The entry method of Engolfinber that enables the fastest entry

この記事は 【エンゴルフィンバーを完全理解!プライスアクションを利用した最速エントリー方法】 でより詳しく解説されています。 |

『エンゴルフィンバー』

Some of you may be hearing about this for the first time, but an engulfing bar is one of the price action patterns.

Price action is a method of reading investor psychology from candlestick price movement to determine high-probability entry signals.

In other words, if you can read engulfing bars from the chart, you can not only anticipate the market’s next move, but also potentially transform your trades by combining them with indicators or methods you already use to achieve even higher win rates.

This article covers:

・Engulfing bar explanation

・Complex engulfing bars

・Entry methods using engulfing bars

・Differences from outside bars

and other topics that are not often covered elsewhere.

Price action for the fastest entry

Have you ever thought, “If only I had known the entry point of the trend a little earlier, I wouldn’t have lost”?“If only I had known the entry point of the trend a little earlier, I wouldn’t have lost.”There are times you might think that.

Since indicator buy/sell signals wait for the close to form a signal, they are always late to light up.

Also, some indicators light signals by considering the current price as a whole, which can cause repainting (signals based on past time entries).

However,price action is judged from price movement (candlestick patterns), so

you can detect entry signals earlier than indicator buy/sell signals.

Useful price actions include inside bars, outside bars, and pin bars; this article focuses on engulfing bars.

Now, let's dive into a detailed explanation of engulfing bars.

5 kinds of price action are automatically detected precisely by MT4 Indicator |

Engulfing bar in detail

An engulfing bar is a kind of “inside bar” in price action, in simple terms.

(Note: Engulfing bars differ slightly from the commonly explained engulfing patterns.)

① Definition of Engulfing Bar

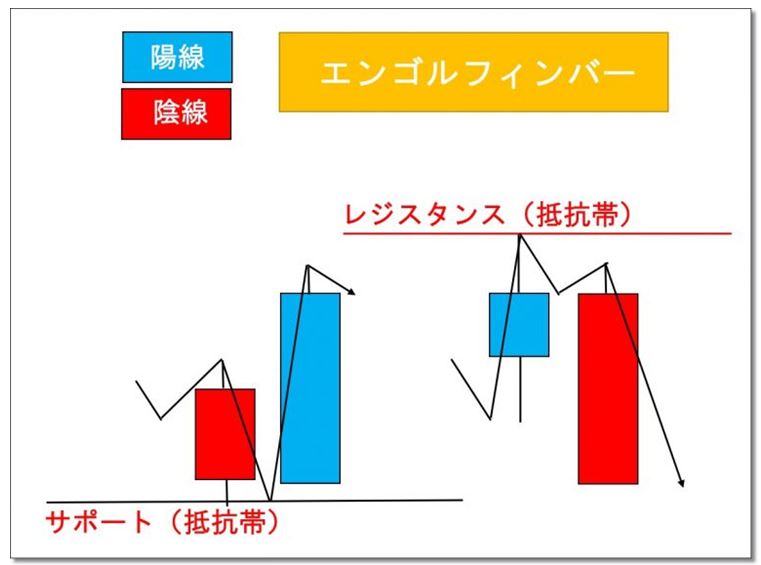

First, visually confirm the engulfing bar. Please look at the image.

Visually it’s easy to confirm, right?

Now, let’s explain the basic definition of an engulfing bar.

As you check the figure above, read the definitions below.

Definition of a bullish engulfing bar

・The previous candle is bearish. The next candle is bullish.

・The opening price of the previous bearish candle is confirmed by the close price of the next bullish candle.

・Also, the high of the previous candle is updated as well.

If these three conditions are met, it’s a bullish engulfing bar.

Definition of a bearish engulfing bar

・The previous candle is bullish. The next candle is bearish.

・The opening price of the previous bullish candle is confirmed by the close price of the next bearish candle.

・Also, the low of the previous candle is updated as well.

If these three conditions are met, it’s a bearish engulfing bar.

② Rationale for Engulfing Bars

In words, an engulfing bar is a candle whose body and wick from the previous candle are both updated in the opposite direction by the next candle’s body and wick, thus confirming the pattern.

