Overlapping indicators too much is dangerous! Simple strategy beginners should know first

The indicator should not be overlaid too much— Why 1–2 filters are just right

During the process of learning trading, there is a path that many people go through at least once.

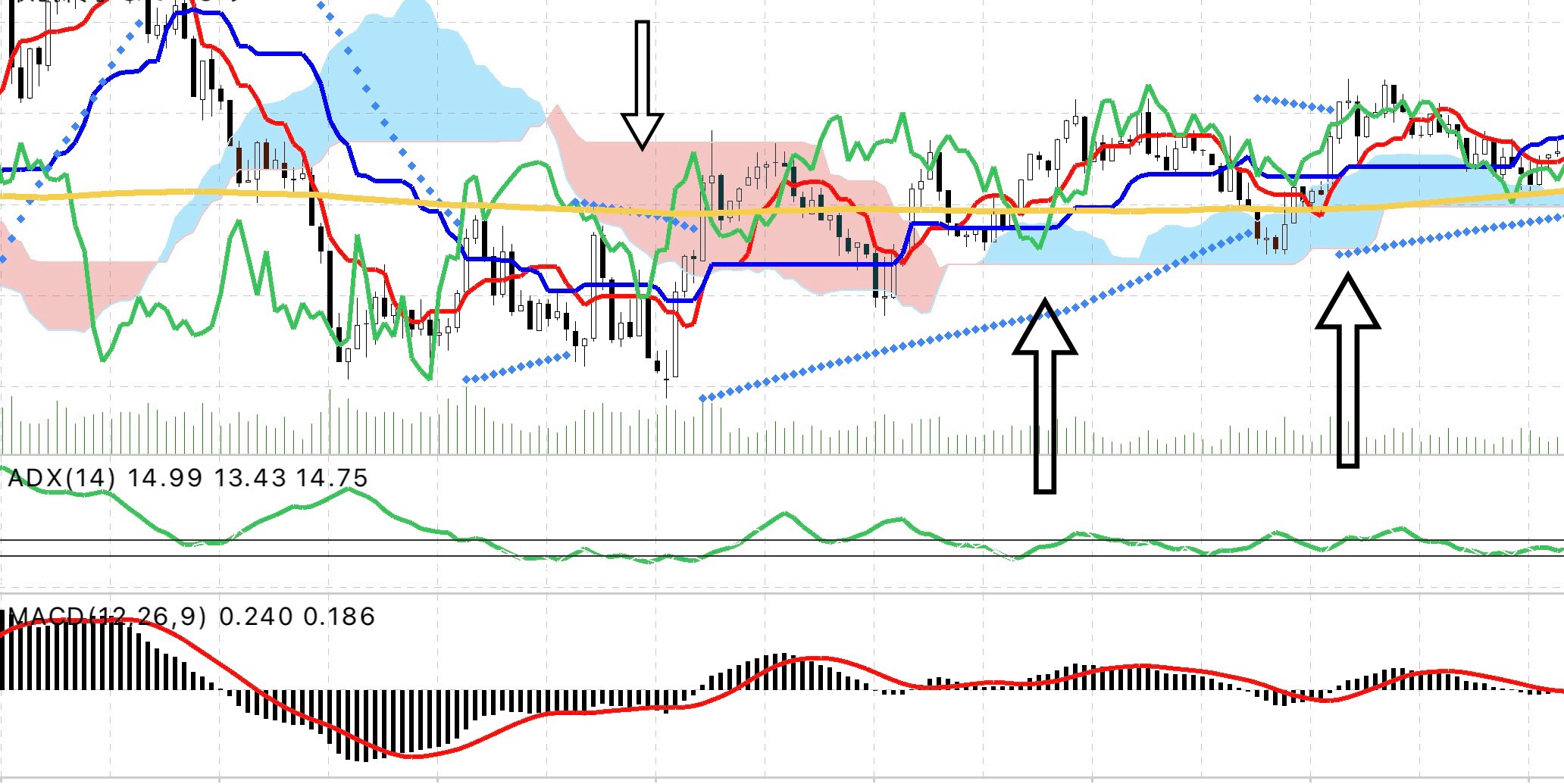

That is layering every technical indicator—moving averages, RSI, MACD, Stochastic, Parabolic SAR, ADX, ATR, CCI, Ichimoku Kinko Hyo—until the chart is completely filled.

And when you add trendlines, channels, Fibonacci retracements, support/resistance lines, etc., you end up not knowing what to base your decisions on….

Individually, each indicator may appear to function, indeed.

However, the more you layer, the more contradictions and confusion you accumulate, and ultimately you only notice “reasons not to enter.”Entries not to enterbecome prominent.

This is something many traders experience at least once.

※ If anything, the arrow points look organized, but it doesn’t seem effective.

⸻

Disadvantages of having too many filters

• Conflicting signals: RSI buy signal vs MACD sell signal, etc., frequent cases where the direction doesn’t align.

