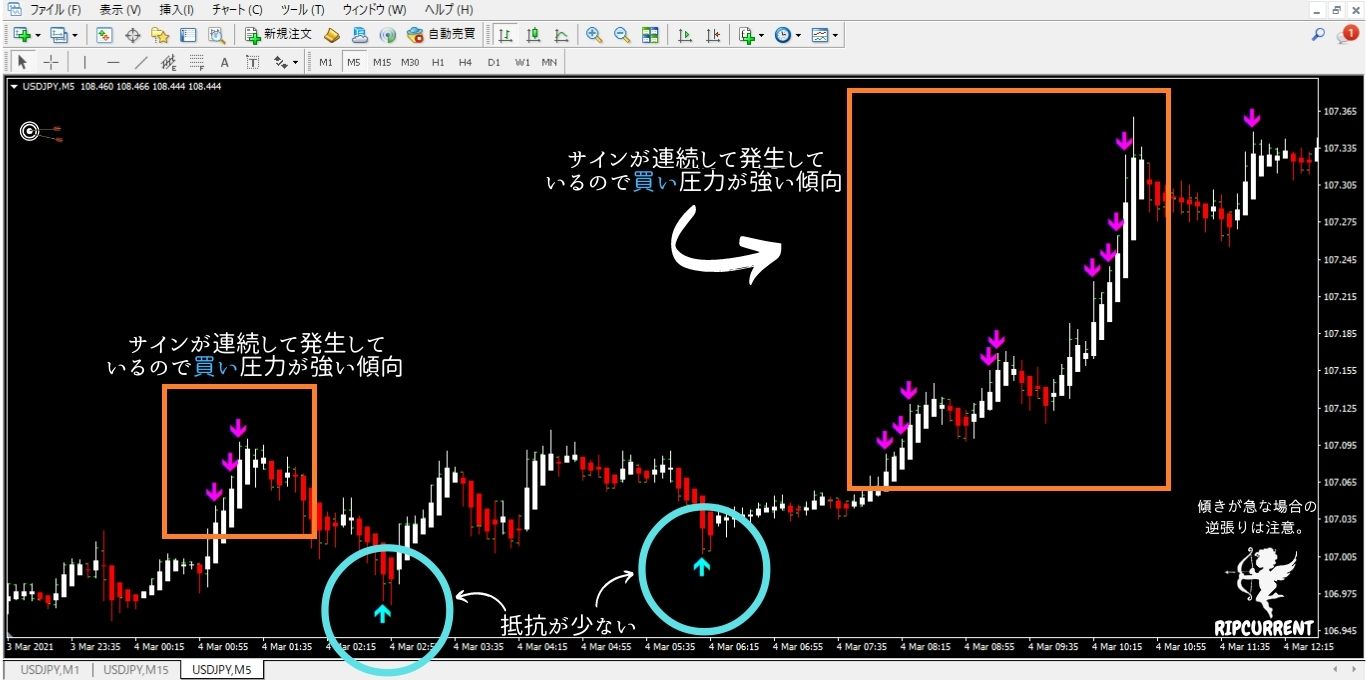

Enter when the signs opposite from the consecutive signs are in a similar position, held back by fewer signs, etc.

The image above shows the timing on the 1-min chart to get the result you want. The three signs on the left side are consecutive, but they have appeared in a similar location. Once you are used to it, you can try it out, but until you are used to it, it would be safer to forgo it for the time being.

The image above shows the timing on the 1-min chart to get the result you want. The three signs on the left side are consecutive, but they have appeared in a similar location. Once you are used to it, you can try it out, but until you are used to it, it would be safer to forgo it for the time being.

