Why completely passive scalping EAs tend to have a long-term rightward downward slope

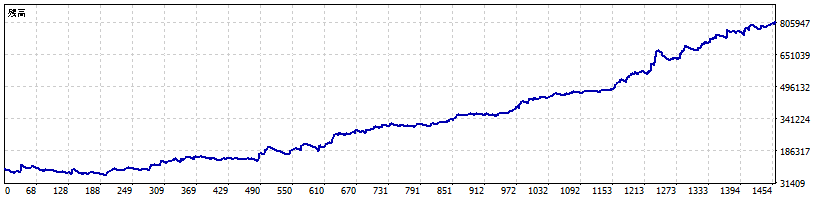

ScalpingEA funding curve: this is how it ends up (reality is difficult)

When you’re building and testing a scalping EA, most people hit the same wall at least once.

That is “you can make explosively a few days, but looking long-term it trends down.”

The two funding curves I’ve attached this time are exactly that典型例です.

⸻

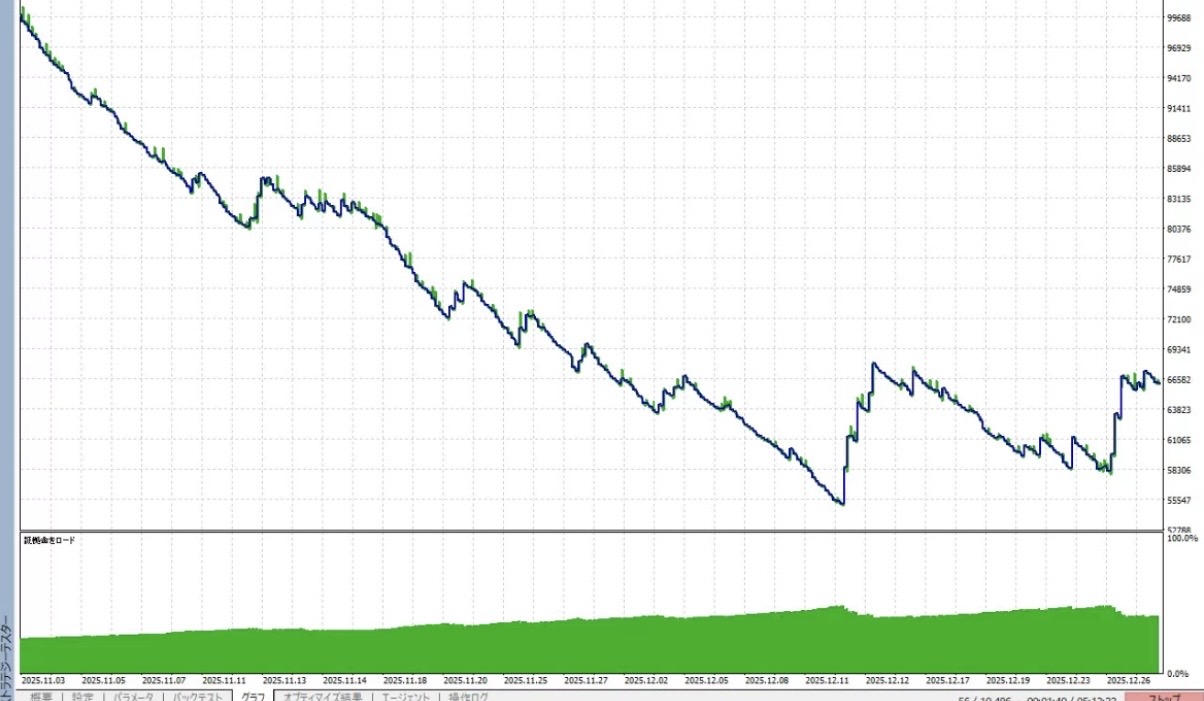

Image ①: a funding curve whose right shoulder keeps trending down

This shape is familiar to anyone who has built a scalping EA.

• Rather than starting with a clean, continuous loss

“There are places where you can take big profits from time to time.”

• But more than that

Small losses and subtle losses accumulate

• As a result, long-term

the right shoulder down trend doesn’t stop

The scary thing about this type is that you occasionally see “hope” along the way.

