【Beginner】Technical Course | Dow Theory

【Practice】 All indicators, rules, and theories are absolute rules:

“Believe and wait for that situation.”is the absolute rule.

Dow Theory

Dow Theory is a theory proposed by Charles Dow for evaluating market price movements.

Dow Theory consists of six basic principles

1. The averages discount all events

It holds that everything, including technical analysis and fundamental factors, is reflected in price.

2. There are three kinds of trends

There are long-term trends, intermediate-term trends, and short-term trends.

3. Major trends consist of three phases

Phase 1: Leading investors who have concluded the bottom enter

Phase 2: Trend-followers participate, and buying expands

Phase 3: Beginners flood in

4. The averages must be confirmed with each other

In FX, you need to confirm correlations and counter-correlations between currency pairs.

5. The trend must also be confirmed by volume

In the stock market, volume is emphasized, but in FX there is no volume data, so it isn’t used.

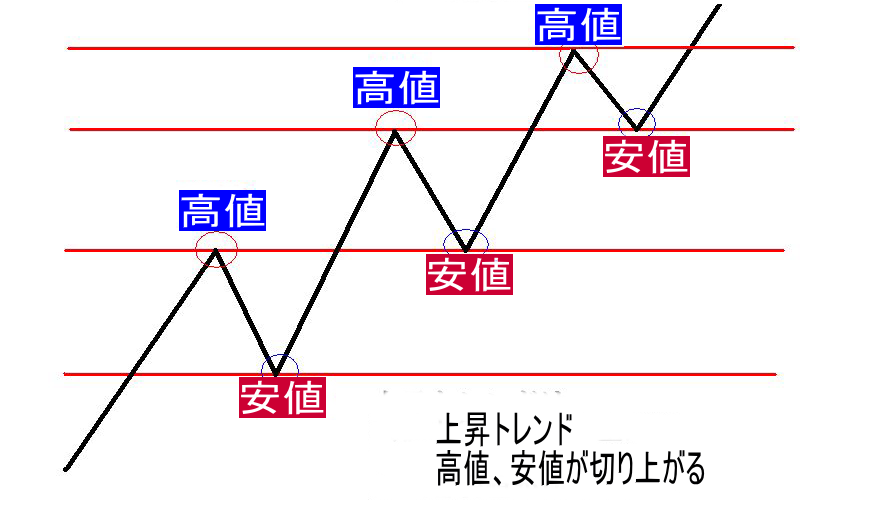

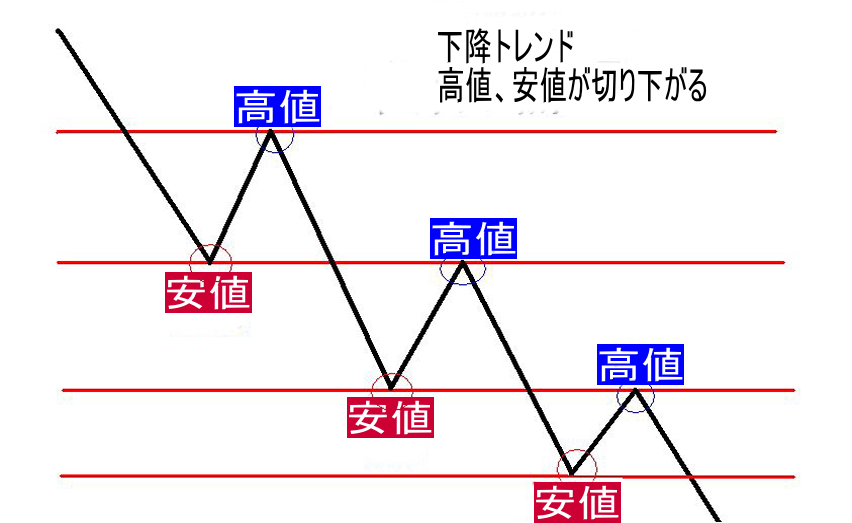

6. The trend continues until a clear signal appears

An uptrend continues “until the low is broken,”

A downtrend continues “until the high is broken.”

Setting aside difficult theories, always keep an eye on the highs and lows on the chart.

Additionally, it is important to be able to distinguish the high/low of a larger swing from the high/low of a smaller swing.

This is a very important theory for determining stop-loss points. Be sure to memorize it.

The interpretation of highs and lows varies by person, but what matters is always looking from the same perspective.