Free download of the 2% bankroll management Excel sheet used by professionals

This article explains in detail, 『A money management method that professionals swear by! An Excel that instantly calculates the 2% rulein detail. |

So,We will explain a money management approach that is the simplest, safest, and makes the most of leverage, used even by pros.to explain it.

When you start doing proper money management, your account balance tends to increase mysteriously.

High leverage and money management

Here, we will explain a safe and simple money management method that maximizes leverage to aggressively grow capital.

Reference article【When did FX leverage regulations begin? Considering three countermeasures from history】

Money management is one of the three main elements of FX

To win in FX, three Ms are said to be essential.

Method ⇒Method

Money management ⇒Money

Mentality ⇒Mental

Method

To make profits from trading, you need an advantageous logic.

And closely related to logic is your trading style.

Scalping is not necessarily correct, and swing trading is not wrong.

The correct method (Method) is the combination of a trading style and a logic that fits your life and personality.

Money management

In many books, legendary traders are said to strictly manage money.

And many traders leverage leverage effectively.

is explained clearly, so please refer to it. |

Mental (Mental)

Mental state is closely related to the two previously mentioned things, ‘Method’ and ‘Money’.

If you have no advantage in your method, you will keep losing, and if you cannot manage your money, you will incur large losses, causing your mental state to collapse.

Regarding mentality,【Six things you can control before your trading mentality collapses in FX】explains it clearly, so please refer to it.

From here, we will explain the main topic: the two-percent money management.

Two-percent money management features and rules

‘Limit the maximum risk of one trade to 2% of total funds’

The feature of this two-percent money management method is that you fix the risk and vary position size, so you can maximize leverage.

Two-percent money management specifics and calculation method

Two-percent money management example

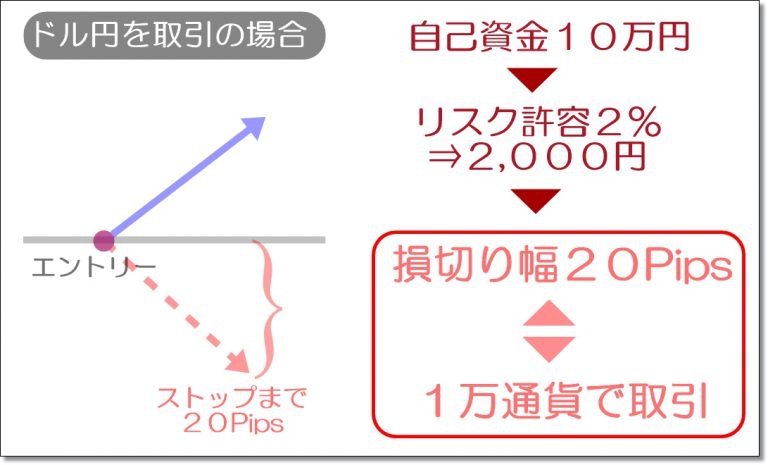

Assume you have 100,000 yen own funds.

The acceptable risk is 2%, so the loss amount is 2,000 yen.

If the stop is 20 pips, trading 10,000 units allows you to limit losses to 2,000 yen even if a stop is hit.

『Position size calculation for cross-yen pairs』

Own funds × 2% ÷ stop width(Pips)÷ 100(yen)

‘Position size calculation for pairs other than cross-yen’

For currency pairs other than cross-yen, convert the value of 1 pip into Japanese yen.

Own funds × 2% ÷ stop width(Pips) ÷ yen value in JPY

If you trade EURUSD and USDJPY is 110 yen, the yen value is 110 yen.

These complex calculations can be easily derived using a money management Excel sheet.