The characteristic is that both the body and the wick update in the opposite direction.

Candlesticks focus on four prices: high, low, open, and close.

Even when you compare the bodies or the wicks of the previous candle, they update in the opposite direction.

In other words,

the previous candle’s body is completely negated → implying a reversal.

This is the implication.

Now, let’s look at a bullish engulfing bar with an image.

In the above figure, both the high and the body update in the opposite direction and are confirmed.

This is a bullish engulfing bar.

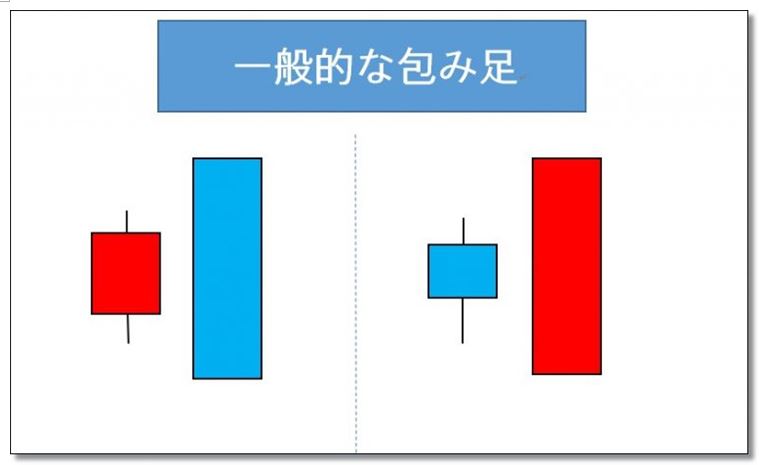

③ Difference between Engulfing Bar and Inside/Outside Bar

Some people call engulfing bars “inside bars,” but

“Is engulfing bar really the same as an inside bar?”

Engulfing bars are similar to the typical inside bar definitions but have some differences, which we’ll explain here.

In stocks and futures, the usual inside bar is defined as the high and low of the first candle being entirely contained within the body of the second candle.

Let’s check with an image.

This inside bar definition is only realized when price jumps and candles start; in the liquid FX market such price jumps are less common.

Furthermore, a price action closer to an engulfing bar is the outside bar, where both high and low are updated.

| ※ Regarding outside bars,【FX’s engulfing and harami patterns fully explained! Reversal signals you must not miss as a pro!】explains them in detail. |

The point is that the previous candle’s body is enveloped by the next candle’s body, so engulfing bar is described here as a type of engulfing pattern.

Beautiful Engulfing Bars and Deformed Engulfing Bars

Engulfing bars can carry multiple meanings depending on their shape.

This section summarizes three points:

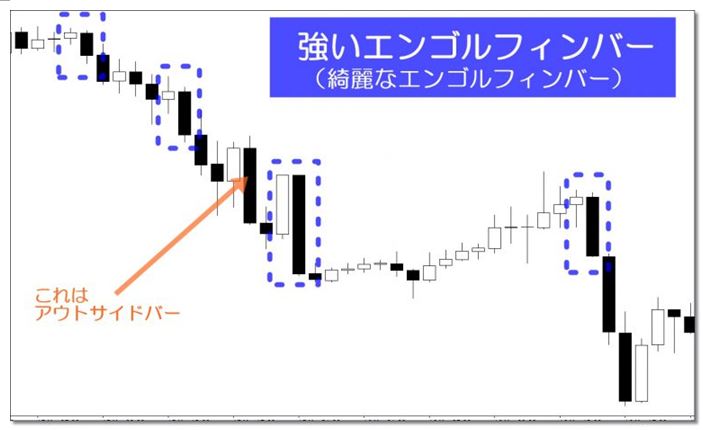

① Strong engulfing bar

② Weak engulfing bar

③ Deformed engulfing bar

① Strong engulfing bar

A strong engulfing bar is a clean engulfing bar.

In other words, the engulfing bar that is obvious to anyone as an engulfing pattern is the strong form.

This isn’t limited to engulfing bars.

It’s also a typical formation for chart patterns like double tops/bottoms and even in Dow Theory’s five waves.

