Despite consecutive losses, assets still grow. The reason for ORION_USDJPY's current strong performance this year

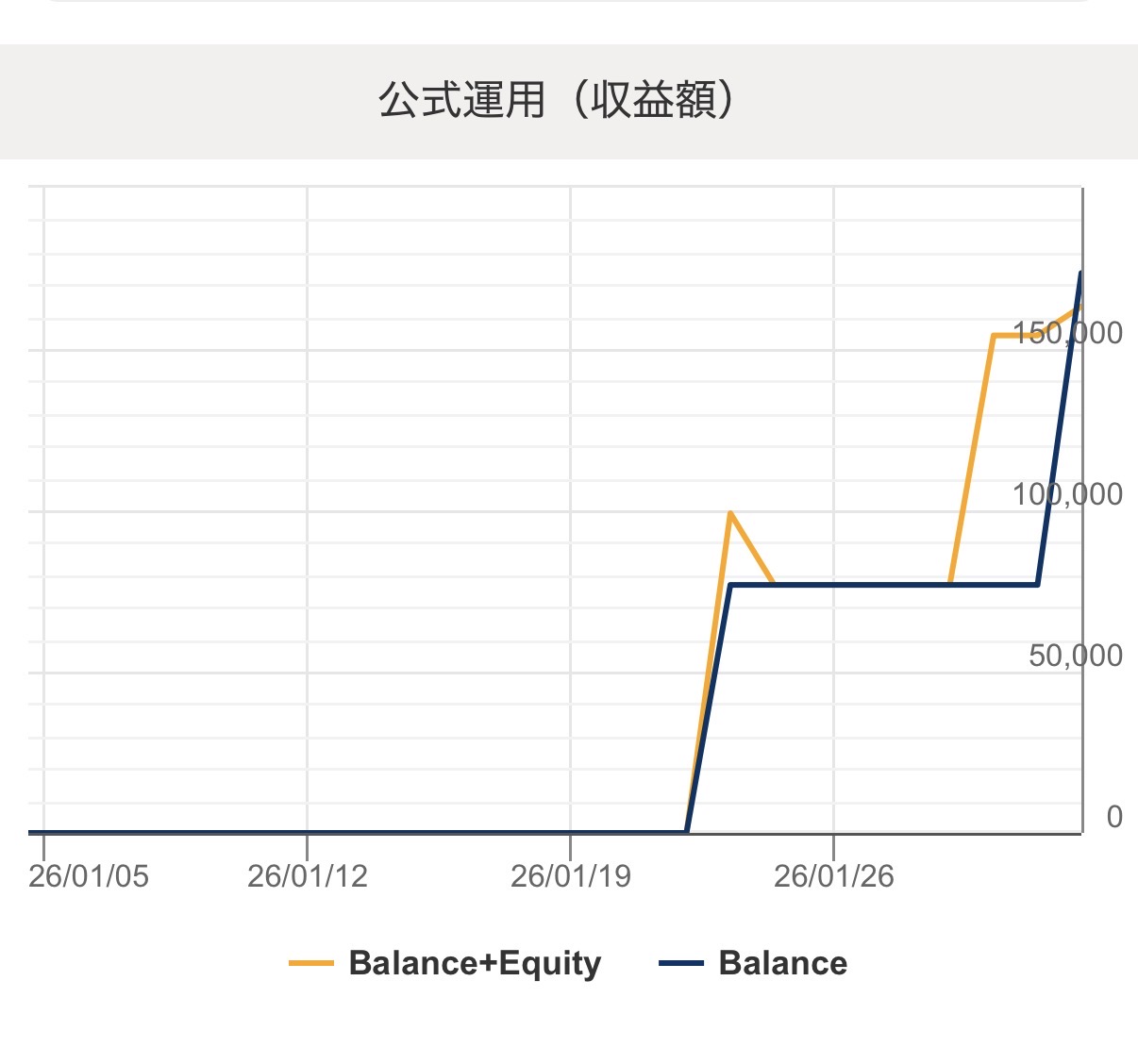

⬛︎ORION_USDJPY — 2026 up to now performance report

Thank you for always viewing.

This timeORION_USDJPY (MT5 compatible) overview and features visible from official results.

ORION_USDJPY is designed for MT5 accounts to facilitate easy optimization.

It is designed with a long-term operation premise, entering only when movements occur, so the drawdown stress is relatively low.

