【Beginner】Technical Course | GMMA

【Beginner】 Technical Course|GMMA (Guppy Multiple Moving Average for Trend Analysis)

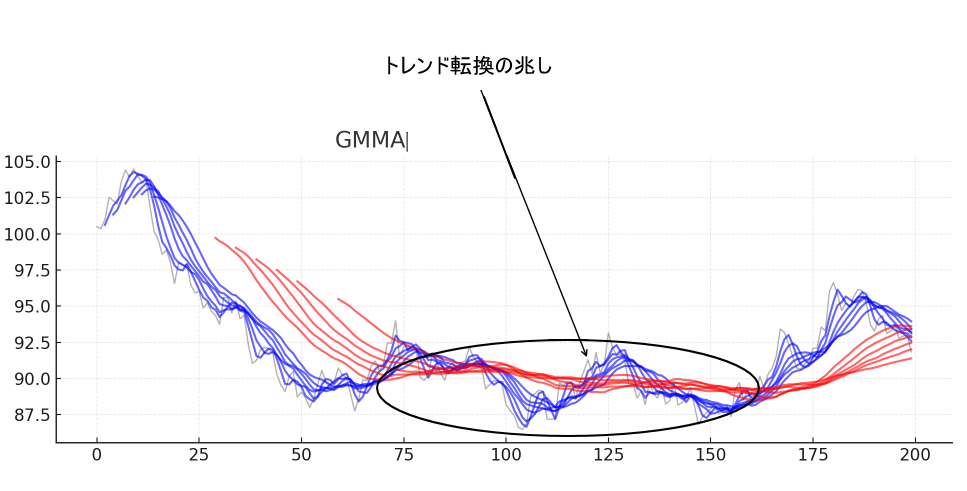

GMMA (Guppy Multiple Moving Average)is a unique technical indicator that uses multiple short-term and long-term moving averages to visualize the psychology of the market participants.

It enables quick detection of the strength of a trend and turning points.

Basic Structure of GMMA

- Short-term group (blue, 6 lines): 3, 5, 8, 10, 12, 15

- Long-term group (red, 6 lines): 30, 35, 40, 45, 50, 60

- The divergence and convergence between the short-term and long-term groups are important

Trend Judgment with GMMA

- Short-term group crosses above the long-term group and spreads→ Uptrend

- Short-term group crosses below the long-term group and spreads→ Downtrend

- The short-term and long-term groups intertwine→ Range or reversal point

GMMA is effective on its own, but when combined with RSI or MACD, andZoneBreaker Corefor situational awareness,

the accuracy in capturing both “direction” and “timing” improves significantly.

Summary

- GMMA is an indicator that can grasp thestrength of the trendfrom multiple perspectives.

- Focusing on the behavior of the short-term and long-term bundles is key

- Used together with ZoneBreaker Core, environmental awareness and trend identification are further enhanced

× ![]()