[US Stocks] A portfolio created by the forty-something generation with a middle-to-low risk appetite

Nice to meet you. My name is Lehman1980 (Lee-man), a part-time investor in my forties.

I run an investment blog focused on real estate investments (https://saitama.website/).

This time, I was asked by GogoJungle to write an article about investing in U.S. stocks.

I have already been trading Japanese stocks and mutual funds, but I’m considering writing for people who are new to direct investment in U.S. stocks and are interested in them.

So I’m thinking, could I write an article for that audience?

Since this is my first article, I’d like to write about my investment stance on U.S. stocks and my portfolio.

Investment Stance

Regarding the U.S. stock market, I have a cautiously optimistic stance.

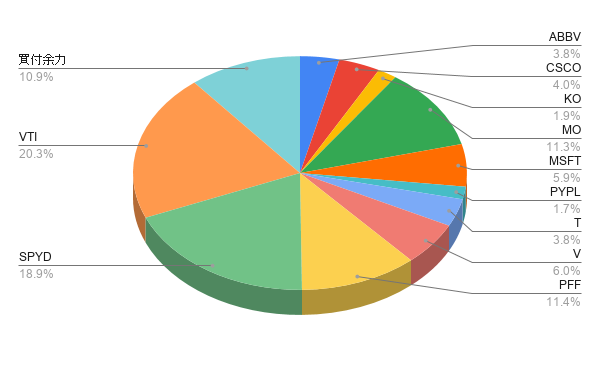

My portfolio uses a core-satellite strategy, with 3 core ETFs (85%) and 6 satellite individual stocks (15%).

(As of October 2019)

Core consists of VTI (35%), SPYD (40%), and PFF (10%), with a focus on high dividends.

Satellites are ABBV, CSCO, KO, MO, MSFT, PYPL, T, and V.

Originally, it would be 2.5% each for 6 stocks = 15%, and MO alone ended up being 10% due to dollar-cost averaging.

It’s clearly far from the guidelines, haha.

By overweighting ETFs and benefiting from overall market upside, and by keeping high-dividend ETFs at 50%,

I built a portfolio with a focus on income, aiming for a somewhat lower-risk, mid-to-low risk profile.

Here, risk is defined by volatility; I’ve categorized it roughly as follows:

High risk: Growth stocks (non-dividend), small-cap stocks, emerging market stock ETFs

Mid risk: Index ETFs such as S&P 500, Dow Jones, Nikkei 225, developed markets

Mid-to-low risk: Large-cap high-dividend/value stocks and high-dividend ETFs, investment-grade corporate bonds, preferred stocks, etc.

Low risk: High-grade government bonds (Japanese government bonds, U.S. Treasuries, etc.)

There is daily price movement, and I plan to rebalance as appropriate.

Holdings ETF Information

VTI (Vanguard Total Stock Market ETF) since inception average return: 7.25% per year (inception: 2001)

SPYD (SPDR S&P 500 High Dividend ETF) since inception average return: 11.75% per year (inception: 2015)

PFF (iShares S&P US Preferred Stock ETF)setting since inception: 4.36% per year (inception: 2007)

Distributes investments across preferred and hybrid securities that individuals rarely can purchase.

Less volatile, closer to bond ETFs in positioning than stock ETFs.

Holdings Information

For the holdings, sector allocation and reasons for selecting the stocks are provided. (Image: close on October 4. Source: FINVIZ)

Technology Sector (High Tech)

CSCO (Cisco Systems): One of the largest network equipment and solutions providers

PYPL (PayPal Holdings): Online payments and remittance giant (founded by Elon Musk during Tesla’s venture)

MSFT (Microsoft): Software giant

V (Visa): Largest payment system

Healthcare Sector (Pharmaceuticals)

ABBV (AbbVie): Chicago-based biopharma company, a world leader in new drug development

Consumer Goods (Essential Goods)

KO (Coca-Cola): Well-known major soft drink company

MO (Altria Group): Domestic tobacco manufacturer with Philip Morris spun off

Communication Services (Telecommunications)

T (AT&T): The largest American telecommunications holding company, also owning Warner Bros. as a subsidiary.

Currently, I’m continuing to select individual stocks and rebalance to gradually increase ETF weight,

with the aim of achieving stable annual dividends.

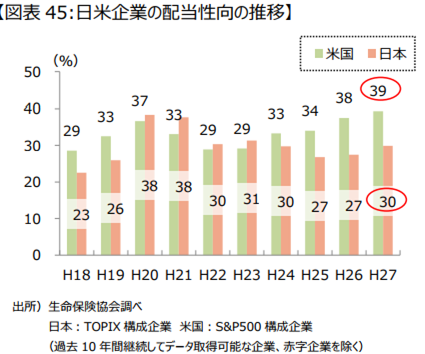

Direct investment in global companies offers higher dividend payout ratios compared with Japanese companies, which I believe is a key feature of U.S. stock investing.

As a mid-term goal over five years, I aim for a management scale of 150,000 USD and annual dividends of 6,000 USD.

See you next time!