[Beginner] Technical Lecture | Granville's Rule

【In practice】 All indicators, rules, and theories must be

“believed and waited for the moment”as an absolute rule.

Graham Bell's Law

This is also a simple rule, but it is important to believe and use it.

Graham Bell's Law is a trading rule discovered by Joseph Granville, who devised the moving average.

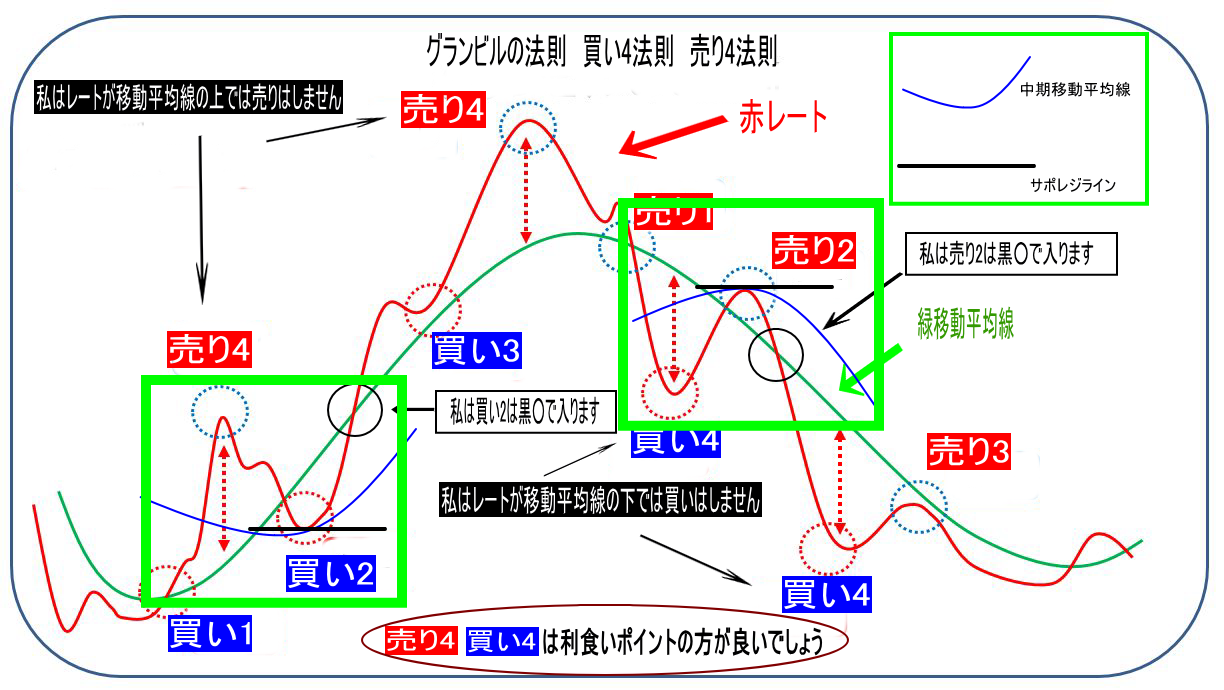

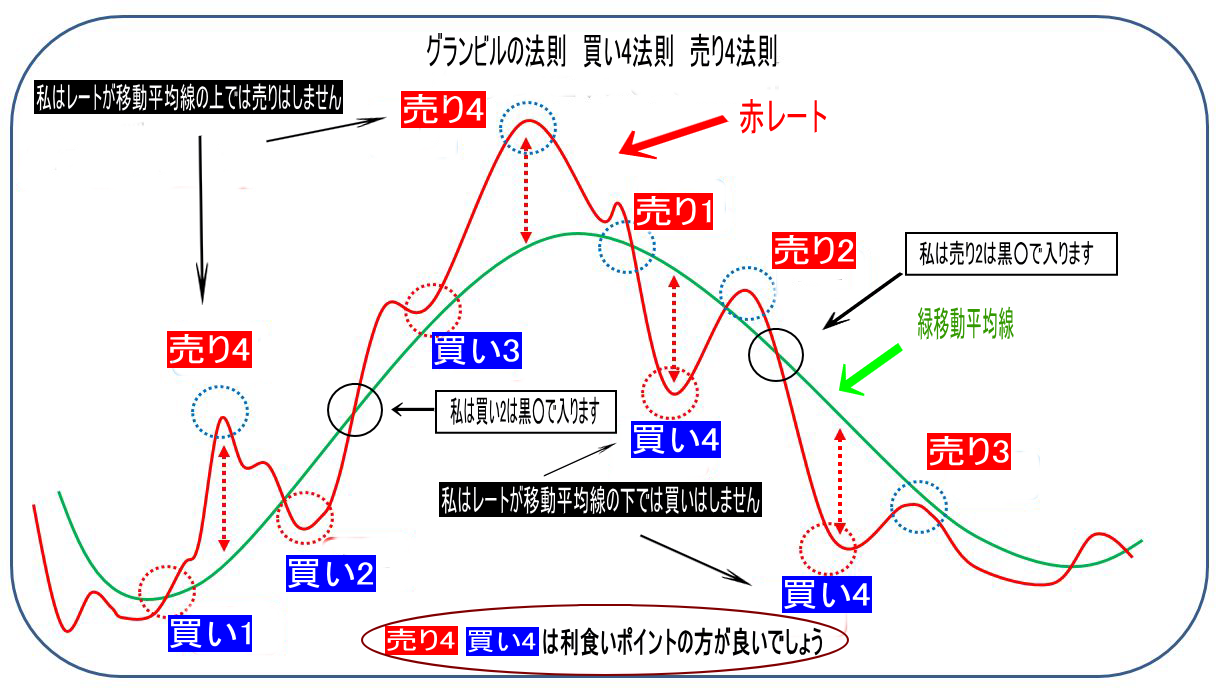

Granville's Law | Eight Buy/Sell Points

Buy 1

When a topping-down moving average becomes flat or turns upward, and the price crosses above the moving average.

Buy 2

When the price temporarily dips below the moving average during an uptrend, then moves back above it.

Buy 3

When the price sharply diverges from the moving average to rise, falls back, and fails to reach the moving average but then rises again.

Or when the price falls to touch the moving average.

Buy 4

When the price significantly undershoots the moving average in a downtrend.

(Trend followers are better off not entering. It is preferable to use it as a profit-taking point)

Sell 1

When the rising moving average becomes flat or turns down, and the price breaks below the moving average.

Sell 2

When the moving average is in a downtrend and the price temporarily breaks above the moving average.

Sell 3

When the price diverges sharply from the moving average to fall, rebounds, but fails to reach the moving average and falls again.

Or when the price rises to touch the moving average.

Sell 4

When the price significantly overshoots above the moving average in an uptrend.

(Trend followers are better off not entering. It is preferable to use it as a profit-taking point)

Supplement:

For Buy 2 and Sell 2, entry is OK if the price rebounds at a mid-term moving average or at support/resistance.

However,the condition is that both moving averages must be in the same direction (both rising or both falling)..