDSB, T, WBK among the 10 stocks, each 4% (previously 2.5%).

Also, satellites will be reviewed from time to time for any temporary increases or replacements depending on individual movements.