【KOMYO光明】 Adding a new feature as an apology to support various trading styles!

A simple tool to thoroughly “take profits when you can”

Take profits when you can—

The most reliable way to leave profits behind.

Support for profit-taking without being erased by overconfidence

【KōmyōKOMYO】 apologies and feature updates

We caused you some inconvenience with the quick fix right after release the other day,

and as an apology we added a new feature .

This tool signals based on a confirmed bar, so there is no repaint at all.

Whether in testing or in real use, you can confirm the same behavior and use it with confidence.

New features:

• Drawing mode: current bar / next bar open price (recommended) / confirmed bar selectable

• Doten mode: only the immediate previous signal direction is enabled

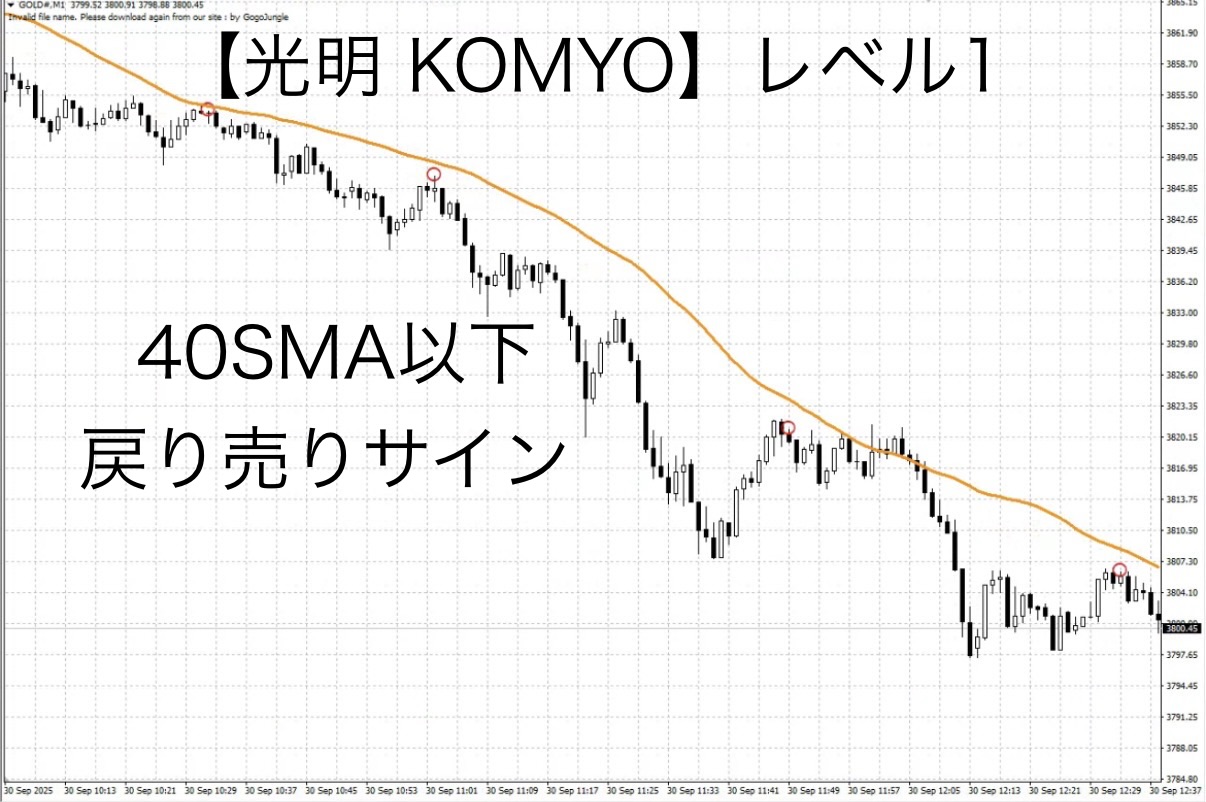

• SMA filter: set “none / above / below” separately for BUY and SELL.

