[July 24] 30-Second Gold Non-Discretionary Scalping Trade Result

Details of 30-second GOLD non-discretionary scalping here

+++++++++++++++++++++++++++++++++

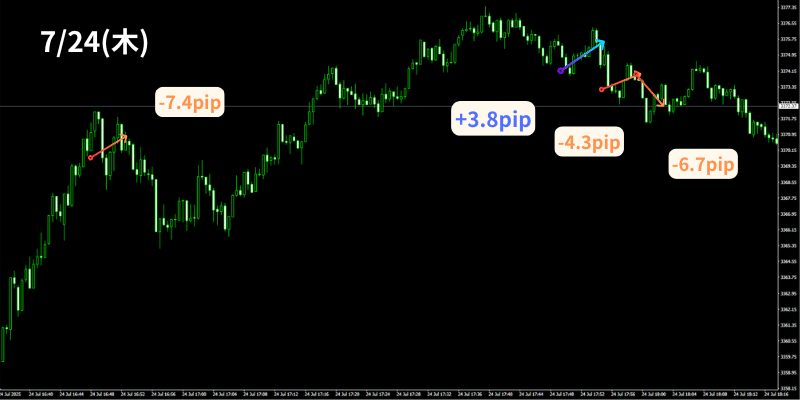

July 24 trade.

21:30

US Initial Jobless Claims 07/06 - 07/12 [Continuing Claims]

21:30

US Initial Jobless Claims 07/13 - 07/19

22:45

US PMI (Purchasing Managers' Index - Flash) July [Manufacturing PMI - Flash]

-19.5 pips 52.9 52.5 49.5

22:45

US PMI (Purchasing Managers' Index - Flash) July [Service PMI - Flash]

22:45

US PMI (Purchasing Managers' Index - Flash) July [Composite PMI - Flash]

23:00

US New Residential Sales June [New Home Sales]

23:00

US New Residential Sales June [MoM]

and so on are in store.

The range of fluctuations is not very large, but because the importance is high and they overlap in the same time frame, caution is required.

Trading is based on that consideration.

After advancing on the 23rd, the price sharply broke the low and showed signs of a turn.

In the Tokyo market on the 24th, lows were further lowered, and the London market also continued to decline.

GOLD, which had been falling steadily, has paused its decline in the NY market for the moment.

From there, it rebounded once and, as in the chart image, rose temporarily.

There have not been clean zigzags every day, entry opportunities have been few, and even when entering, prices did not move cleanly in that direction, resulting in mediocre entries.

This week has many such markets, with movement on a long-term view, but the NY market has struggled.

Since it is only a small loss, there is no problem, but it would be nice to see a large positive soon.

That said, it is a market, so the only thing we can do is continue entering without discretion, so let's keep at it.

*********************************