Now, let’s pick out strong engulfing bars on a chart.

With a pullback, you can see the decline accelerate starting from the engulfing bar.

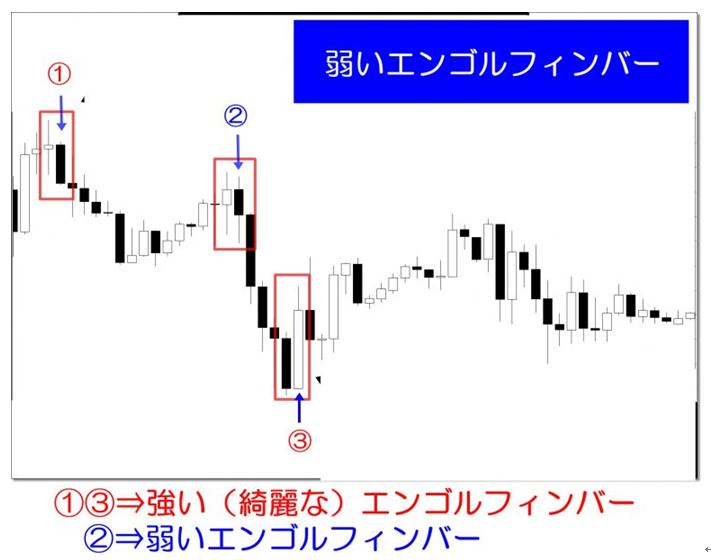

② Weak engulfing bar

We previously described strong bars, but engulfing bars can also be weak and lack momentum.

First, look at the image.

Compared to the strong engulfing bars ① and ③, can you identify the differences with ② weak engulfing bars?

② weak engulfing bar is where the low (wick) and the body of the previous candle update in opposite directions, so it is indeed an engulfing bar.

However,the body of ② weak engulfing bar does not update the previous low to confirm it.

In other words, the candle closes without finishing at the end of the session, so this engulfing bar indicates a slight balance between buyers and sellers and is a weak engulfing bar.

Thus, when in doubt, it is prudent to avoid trading.

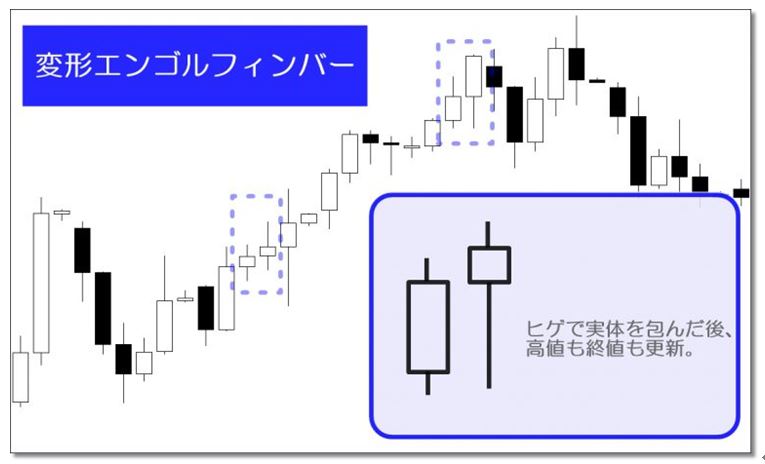

③ Deformed engulfing bar

Next is the deformed engulfing bar.

First, check the image.

The deformed engulfing bar first envelopes the body of the previous candle, then updates the wick and close in the direction of the move.

This pattern can appear occasionally within a strong swing.

However, because it appears within momentum, it is not suitable as a reversal entry for pullbacks or retracements.

Furthermore, I personally would not enter, due to the risk of catching a top.

If you use it, it’s better to already be in a position and use it for trailing stops.

So far we have explained various engulfing bars; you must create your own rules on which patterns to adopt and which to avoid.

In my case, I only enter on clean engulfing bars.

Engulfing bar entry methods

We’ve explained what engulfing bars are up to this point.

So, when using engulfing bars as an entry trigger, how should you enter? It’s the same method as outside bars, inside bars, and pin bars.