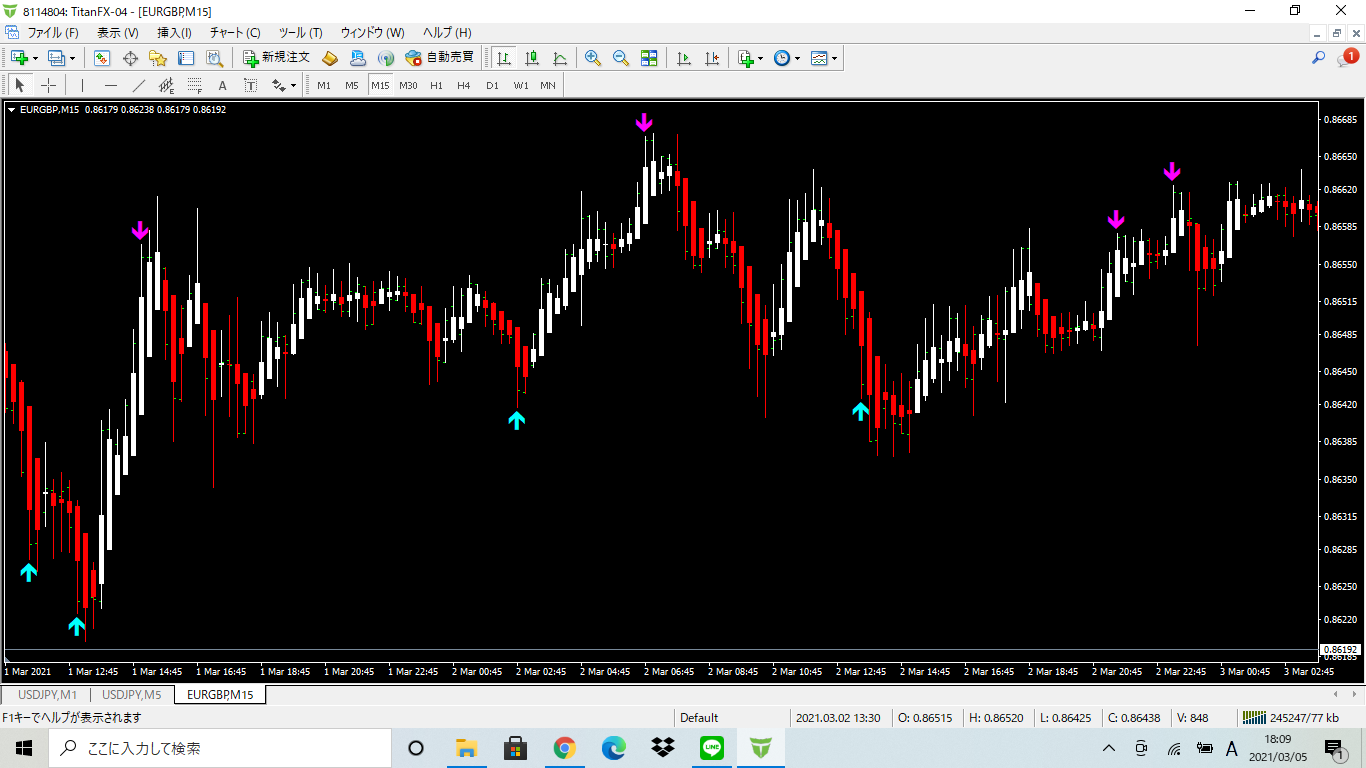

It is reversing very clearly at a single sign and informing you of the timing to get the result you want.

It is reversing very clearly at a single sign and informing you of the timing to get the result you want.Enter according to signs on a chart with a higher time interval, such as a 15-min or 1-hour chart, showing a rise → Close according to signs on the 1-min and 5-min charts.

When in the direction of the trend, it is difficult to get a sign on a chart with a higher time interval going in the opposite direction (for example, if the trend is upward, it is rare for a sign to appear on a 5-min or higher chart during a temporary drop), so it is better to judge when to close using the 1-min chart, etc.

When trading against the trend, in some cases, it is better to enter at the second wave of signs rather than at the first wave.

As a general rule, this indicator tends to appear at the point where the minority and the majority are focusing attention. However, when trading against the trend, we recommend that you keep an eye on the signs on the multi-hourly charts and the slope of the trend line as well.

It is safer to forgo trading against the trend when signs appear in rapid succession without a pause.

The one-hour-long candles have been shortening for a very long time. There are some adjustments here and there, but there is no clear point of decline.

At a time like this, it might be better to wait for a chance to enter that follows the trend.

Signs are also continuing to appear on charts with other time intervals.

Incidentally, signs of reversal appeared on the weekly and monthly charts prior to this rise.

As you get used to trading, you can add elements such as Fibonacci, Bollinger Bands, trend lines, etc. to ascertain changes in market trends with even greater precision.

For those using GogoJungle for the first timeEasy 3 steps to use the product!

At GogoJungle, we provide services to enrich your investment life for our members. In addition, product purchases are normally limited to members. Why not register as a member now and make use of GogoJungle!