• You miss opportunities when you notice them: while waiting for conditions to align,the market has already moved.

• Discretion risk: as indicators increase,“only pick signals that suit me”becomes more likely.

⸻

The importance of narrowing down to 1–2

What actual testing shows is thatfilters should be narrowed down to 1 or 2 for effectiveness.

Common basic examples you’ll find online include:

• The slope of moving averages and the strength of the ADX

• RSI levels and a break of trendlines

and so on.

(These are just examples and not particularly novel. However, simplicity is this strength.)

If you limit to this extent, you won’t be confused when looking at charts, and you can make smoother judgments the moment signals appear.

⸻

Summary

The more indicators you use, the more you feel invincible and secure, but in actual trading itleads to missed opportunities and confusion.

What matters is not piling up many indicators, but

“one-to-two filters you can be convinced by” + “clear rules”

Ultimately, simple systems form the foundation for long-term trading continuity.

For those who get lost in trading.

“The Sky Between the Heavens” is a simple strategy where entries are automated and decisions are made by rules. First, read the free material

and you should get a general sense of the rules and mindset.

It explains “in what situations and why that judgment is made” with diagrams.

Even with simple rules,if you understand the structure, anyone can make reproducible judgments.

If you want a clear set of criteria inside you, start here.

Sky Between the Heavens main text here

Why publish negative results?

Investing Navi+ deliberatelypublishes negative results without hiding them.

The reason is that “trading is not always possible to win.”

Rather, by recording losses you can analyze “what conditions cause losses” and make your logic more robust.

Instead of obsessing over each win or loss,

over a span of 1 week or 1 month, if the total net result is positive, that’s what matters.The most important thing

• “I’m happy because I won today”

• “I’m anxious because I lost today”

To remove this emotional wave, let the EA handle entries and have humans focus on “settling according to the rules.”

“I want to win” but “I want to earn” —this mindset is the foundation for long-term gains.

Stability gained by following the rules

The common point for people who lose big in trading is“the desire to win”drives rule-breaking

For example, thinking “I want to extend it more” or “I want to wait a bit longer” and delaying the settlement can wipe out profits in one go.

Sky Between the Heavens is

• Entries fully automated by EA

• Settlement under fixed, rule-based conditions

This reduces human intervention as much as possible and eliminates hesitation.

By mechanically following the rules, win rate and risk-reward naturally stabilize.

⸻

We tested the strategy aimed at the “maximum profit while in the sky zone,”

There are times when you end up with borderline or breakeven settlements, but because you followed the rules, you can calmly seize the next opportunity.

Even in cases where you could have taken more,

by closing at the breakeven according to the rules, you ultimately maintain a positive total—this is the strength of this strategy.

What matters in trading is not “win rate” but “reproducibility”

Many traders worry about win rate, but

even with a 50% win rate, if risk-reward (RR) is good, capital will grow

What matters is having rules that arethe same result no matter who uses them“reproducibility”

Sky Between the Heavens is,

•EA entries → mechanical stop-loss → rule-based take profit

is used to establish trading as a “business.”

⸻

A strategy aimed at overall profit

Focusing on daily wins and losses is dangerous.

For example, over a week or a month, even with a few negative days, as long as the total is positive, that’s OK.

EA, lacking emotions, is ideal for long-term capital management.

Operating the rules with the vision of “earning” rather than “wanting to win” tends to stabilize the growth of funds.

ℹ️Information on the dedicated tool (purchase bonus)

Currently, for those who purchase Sky Between the Heavens, we provide a supplementary tool (automatic entry + stop-loss processing).

This was created from the desire that users themselves want to use it daily,

and it is designed to delegate breakouts and risk management according to market structure.

For those who prioritize “the take profit is their own decision,” this tool is an excellent match.

Reviews are not yet numerous, but perhaps because the tool is simple and straightforward enough that it requires little interaction before or after purchase.

However, if the number of users grows, a paid model may be considered.

The reason is that “selling the tool alone” may not be sufficient; there may be a need for “support and set usage.”

◻️ For those who want automated EA entry

This logic-to-EA tool is distributed as a purchase bonus.

If you’re considering purchasing, feel free to contact us.

Sky Between the Heavens Entry EA here

If you are interested in Sky Between the Heavens, you can join the online community

Join the online community here

Within the online community, specific trading logic cannot be explained, but

you can join a “chart critique community” using Sky Between the Heavens.

• If you send a chart image you’re curious about,

“In this situation, how should I judge?”

“Where were the entry and take-profit points?”,andwe will provide feedback with rule-based judgment examples.

•Past charts at specific times are also OK.

We will respond in order as time allows.

To you who are interested in Sky Between the Heavens

In short-term trading, the goal is to build a foundation for “decisive rule-based judgment”

that is the basic philosophy of Sky Between the Heavens.

“Can I enter this chart?”

When you’re unsure,it would be helpful to switch to thinking that you judge by rules, not by feel.