開発者:るなまる

相場の“加速”に追随する

トレンドフォローEA「カスタムの刃」

統計×プログラミングでビッグデータ分析を行うプロが設計。

最大ポジション1・固定SL・トレーリング機能を搭載し、ナンピン・マーチンに頼らない「リスク管理徹底型」の自動売買システムです。

- ✅ 相場状況に合わせて“スキャル〜スイング”まで最適化可能

- ✅ リスク管理はシンプルに:ナンピン/マーチンなし、固定SL+トレーリング

- ✅ MT4にセットするだけで24時間稼働(業者指定なし/1万円〜運用可)

「相場の変化」に、EA側を合わせる。

テイクプロフィットやストップロスは自由にカスタマイズ可能。

値動きが緩やかならスキャル、ボラ拡大時はスイングへ。

この高いカスタマイズ性により、最新の相場条件に最適化して運用し続けることが可能です。

主な仕様

基本設定

通貨ペア:ポンド円(GBPJPY)推奨

時間足:パラメーター指定の足を基準に内部判定

必要資金:1万円〜(0.01Lot想定)

トレードロジック

スタイル:順張り(トレンドフォロー)

ロジック:加重平均ベースで急騰/急落に追随

稼働方法:MT4セット型(24時間)

🛡 リスク管理(重要)

最大ポジション:1(単利運用)

ナンピン / マーチン:なし

固定SL + トレーリング機能

搭載ロジックについて

- トレンドフォロー型:急騰・急落の「加速」に追随します。

- デュアルタイムフレーム:2つの時間足(デフォルト:30分/60分)を使い分け、柔軟にエントリーします。

- ポジション管理:最大ポジションは常に1。決済後に次のチャンスを狙います。

🔍 ロジックの内部計算式(クリックで詳細を表示)

「カスタムの刃」は、過去15年のポンド円ビッグデータをもとに設計されました。

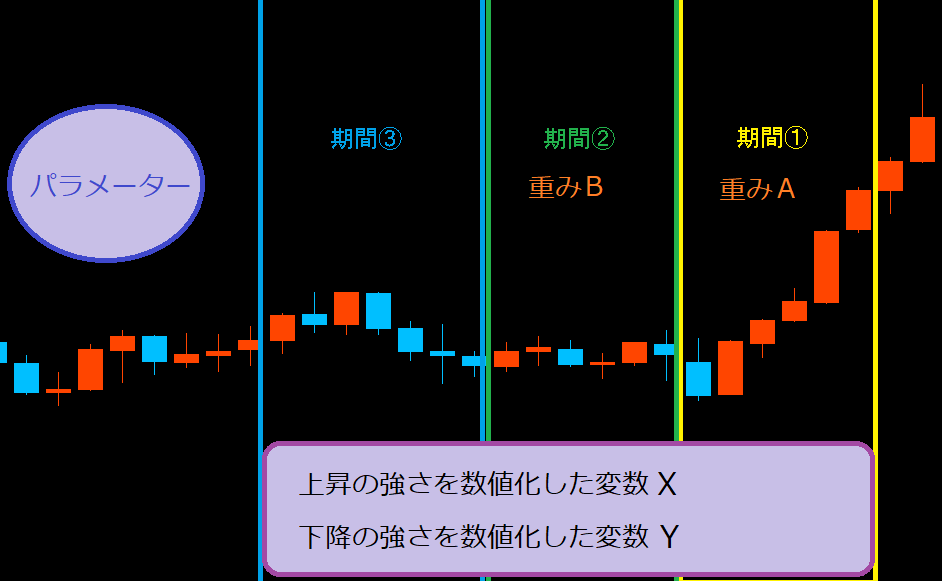

30分足を例に、変数X/Y(上昇/下降の強さ指標)を「期間×重み」で総合評価します。

パラメーターを大きくするとエントリー条件が厳格になり、ダマシを減らして取引頻度を絞ることが可能です。

買い条件式:

(期間A_Y×A + 期間B_Y×B + 期間C_Y) × Logic1_param < (期間A_X×A + ...)