⸻

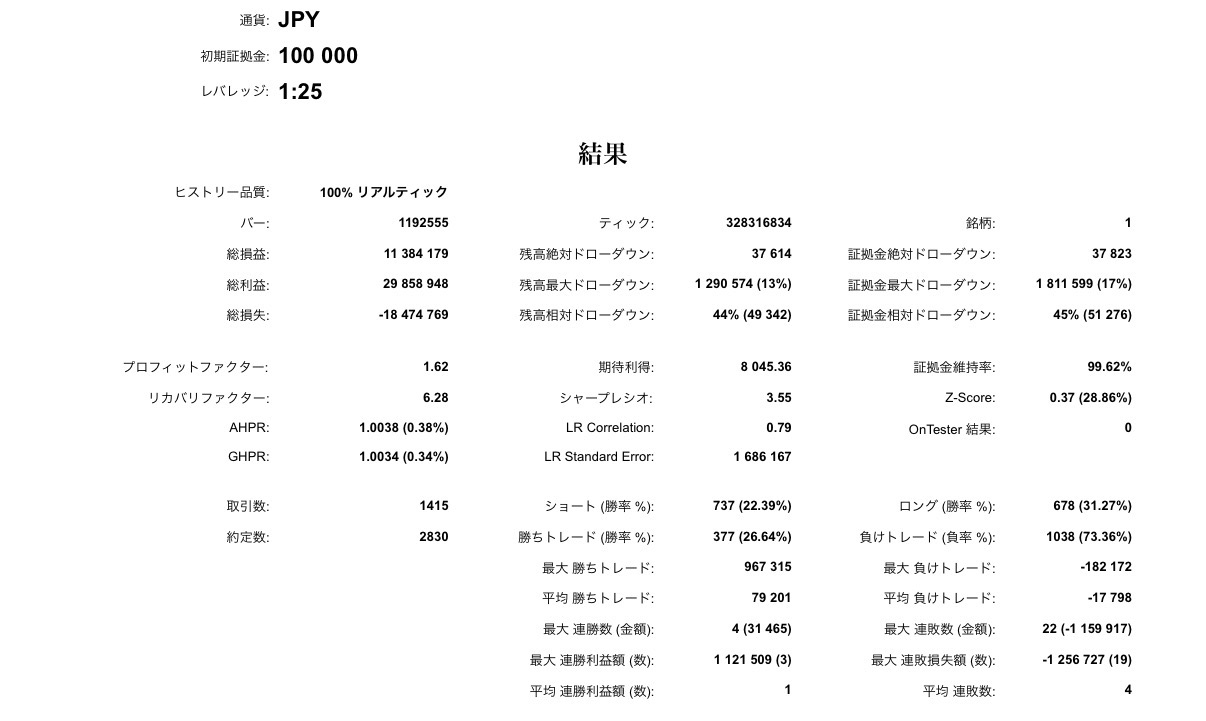

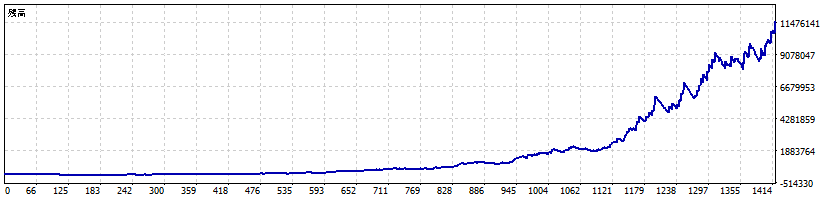

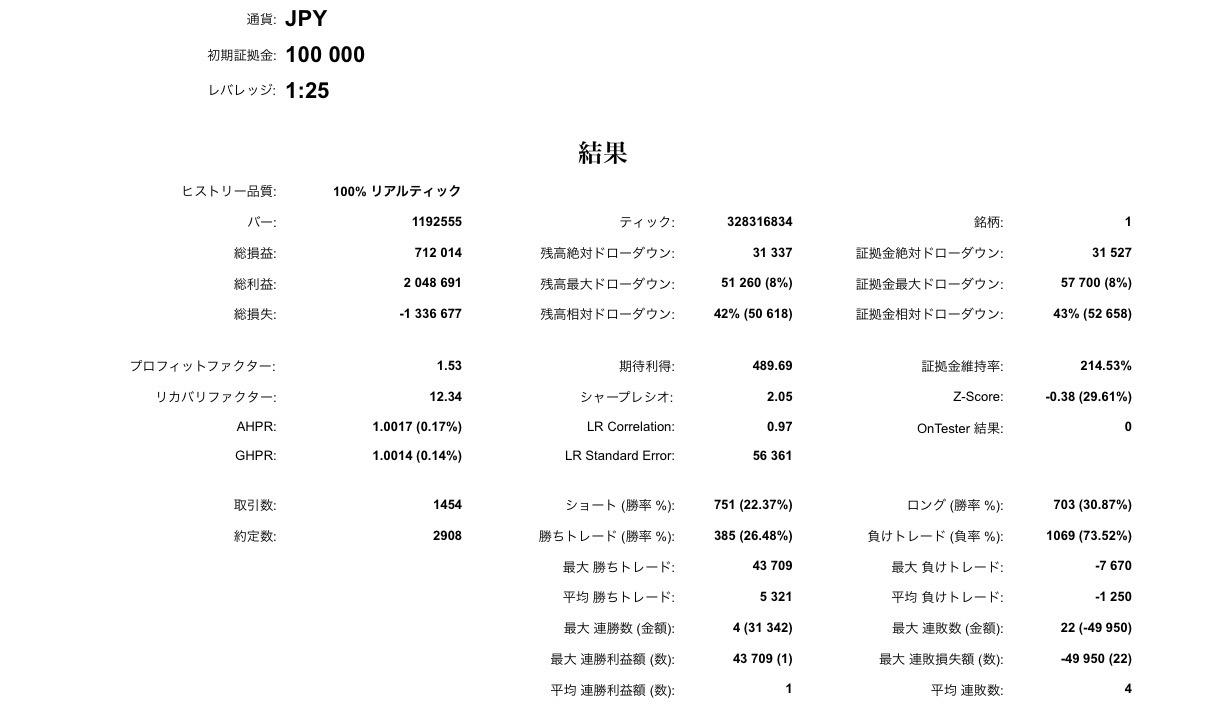

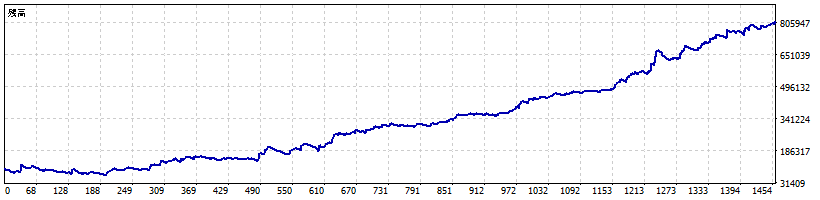

⬛︎Main performance posted on site (backtest)

Official backtests show the following results:

• Initial capital: 100,000 yen →increased to about 113 times (about 11,384,179 yen).

• Profit factor (PF):1.62

• Recovery factor:6.28

• Total trades: about 1,415

• Maximum drawdown: about 13% (balance basis)

• Average gain: about 79,000 yen

• Average loss: about -17,000 yen

• Win rate: about 26% (long-term trend following)

These are based on a long-term backtest of 15 years (2010–2025), and emphasize risk-reward of small losses and large gains, not just win rate.

⸻

Features / Strengths

◾︎Trend-focused design

Win rate is not high (low), but gains on winning trades are large, and the structure covers losses.

◾︎Lower mental burden

Does not enter unnecessarily in noisy range markets, and takes on trades when a trend emerges.

◾︎Suitable for day trading to swing trading

Based on M5 timeframe, designed to capture medium to long-term trends.

⸻

Usage points

✔ Although the EA is designed to have small drawdown,

it is not a high-win-rate type, sostart with a lot size that can be run without stress.

✔ Setting to a safe side with fixed lot operation helps limit drawdowns mid-flight.

✔ Backtests are based on historical data and do not guarantee future performance.

Past articles

↓

ORION_USDJPY Announcement|USDJPY-specific logic that does not trade in quiet markets

We have just released a new system for USDJPY “ORION_USDJPY”.

Product page:

In one sentence, this ORION is a design that “does nothing until the conditions are met.”.

Compound interest

Simple interest

⸻

■ ORION_USDJPY is a “market-selective” type

Dollar/Yen tends to be cut back during periods without clear trends or volatility.Thus ORION

• Trend is weak

• No price movement range

• No momentum to push

In such situations, we do not enter at all.

⸻

■ Trades may occur only a few times a month

Depending on the situation, there may be only a few trades in a month.

This is not a flaw but an intentional design to avoid unnecessary stop-outs.

⸻

■ Target only the moments when movement is needed

A favorable market feels different from the start.

ORION codifies that difference and targets only the expanding phases.

⸻

■ Recommended for whom

• Prioritize quality over quantity

• Want to reduce unnecessary entries

• Want to chase only when USD/JPY is rising

• Prefer a more passive style of operation

⸻

If you're interested, please take a look here.