[Important] Technical Seminar|Volatility by Time Zone and Currency Pair

【Technical Course】Importance of Time-of-Day Volatility and Currency Pair Selection

In FX trading,understanding volatility changes by time of dayis extremely important. Just like the stock market, the “pre-market (open to 2–3 hours)” period concentrates participants and is the time when the market moves most easily.

Furthermore, important economic data releases also cluster in this time frame, which tends to cause volatility to rise rapidly.

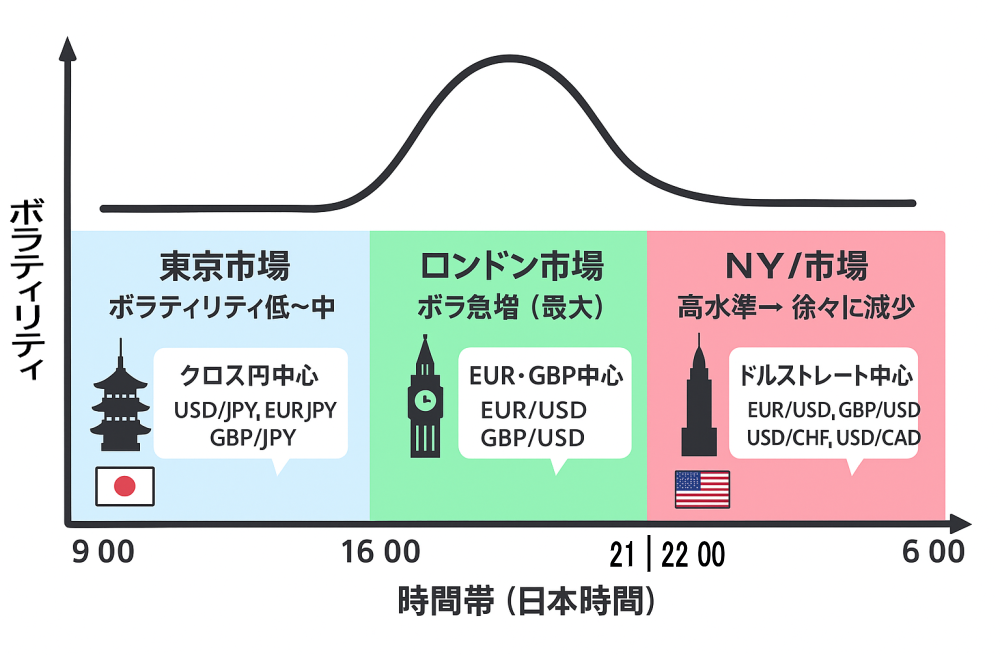

Three Major Markets and Characteristic Currency Pairs

- Tokyo Time (9:00 onward)Japanese participants lead. With many participants from the Asian markets,cross-yen pairs (USD/JPY, EUR/JPY, GBP/JPY, etc.)tend to move more.

- London Time (16:00 onward)The market with the world's largest trading volume.EUR/USD, GBP/USD, EUR/GBPare active, among others.

- New York Time (22:00 onward)U.S. participants join in.Dollar pairs (EUR/USD, GBP/USD, USD/CHF, USD/CAD)are central. Pay attention to U.S. economic data and key speeches.

Summary: Make Time Your Ally

・From open for 2–3 hours, volatility tends to be high due to participant concentration and data releases

・It is important to identify, for each time window, the currency pairs to target

・Rather than chasing all time zones, choose times that fit your lifestyle and trade with focus

To improve win rate in trading, not only indicators and signal tools but alsoa strategy that combines “time of day” and “currency pair” selectionis indispensable.

■ ZoneBreaker Core Purchaser-Only Free Bonus

A chart view that allows you to grasp at a glance the opening times of the three major markets

Time Line Indicatorisbeing offered for free!