[Important] Technical Course | Importance of Past Verification

For those just starting trading or intermediate traders who have gained some experience,

there are many cases where people disregard "backtesting."

However, no matter what method or signal tool you use,backtesting is the only sure path to improve trading skills.

■ What you can learn from backtesting

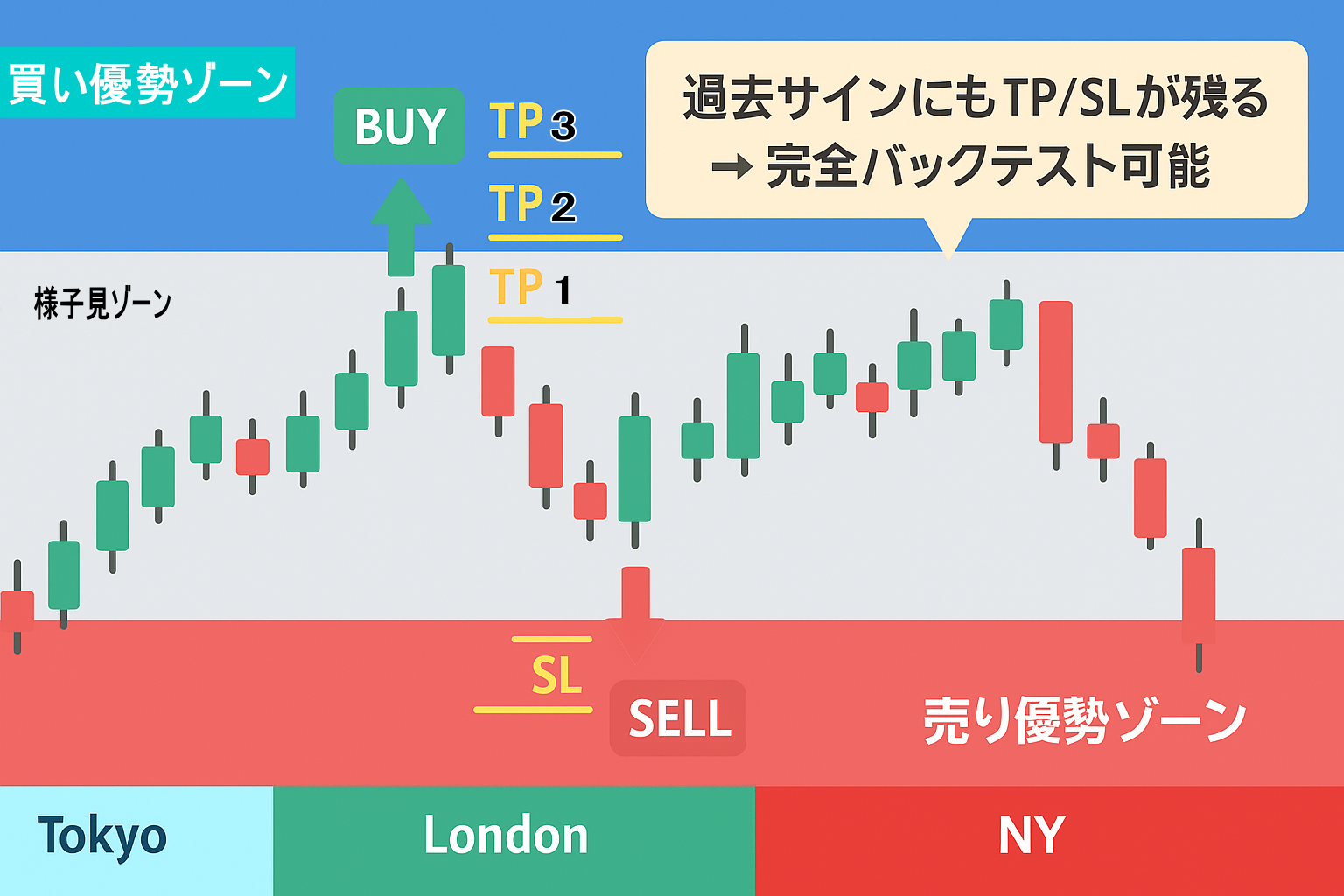

- Win rate when signals align with “environment recognition”

- Performance trends by market (Tokyo, London, NY)

- Probability of reaching the TP line / SL line and balance of profit and loss ratio

- Common failure patterns when entering during the “wait-and-see zone”

Click to enlarge (backtest image)

■ Backtesting with ZoneBreaker Core

In ZoneBreaker Core, even on past charts,cloud zones showing buy bias, sell bias, and wait-and-seeremain.

Therefore you can verify later what environment signals appeared in the past.

In addition, with signal tools I developedXAUUSD Arrow,

you can display up to 100 TP lines historically, and all SL lines remain.

In other words,you can track from entry to take profit and stop loss at a glance.

■ Further accuracy with Premium Tools

Using the included bonus “Time Line Tool,” you can leave on the chart themarket hoursfor Tokyo, London, NY, etc.

This allows you to objectively confirm, through backtesting, which time periods tend to show stronger performance.

■ Why beginners should absolutely do this

Many beginners say, “I don’t know how to backtest,” or “I don’t see the point.”

However, backtesting is the process of elevating your method to a level you can use with confidence.

Data you confirmed with your own eyesis the most convincing material when you enter a trade.