[US Stocks] Portfolio as of November 1st

Hello, I’m Lehman (@Lehman1980).

After reviewing the portfolio, I will write about how the unrealized gains and losses are moving.

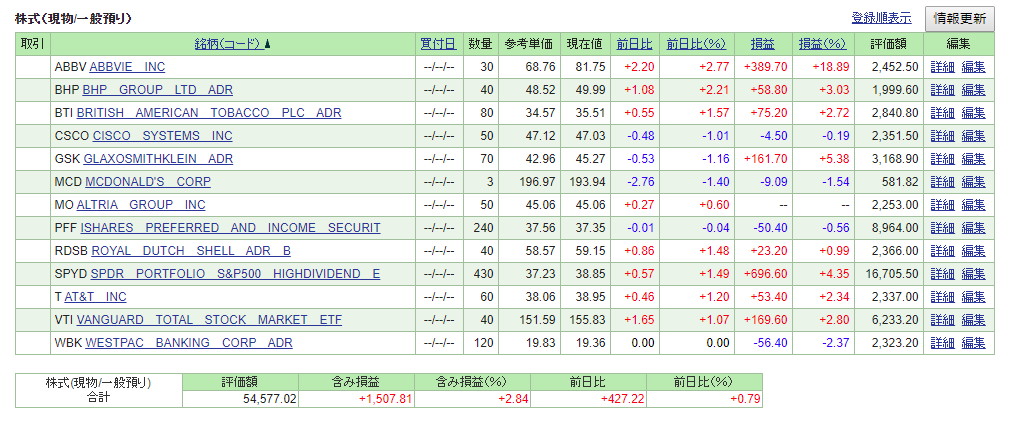

U.S. stock holdings

This is the SBI Securities account summary (end of trading on November 1).

From this time, for readability I have transcribed by manual entry. In addition to the below, there is about 6,300 USD of buying power remaining.

In the past two weeks, the U.S. stock market trended upward.

The S&P 500 index hit new all-time highs three times (October 29 and 30, and closing on November 1 at 3,066 points).

My portfolio also reached its all-time high unrealized gains of +1,500 USD.

There was a period when all positions were in positive territory, but now a few have turned negative.

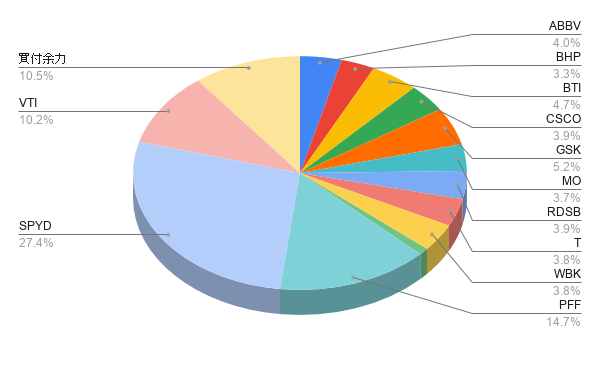

Rebalancing is almost finished, and I’m adopting a stance of gradually adding to VTI.

New purchase: 3 shares of MCD

I placed a limit order to buy the dip in McDonald’s (MCD).

As a 10th potential holding, I am considering MCD and MSFT, and plan to hold both going forward.

If so, I intend to reduce MO’s holding percentage.

This week's stock highlights

This week’s heatmap of S&P 500 constituent stocks (week of October 28 to November 1). (Source: FINVIZ)

Among existing holdings, ABBV (+6.8%) and T (+5.5%) performed well, while MO (‑3.7%) and CSCO (+0.2%) did not.

Among ADRs, GSK stands out. It broke out of the box range as expected and is now in the 45-dollar range with an upward trend.

Current portfolio status

As mentioned earlier, rebalancing is largely complete.