売り条件式:

(期間A_Y×A + 期間B_Y×B + 期間C_Y) > (期間A_X×A + ...) × Logic1_param

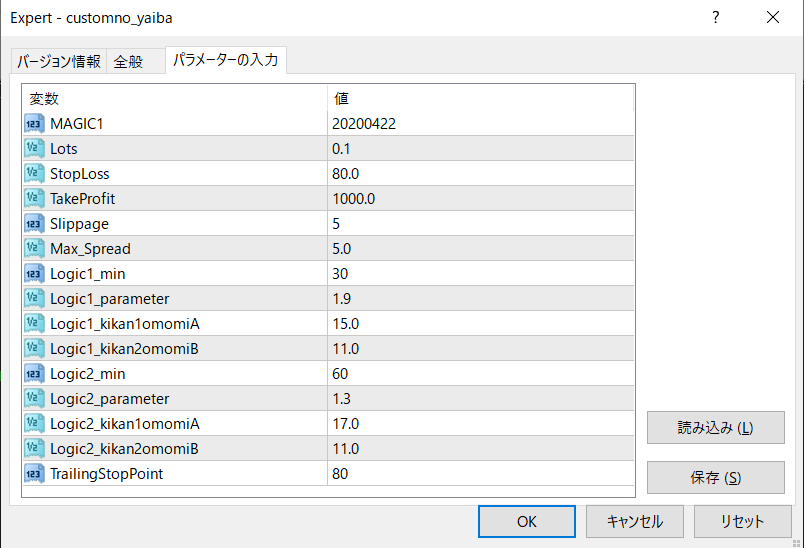

パラメーター設定

基本項目

- MAGIC1:マジックナンバー(他EAと区別)

- Lots:初期0.1(資金に合わせて調整)

- StopLoss:初期80pips(固定損切り)

- TakeProfit:最大1000pips目安

- Slippage / Max_Spread:約定不利対策

ロジック調整

- Logic1_min / 2_min:時間足指定 (1~1440)

