[Beginner] Technical Course | Bollinger Bands (Bollinger Bands)

In practice, all indicators, rules, and theories are

“believe and wait for the moment”the absolute rule.

Technical Course | Bollinger Bands

Bollinger Bandsis an indicator that visualizes price volatility by combining moving averages and standard deviations.

It can confirm market “overextensions” and “contractions,” and is used for both trend-following and counter-trend strategies.

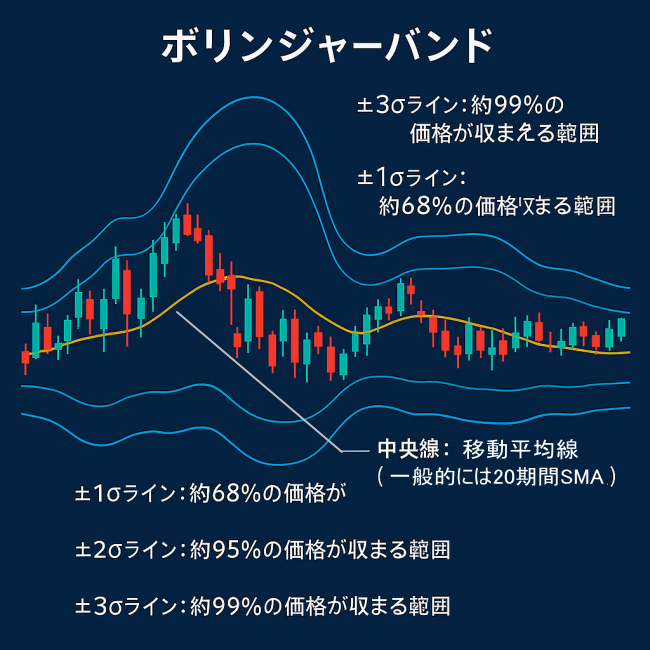

Basic components of Bollinger Bands

- Central line:Moving average (commonly a 20-period SMA)

- ±1σ line:Range that contains about 68% of prices

- ±2σ line:Range that contains about 95% of prices

- ±3σ line:Range that contains about 99% of prices

Basic usage

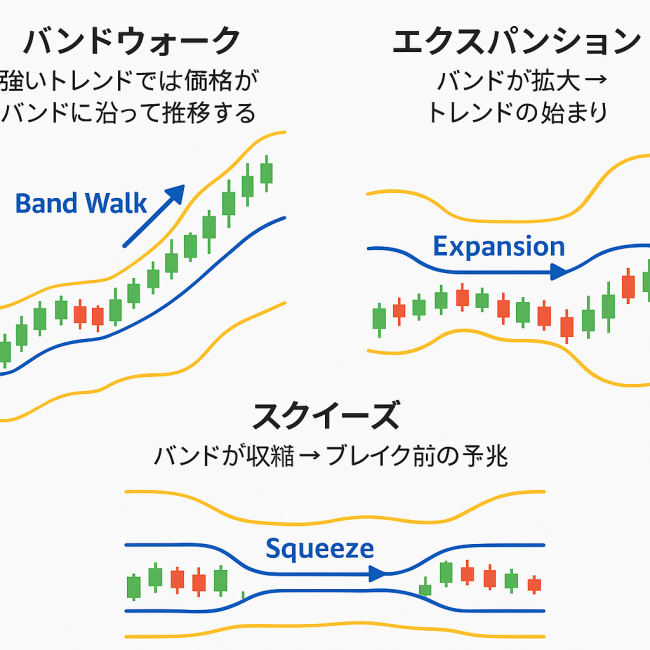

- Band walk:In strong trends, prices move along the bands

- Expansion:Bands widen → start of a trend

- Squeeze:Bands contract → prelude to a breakout

- Counter-trend:Target rebound when ±2σ or ±3σ is reached (effective in ranging markets)

Important:Bollinger Bands are not a “line where price must return,” but a

leading signal reflecting market momentum (volatility).

Practical ways to use them

- Look for squeezes → energy accumulation before a trend emerges

- Go with the breakout direction → enter when expansion occurs

- In ranging markets, use counter-trend → aim for rebounds near ±2σ or ±3σ

In particular, “expansion after a squeeze” is a signal that many traders watch.

Use Bollinger Bands in combination with moving averages and support/resistance to improve accuracy.

Checklist

- Is the band width narrow or wide? (squeeze or expansion)

- Is the price above or below the central line (moving average)?

- When a trend forms, is the price riding the Band Walk?

- If taking a counter-trend position, always confirm that the market is range-bound

Bollinger Bands are a versatile tool that can handle both “trend” and “range.”.

However, proper usage is key. In trending markets, focus on trend-following; in ranging markets, focus on counter-trend strategies.