The Way of Investment (Part 200) - Commemorating Issue 200, Market Analysis Edition -

The Way of Investing (Part200)

-200th Issue Commemoration, Market Analysis -

Deriving a Weekly Trading Strategy from Heatmap Analysis

1. Introduction (To make daily profits from trading)

In The Way of Investing (Part197), I wrote that “I intend to cover discretionary day trading in a separate chapter later,” but in this manuscript (The Way of Investing, Part200) I plan to describe it systematically.

2. Daily OHLC data analysis

2007 year to 2025 year 8 month 18 years of daily data(USDJPY D1) was exported to a file in MT4 in CSV format. I will load this file into AI for data analysis. In earlier times, I would load it into Excel and analyze the data manually, but now I will use the latest AI.

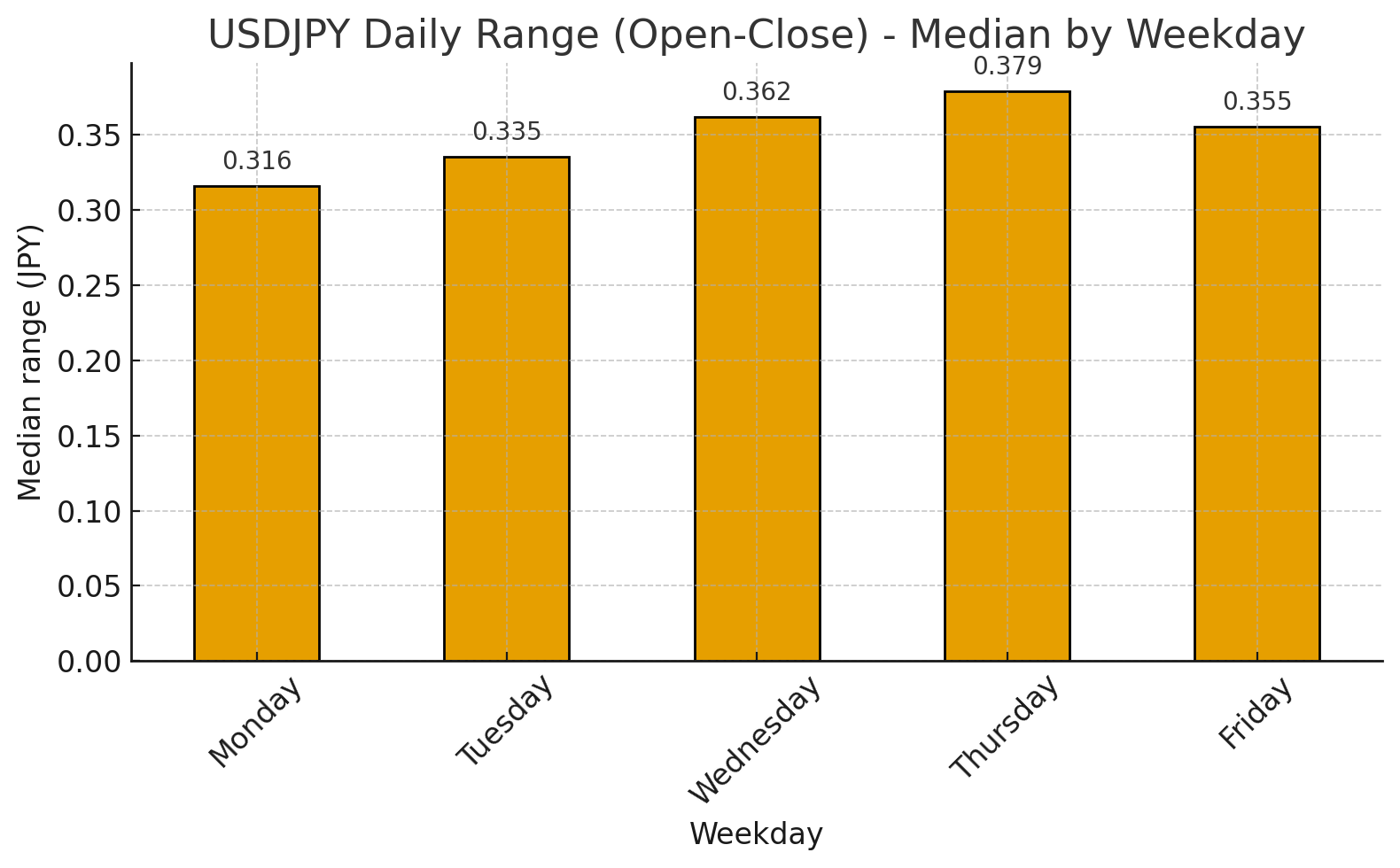

First, I will start with weekday analysis. Answer the simple question: which day of the week has the largest price range? (absolute value of close minus open) To remove extreme outliers, I used the data median for analysis.

3. Results of weekday analysis

The results are shown in a graph.

From the graph, Thursday shows the largest price range, while Monday shows the smallest.

When I asked AI why “there is often large price movement on Thursdays,” the answer was that “events tend to cluster in the middle,”AI,

<AI’s answer>

--------------------------------------------------------------------------

The European Central Bank announces policy and holds a press conference on Thursday (ECB at at 14:15/14:45 CET). The Bank of England also typically releases a statement and minutes at noon on Thursday. These events tend to ripple into through U.S. rates and risk sentiment.

U.S. regular indicators (weekly initial jobless claims)

Every Thursday 8:30 ET are released. Because they frequently move market rate expectations, Thursday volatility tends to be elevated.

FOMC generally releases on “Wednesday” → in Tokyo time, the price movement on Thursday is often affected.FOMC has about eight cycles a year, and the policy statement is usually published on Wednesday in the U.S. The Thursday Asia session often experiences the aftereffects.

Monday tends to see trading hold and thinner volumes; Tuesday sees more substantial position-building. Thursday tends to have larger ranges due to pre-weekend adjustments (risk-off and hedging).