⸻

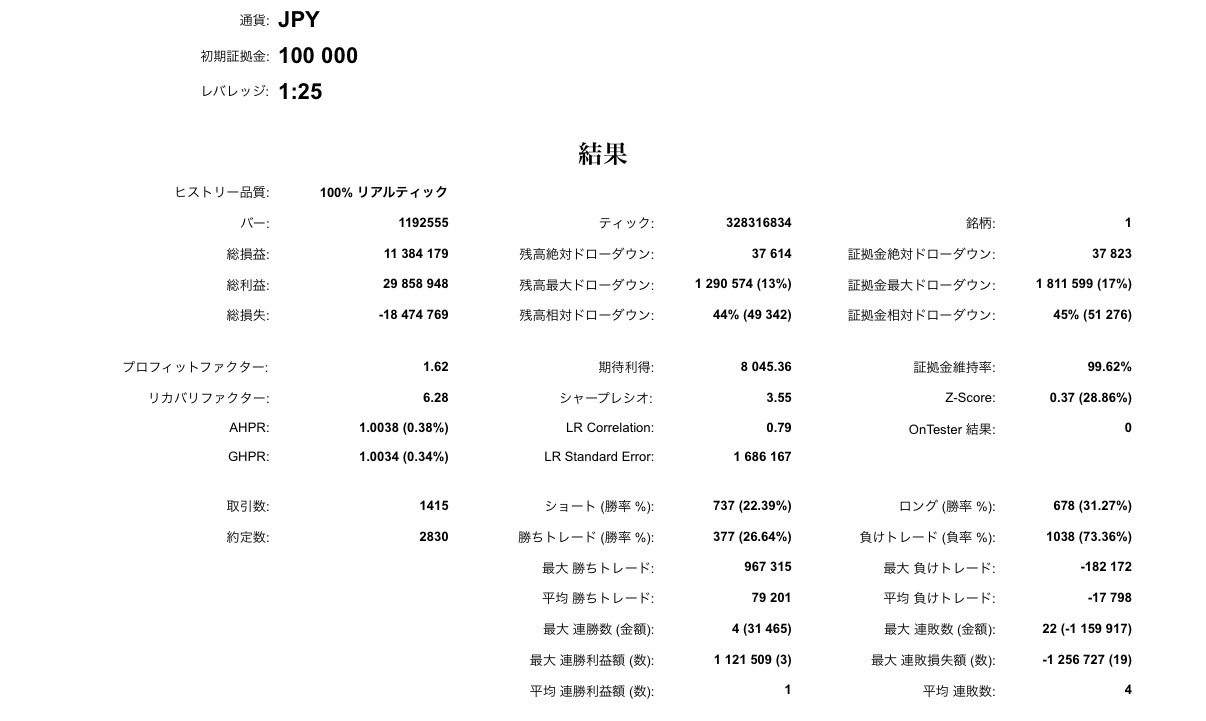

Image ②: It seems you’re gaining in the short term, but in the end you’re being whittled away

When you capture over a short period, such as a few days,

• Clearly a “winning day”

• What looks like a surge that could become enormous

• Times when you’re on a winning streak

These moments certainly exist.

But in the long term,

• You enter even in low-odds situations

• Spread and slippage (realistic) start to bite

• There are more times when the market doesn’t move than when it does

These accumulate and ultimately lead to drawdown.

⸻

Why do scalping EAs tend to end up like this?

I’m pretty clear about the cause in my own mind.

• Scalping has a short period where an edge can appear

• EA tends to mechanically touch those “subtle times”

→Small losses accumulate

• Even if you win on OHLC (1-minute bars), it collapses in RealTick

→Operating costs in real trading are heavier than you imagine

In the end, scalping isn’t just about finding times when you win; you need a design that thoroughly avoids times/areas where you lose, otherwise it won’t last long-term.

⸻

Then, how can you avoid drawdown?

For me, there are two conclusions right now.

①Create a rule/indicator where reproducibility and edge appear only when they do

For example, thinking in this way:

• Only when the trend is clearly present

• Only when volatility exists

• Only when spreads and slippage are within tolerance

• Only when the structure is well-formed

This kind of “restricted entry moments” should be formalized as a rule.

This is where scalping cannot function well unless you do this; otherwise the equity curve becomes choppy.

②Hedge toward EA that are easier to run long term (increase time frame, reduce frequency)

Even if short-term explosiveness drops,

• Reduce number of trades to lower cost impact

• Reduce noise to improve stability of same logic

• Not by increasing winning moments, but by reducing losing moments

In practice, this approach often makes it easier to achieve an upward-trending shape.

⸻

:Winning in a few days does not equal winning long-term

Looking at this funding curve, I’ve thought again.

• There is nothing unusual about a place where you can take profits in a few days

• Problem is being whittled away in the times when you cannot take profits

• Therefore what’s needed is

“Design to touch only when edge appears” or

“Shift toward an easier long-term shape.”

For now, I believe this is the best thing I can do.

