Today as well, easy currency selection with an advantage ♪ Oops, that was close!

According to the Bank of Japan's report, general traders in Japan are focused on trend-following and short-term trading.

Of course, I think beginners should stick to trend-following.

However, traders at an intermediate level and above also have counter-trading (contrarian) methods in their toolkit.

If you are seeking stability as a trader, I won't say you must, but you should consider when contrarian trading is targeted. Such perspectives are necessary.

Now, let's pick up an example from yesterday's market and introduce it.

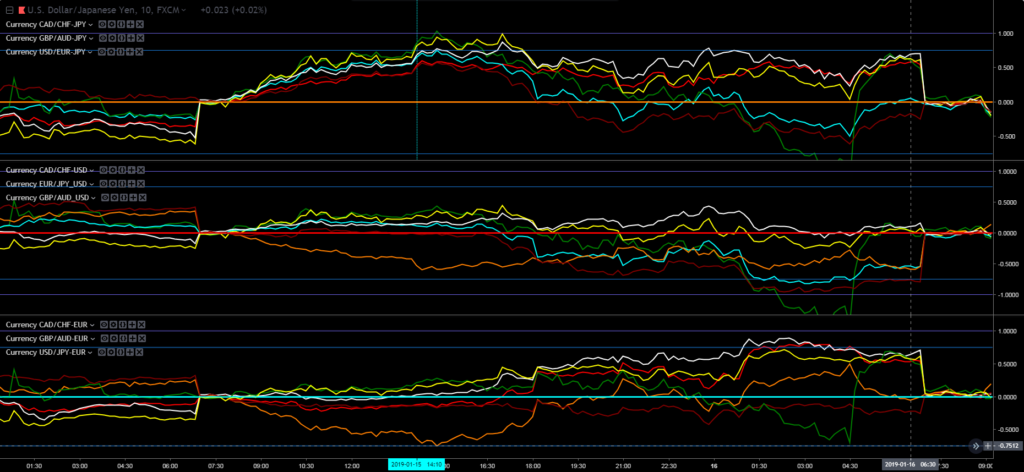

The abovecurrency strength by pair chartshows a Yen-weak market movement.

The central line at the top, the orange line, represents the yen. Since all other lines are above, the yen becomes the weakest currency.

Next, pay attention to the red central line in the middle. This represents the USD pair.

The orange yen line is downward, while the others are positioned higher.

What does this mean?

The yen is being sold, but in fact the dollar is also being sold.

Now, let's look at the actual USD/JPY chart.

Until 2 PM, it was rising sharply. However, afterward it was sold down rapidly to the morning breakout point.

In other words, contrarian trading is triggered by aiming at such an imbalance.

By adding a touch of contrarian thinking to a trend-following approach, you can achieve more stable trading.

◎ The overall currency strength chart is freely available here freely available here Please make good use of it.

◎ The currency strength by pair chart is freely available here freely available here Please make good use of it.