[Beginner] Technical Course | RSI (Indicator Free)

[Beginner] Technical Course|RSI(Relative Strength Index)

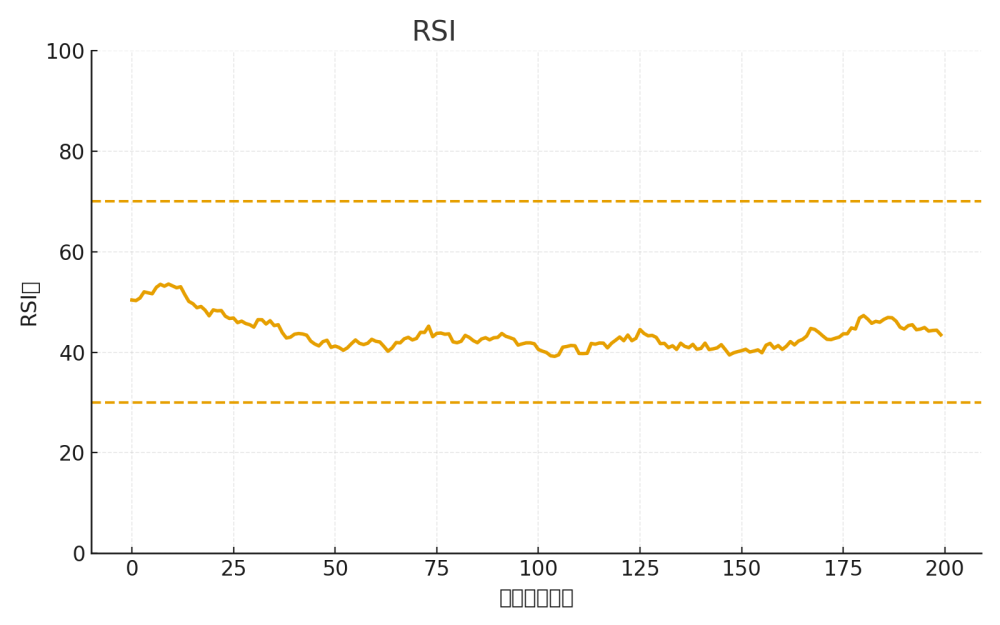

RSI(Relative Strength Index)is a representative oscillator indicator that visualizes market “overbought/oversold numerically. On a scale from 0 to 100, it helps gauge strength, and traders worldwide use it as a guide for range-bound pullbacks and reversal moments.

RSI Basics

- Value range:0–100

- General thresholds:

- 70 or higher… Overbought (watch for a pullback)

- 30 or lower… Oversold (watch for a rebound)

- Concept:Ratio of gains to losses over a periodquantifies market strength

Practical Ways to Gain an Edge

- Divergence

When price makes a new high (or low) but RSI does not, it signals momentum waning. Watch as a potential reversal signal. - Match to market condition

Range market: 70/30 works well.

Strong trend market:80/40and60/20, slightly shifting thresholds to reduce false signals. - In conjunction with context

RSI indicates timing, not direction alone.Higher-level context(direction or zones) filters improve accuracy.

ZoneBreaker Core × RSIexample combination:

In ZoneBreaker Core, a “buy bias” zone→ Look for RSI to rise from around 30–40.

In ZoneBreaker Core, a “sell bias” zone→ Look for RSI to fall from around 60–70.

The key is to divide duties between direction (environment) and timing (RSI).

Summary

- RSI is the classic indicator that quantitatively captures“overbought/oversold”.

- Effective in range markets; in strong trends, adjust the reference values

- Do not rely on it alone.Use with environment awareness × timingfor best results

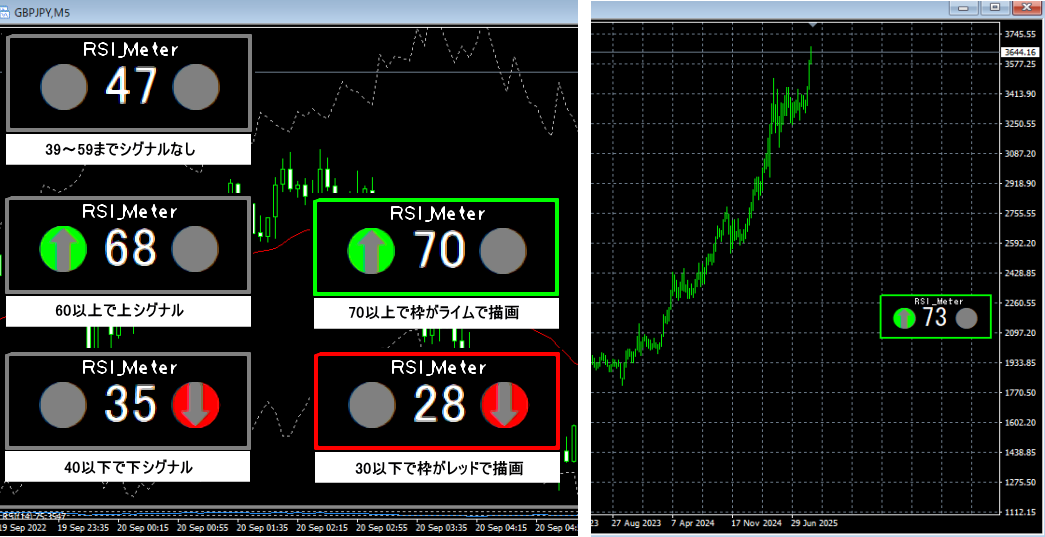

RSI Meter free gift! Click “Read more” below to download.

× ![]()