【Free download: an Excel that instantly calculates the 2% rule used by professionals】 【Free download: An Excel that instantly calculates the 2% rule used by professionals】 |

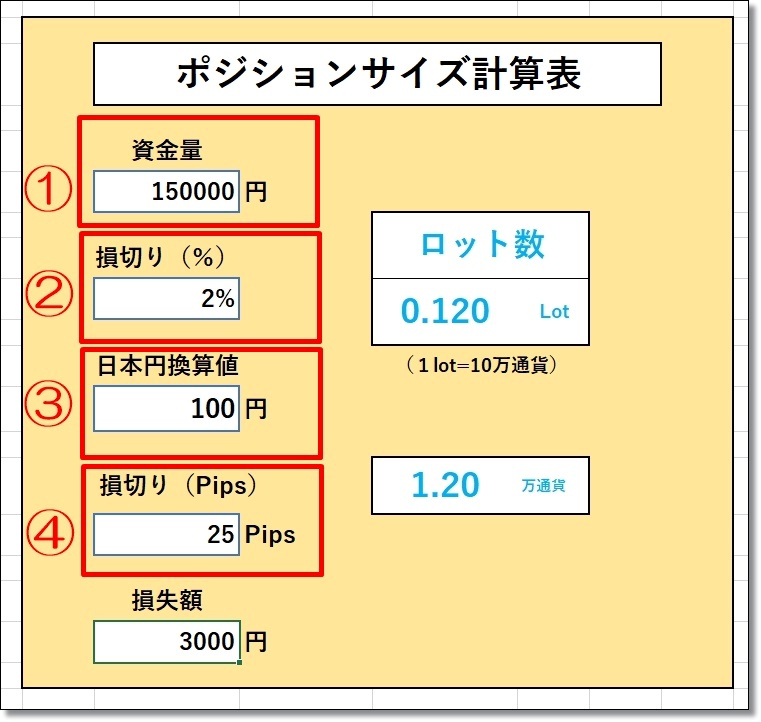

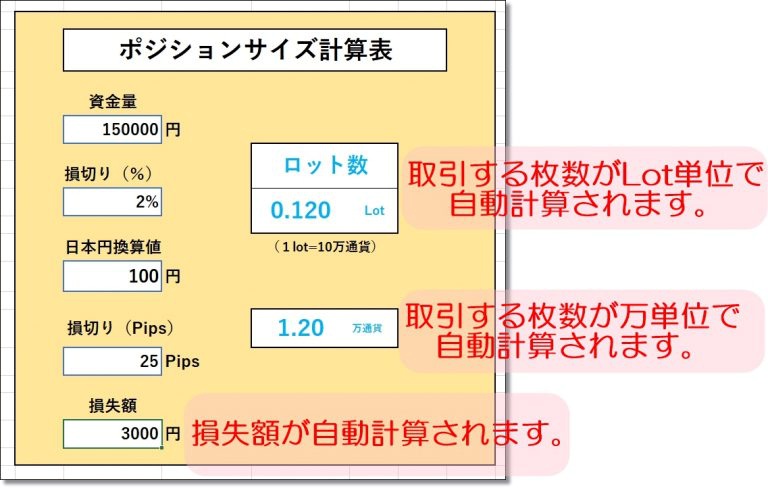

How to use the money management Excel sheet

Step 1 | Enter your capital

Please enter your own funds in yen here.

To determine accurate position sizes, check your account balance each time and input it.

Step 2 | Enter the stop (percentage)

Set what percentage of your own funds would be lost if stop-out occurs.

This article recommends a 2% stop, so keeping it at 2% is fine.