- Logic_parameter:取引頻度の閾値

- omomi(重み):期間ごとの比重調整

- TrailingStopPoint:初期80pips

※実運用前にバックテストでの確認を推奨します。

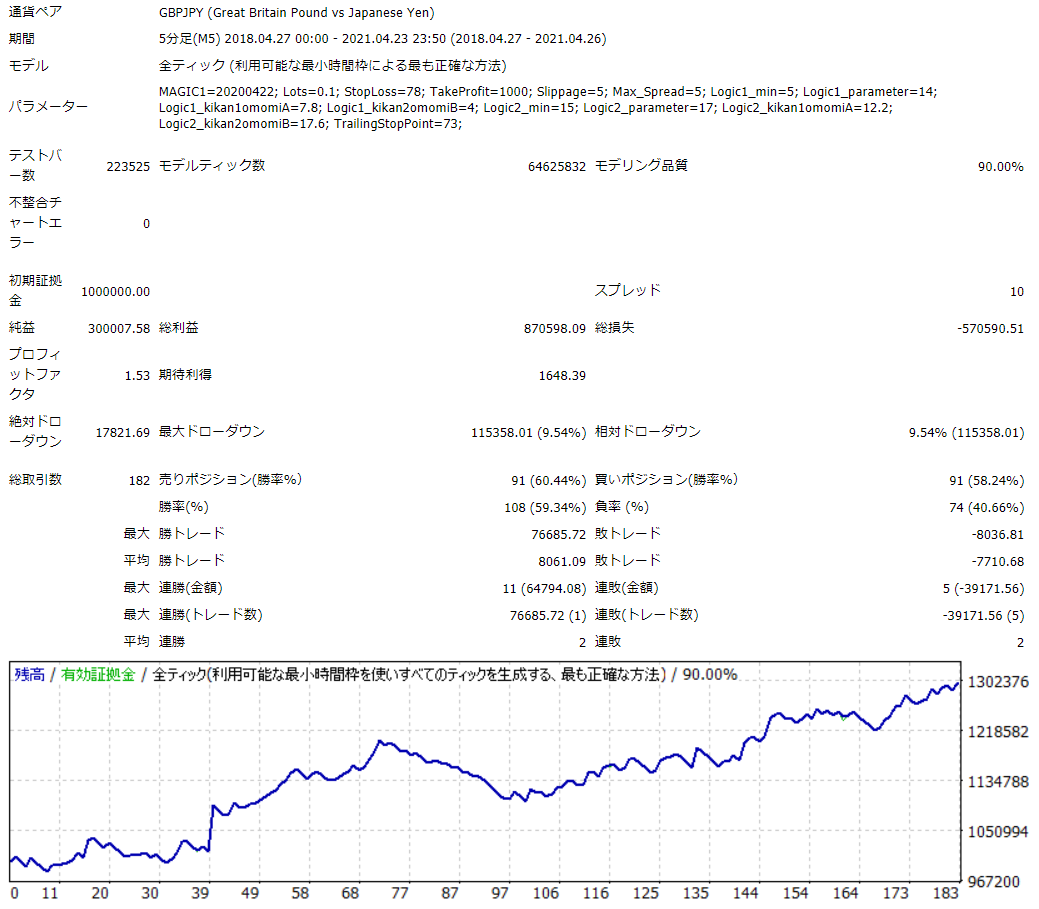

バックテストと最適化例

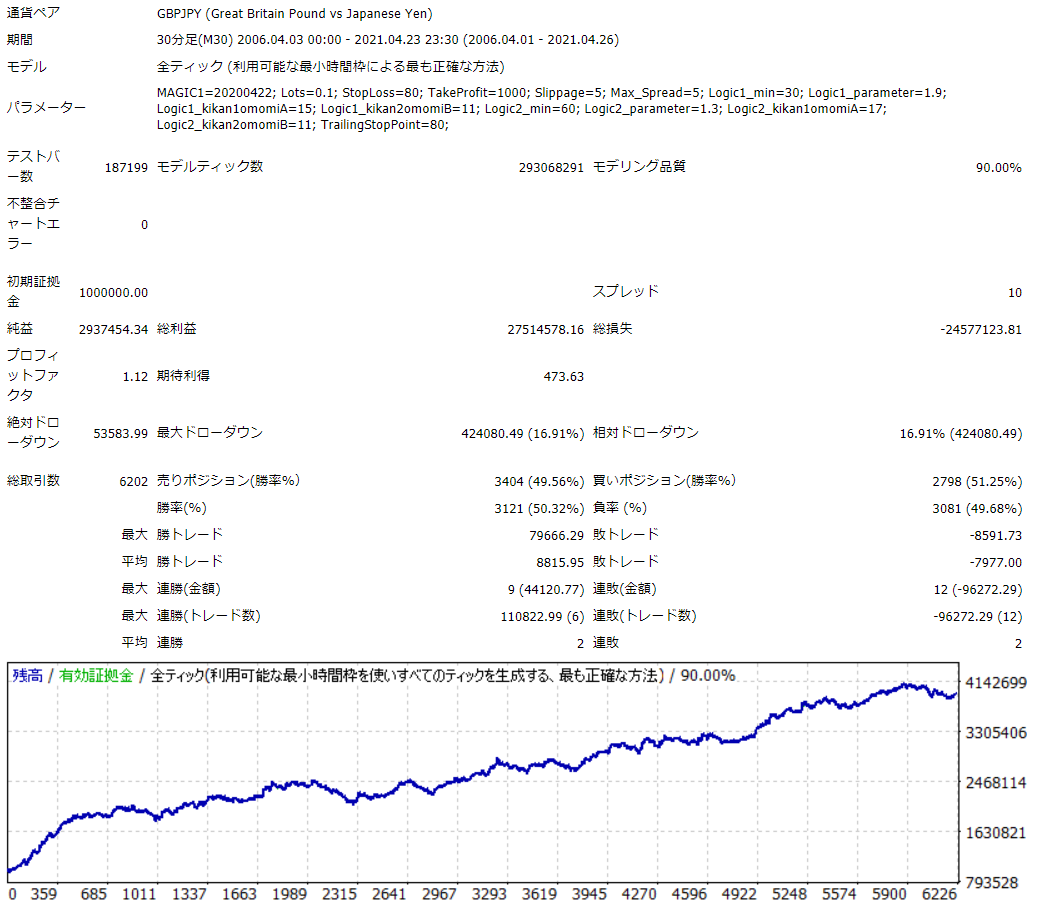

📊 1. 初期設定(15年間の長期テスト)