Because you can specify upper-timeframe SMA as well,

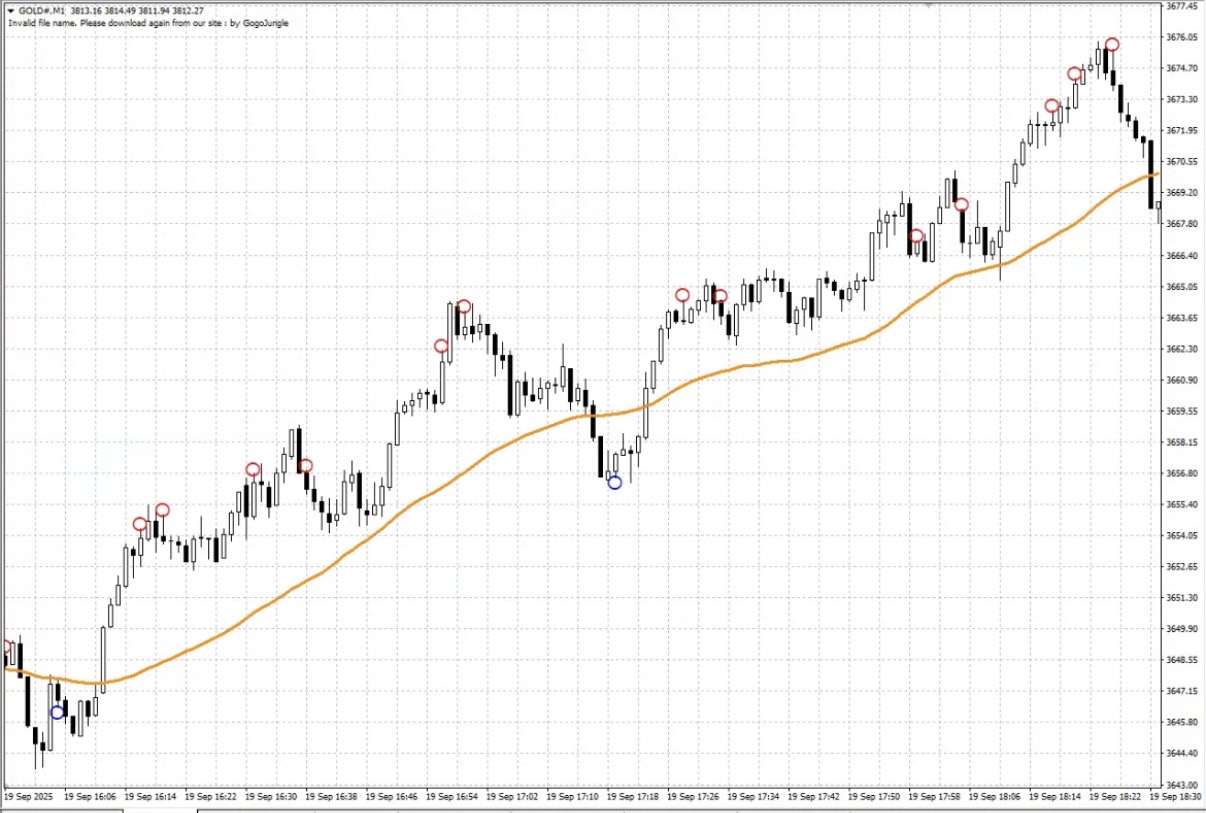

• For profit-taking (red circle signal during uptrends)

• For buying on dips (blue circle signal during uptrends)

• For selling on retracements (red circle signal during downtrends)

You can switch signals according to use case

and adjust to market conditions and your own style.

【Kōmyō KOMYO】 Signal appearance

【Kun'ei UNKAI】 Signal appearance

EA-driven breakout strategy

Here is the Entrypoint EA of the Heaven’s Gap

Entry EA manual included

“Heaven’s Gap” is a simple strategy where the entry is delegated to an automated entry EA , and traders focus only on monitoring after entry and executing the exit rules.

The EA constantly monitors the chart and enters precisely at the breakout moment without missing it.