Previous articles

↓

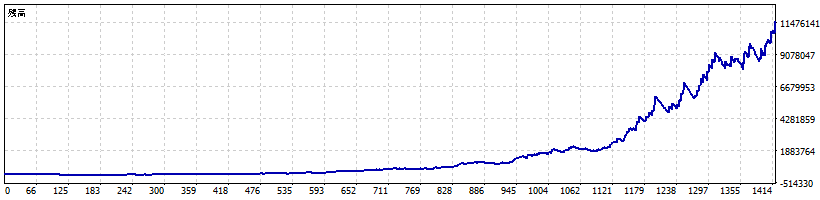

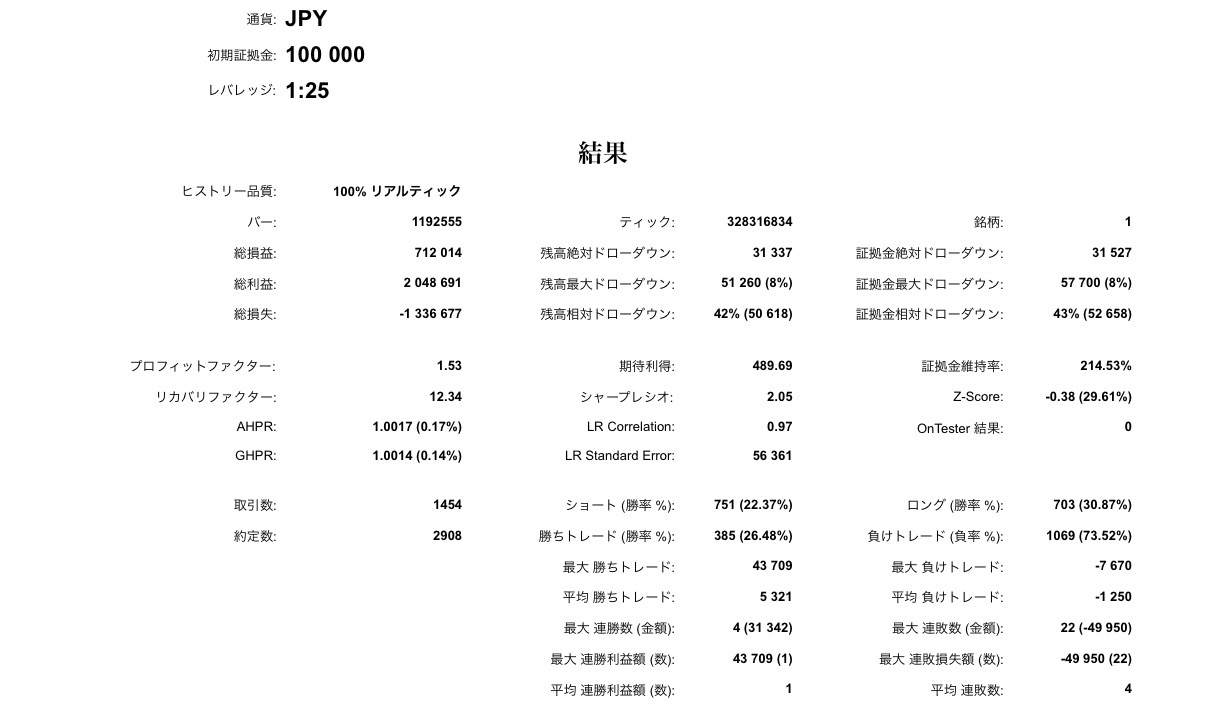

ORION_USDJPY Public Announcement — “Don’t trade in quiet markets” USDJPY-specialized logic

This time we published a new system for USDJPY “ORION_USDJPY”.

In one sentence, this ORION is designed as“do nothing until conditions align.”.

Compounding

Simple interest

⸻

■ ORION_USDJPY is a “market-selective” type

Dollar-yen tends to be shaved away in times when there is no clear trend or volatility.

Therefore ORION is,

• When the trend is weak

• When there is no price range

• When there is no buying pressure

In such situations we simply do not enter.

⸻

■ There are times when you trade only a few times per month

Depending on the situation, you may trade only a few times in a month.

This is not a flaw, but an intentional design to avoid unnecessary stop-outs.

⸻

■ Aim for “only the timings when movement should occur”

A favorable market from the start has a different atmosphere.

ORION formalizes that difference in logic and targets only expanding moments..

⸻

■ This is recommended for people like

• Value quality over quantity

• Wants to reduce unnecessary entries

• Wants to target only the rising moments in dollar-yen

• Wants to run toward a more hands-off approach

⸻

If you’re curious, please take a look here.