Other price action patterns are summarized here, ⇒【Win with candlestick price action! FX’s 7 strongest signals — definitive guide】for details. |

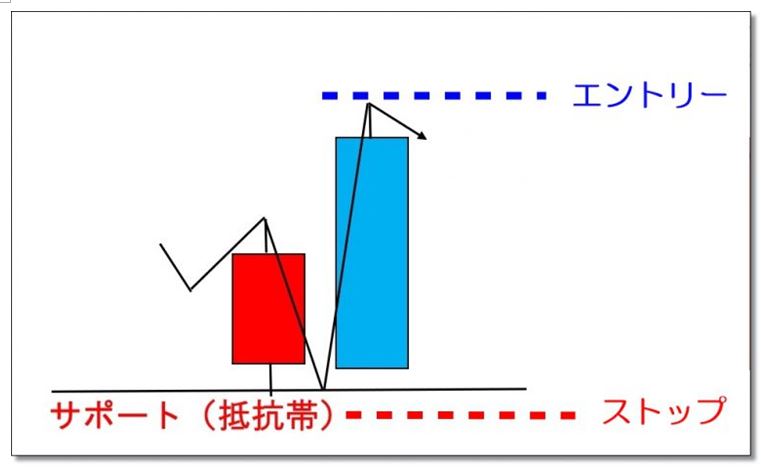

Here, we will explain the bullish engulfing bar entry method as an example.

(If shorting, the entry and stop are reversed.)

Now, please look at the images.

Engulfing bar entry steps

① Confirm the engulfing bar at the reversal point.

※Note

Engulfing bars appear frequently on charts.

Be careful not to use only reversal-point engulfing bars, or it won’t work at all.

② Place a buy limit slightly above the engulfing bar’s high (high + spread).

③ Place the stop slightly below the engulfing bar’s low.

That is the engulfing bar entry method.

Fusion of Engulfing Bar with Methods

When using reversal price actions such as inside bars, outside bars, and pin bars, combine with trusted methods or support/resistance to use as entry triggers.

Typically around resistance or support levels.

There are various forms of resistance/support.

If you use moving averages (MA) in your method, you can use an MA rebound as a trigger with engulfing bars or other price actions.

If you use Fibonacci methods, you can use engulfing bars as a reversal trigger.

If you use indicators in your method, check for overbought conditions with indicators like RCI, and decide an upward confirmation using price action; you can enter earlier than the indicator’s signal.

For methods using RCI ⇒【Make the RCI method with three lines highly reliable】for details. |

Besides engulfing bars, there are price action patterns that, when combined with indicators or your own method, yield outstanding effects. For details on select price action patterns,【Win with candlestick price action! FX’s 7 strongest signals — definitive guide】refer to the guide. |

All of these lights up signals at remarkably good timing, so definitely find engulfing bars within your method.

Differences and effects of Engulfing Bar vs Outside Bar

Finally, a note on the difference between engulfing bars and outside bars.

Engulfing bars and outside bars look similar but are entirely different.

For outside bars, 【FX’s engulfing and harami patterns fully explained! Reversal signals you must not miss as a pro!】 goes into detail. |

Now, the differences between engulfing bars and outside bars: please refer to the image below.

Pay attention to the red circle on the outside bar.

After updating the previous candle’s low, the high is also updated, making it an outside bar.

In other words, outside bars show a high price update after a low break, with the body moving in the opposite direction.

Engulfing bars and outside bars look similar but are completely different.

Conclusion,

outside bars are more effective and functional than engulfing bars.

That’s the conclusion.

Engulfing bars are one price action; you may choose to discard them and only pick outside bars as part of your strategy.

5 types of price action patterns detected with high accuracy MT4 Indicator ⇒『MT4 Price Action Indicator! The long-awaited candlestick detection tool』 |

Summary

‘Aiku’s FX Blog’explains winning trading methods and trading skills!

Knowing Engulfing Bars in price action allows you to catch reversal signals on charts earlier.

Also, when you merge it with your own method, Engulfing Bars can become a powerful weapon.

Please open a chart and check your method’s entry point candlestick pattern.

Engulfing bars should be identifiable!