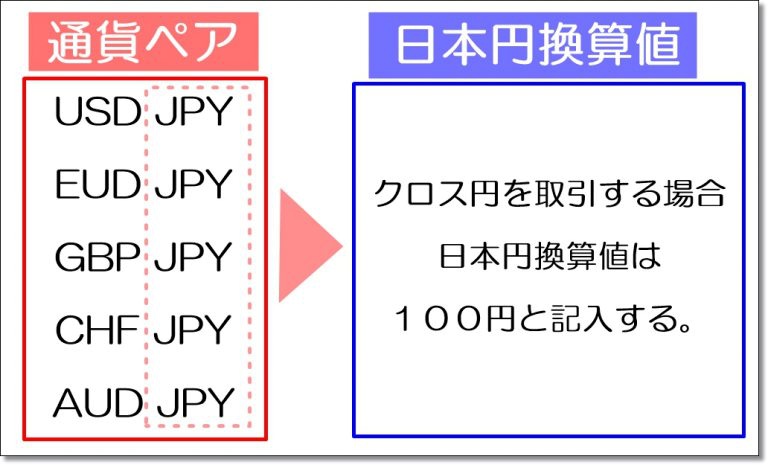

Step 3 | Enter the yen conversion value

Enter the pip value for a 10,000 unit trade.

For cross-yen, the value can remain [100 yen].

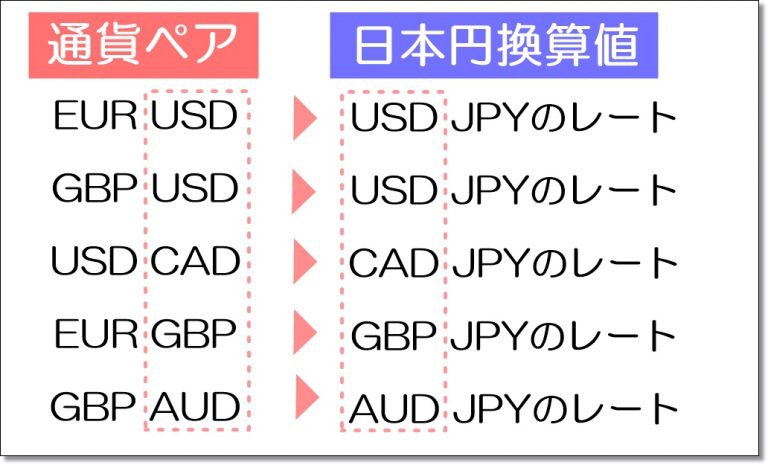

For other currency pairs, fill in the yen rate of the cross currency as shown below.

When trading EUR〇〇 or GBP〇〇 pairs, check [〇〇JPY] and enter into [yen conversion value].

Step 4 | Enter the stop (Pips)

Enter how many pips from entry point to the stop point.

Using this money management method tends to develop a habit of setting stops, which is recommended.

Other items

Items outside ①–④ described above are calculated automatically.

[Loss amount]

When trading with the specified position size, the loss amount in yen when stopped out is calculated automatically.

[Lot size]

Here, the position size is calculated automatically.

・In MT4, 1 lot = 100,000 units

・Shown in unit of 10,000 units

Both represent the same position size, so please use the one you are familiar with.

FX three money management methods

① Position size

What level of position size should you trade with?

First, trading with the correct position size is the first money management step.

② Loss management

For professional dealers, loss management is often regulated within the organization to some extent.

However, for individual traders, there are no rules.

Even if your mentality collapses and you cannot control trades, there is no one to advise or correct discipline.

Therefore, loss management becomes necessary.

Loss management is the maximum acceptable loss over a certain period.

Set a rule to stop trading once the maximum acceptable loss is reached.

・End trading once you lose 5% or more in a day.

・End trading for the month once you lose 10% of your own funds.

・If you incur 20% loss of own funds, review and test the logic.

・If you have three consecutive losses, distance yourself from trading for a while.

③ Risk hedge

Here, risk hedge means diversification of risk.

‘Do not put all eggs in one basket!’

・Trade multiple currency pairs.

・Engage in both day trading and swing trading simultaneously.

・Use two different methods.

In this way, avoid concentration of risk and operate for the long term.

Summary

This 2% money management method excels in safely and efficiently increasing funds while maximizing the use of leverage.

Please use the money management calculation Excel sheet to learn proper money management.

For fixed-leverage 2% money management, 【Why do advanced traders use the FX money management 2% rule to maximize leverage? Five benefits】is also clearly explained, so please refer to it. |

If you would like to read other articles,【Aik’s Blog】please take a look.