This eliminates the stress of sticking to the screen before entry and the worry of missing timing.

ADX, ATR, SMA and other filters are built in.

As a bonus for purchasers, this EA becomes available for use.

【雲海】Colors the White Cloud — the Beam of Light is here

For those who already have solid rules—Unkai of Clouds will further strengthen your method.

Take profits when you can—

The most reliable way to leave profits behind.

Support for profit-taking without being erased by overconfidence

Why publish negative results as well?

In Investment Navigator+, we deliberately publish even negative results without hiding them.

The reason is that “trading cannot always be winning.”

Rather, by recording negatives, you can analyze what conditions lead to losses and make the logic more robust.

Rather than focusing on each win/loss,

Over a week or month, having a total positive balance is most important and a positive overall result.

• “I’m happy because I won today.”

• “I’m anxious because I lost today.”

To eliminate these emotional swings, delegate entry to EA, and have humans focus on executing according to the rules for exits.

Not “I want to win” but “I want to earn” — This mindset is the cornerstone for accumulating long-term profits.

Stability gained by following the rules

The common trait of people who lose big is the urge to win often triggers rule-breaking

For example, hoping to “stretch it further” or “see a bit longer” and delaying exits can wipe out profits in an instant.

Heaven’s Gap offers:

• Entries fully automated by EA

• Exits governed by fixed, rule-based conditions

This reduces human discretion to a minimum, eliminating hesitation.

Just by mechanically following the rules, win rate and risk-reward stabilize naturally.

⸻

There are countless techniques in technical analysis, including moving averages, RSI, MACD, stochastic, Parabolic SAR, ADX, ATR, CCI, trendlines and channels, Fibonacci retracements and expansions, Ichimoku, volume, support/resistance lines, and more.

There is no single “correct” method; what matters is having one personal rule you believe in and actually testing it to verify it.This way you gain confidence that translates into real market applicability and a sense of expectancy buildup.

⸻

In Heaven’s Gap, test using the “maximum profit-taking type” rules,

even if occasionally you take profit at break-even, by sticking to the rules you can calmly seize the next opportunity.

Even in cases where you could have taken much more,

because you exited at break-even according to the rules, you end up maintaining a total positive result, which is a strength of this strategy.

What matters in trading is not “win rate but “reproducibility”

Many traders chase “win rate,” but

even a 50% win rate can grow capital if the risk-reward is favorable

What matters is having a rule that yields the same results no matter who executes it, i.e., a reproducible rule.

Heaven’s Gap is,

•EA entry → mechanical stop-out → rule-based profit-taking

By performing this sequence with zero emotion, we emphasize building a trading business mindset.

⸻

Strategy aimed at overall profitability

Focusing on daily wins and losses is risky.

For example, when viewed over a week or month,even with some negative days, if the total is positive, that’s fine.

EA has no emotions, making it also ideal for long-term capital management.

By operating the rules with the vision of “earning” rather than just “winning,”

the capital growth curve tends to be more stable.

If you are interested in Heaven’s Gap, you are invited to join the online community

Join the online community here

Within the online community, we cannot explain concrete trading logic, but

you can join a “chart critique community” that utilizes Heaven’s Gap.

To those interested in Heaven’s Gap

Lay the foundation for making decisions with rules in short-term trading—

that is the core philosophy of Heaven’s Gap.

Free materials here:

▶︎ Download ‘Trail to the Gap’

In ‘Trail to the Gap,’ you’ll find explanations of when you can actually trade in real situations

and the criteria for making judgments, made easier to understand.

The sales page for Heaven’s Gap alone could not convey this,

and it provides detailed guidance on entry points and zone selection with diagrams and case studies.

Even beginners can easily replicate the structure, so

if you’re curious, please also make use of that resource.

If you’re interested, please first receive the free material ‘Trail to the Gap’.

From there, your first step in Heaven’s Gap begins.

“Should I enter this chart?”

When in doubtI’d be glad if this helps shift your thinking to “decide by rules, not by feelings.”