期間:15年 / 通貨:ポンド円 / 時間足:30分・60分

※初期設定はデイトレ想定です。取引回数は年200〜300回程度を目安に、安定性を重視しています。

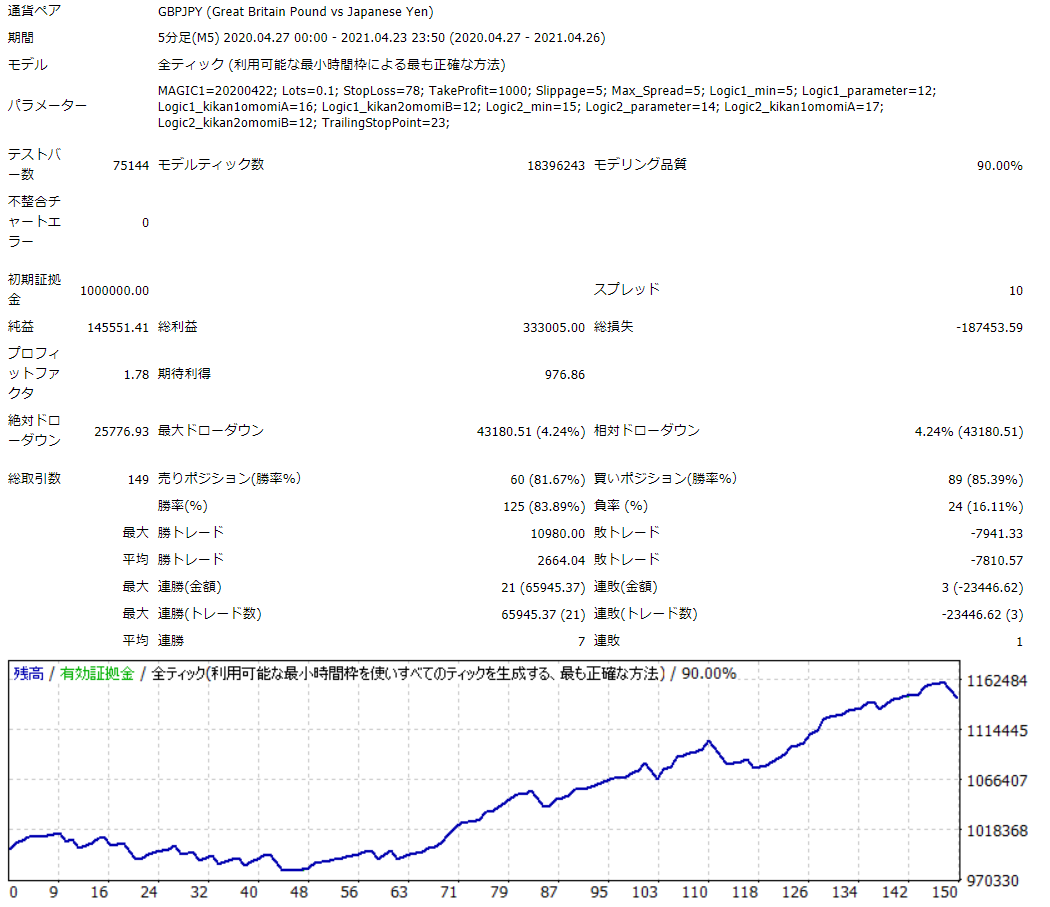

📈 2. 直近1年 最適化(スキャル寄り)

直近の相場に合わせ、回転数を上げた設定例。

📉 3. 直近3年 最適化(スイング寄り)

ゆったりとした値幅を狙うスイング設定例。

基本構成と運用のポイント

- TP:80〜1000pips / SL:80pips(変更可)

- フォワード/バックテストは初期値基準。カスタマイズ無しでも運用可能です。

- 24時間稼働、複利/ピラミッディング/ナンピンなしの低リスク設計。

- トレーリングストップで利益の伸びを確保します。

💡 トレーリングストップとは:

値動きに応じて決済ライン(SL)を有利な方向へ追随させる機能です。一時的な押し目で利幅が削られる可能性はありますが、トレンド発生時に「損小利大」を最大化するために、ボラの大きいポンド円と相性の良い本機能を採用しています。

データに基づいた「安心感」を、

あなたのポートフォリオに。

ナンピンなし、固定SLの堅実なトレンドフォローEA。

ご購入は、本ページ上部の「カートに入れる」ボタンからお進みください。

免責事項

FX取引には高いリスクが伴います。投資目的やリスク許容度をご確認の上、最終判断はご自身の責任でお願いします。本EAのバックテスト/フォワードテスト結果は将来の利益を保証するものではありません。本ツール利用によるトラブルや損害等につきましては一切の責任を負いかねます。