Translate the below HTML to English, keep format HTML, the result is not in markdown code and not break line, convert standard decode before translate: 【誰でも分かる買い合図】〜突破乗り〜水平ラインしか使わない東京時間・高値安値ブレイク[木里ゆう] Translation: 【Buy Signal Anyone Can Understand】 ~ B

To win with FX, many traders believe technical analysis is indispensable, but that is a misconception. There are trading ideas that can be profitable without technical analysis.

In this article, we asked Yu Kobiri (Kobiri Yu) to share such highly useful tactics. All of them are easy to replicate, so please give them a try.

Table of Contents

1. Yu Kobiri’s Profile

2. Key Points of this Method

3. Just wait for the trend. We won’t try to predict the direction!

4. Place stop orders on both sides

5. Pursue expectancy as a long-term operation

6. Price-movement tendencies differ by market

7. Possible trend during London session!

8. Draw horizontal lines at the high and low of the Tokyo session!

9. Prepare two FIFO orders to handle breakouts in both directions

10. Steps for breakout trading

11. Different profit-taking and stop-loss widths by currency pair

12. Breakout trading example ① GBP/JPY 1-hour chart / Apr 12–13, 2018

13. Breakout trading example ② EUR/JPY 1-hour chart / Feb 27–28, 2018

14. Breakout trading example ③ GBP/JPY 1-hour chart / Apr 19–20, 2018

15. Set appropriate parameters according to market movement

16. How to validate the parameters

● Character count: 3381 characters (including headings)

● Images: 11

※This article is a re-edited version of an article from FX Gokaku.com July 2018 issue

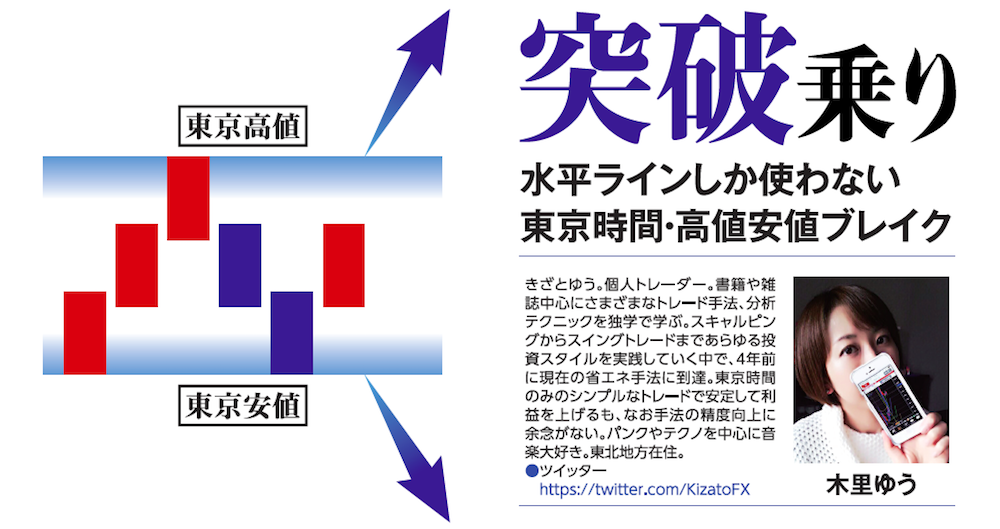

Yu Kobiri’s Profile

About 10 years of FX experience. Never doing detailed technical analysis, aiming for profit with probability theory and psychology. Also operates steadily with compounding via swap carry, while being a free spirit who loves spirituality and music. Based in Tokyo.

●Twitter

● Official site “Yu Kobiri’s Swap FX Life”

Key Points of this Method

■ Trading Steps

- Draw horizontal lines at the Tokyo session high and low, and place a stop-IFO order 8 pips ahead at 17:00 with the range setting from step (4). Do not enter on Fridays.

- If one of the new orders is filled, cancel the other.

- Leave the filled position unlit until it is closed (but liquidate positions at market price every Friday at 16:59). If no new orders are filled and midnight passes, cancel the IFO orders.

- Stop-loss: 150 pips for EUR/JPY, 150 pips for GBP/JPY; Take-profit: 135 pips for EUR/JPY, 110 pips for GBP/JPY

■ Target Currency Pairs

- EUR/JPY, GBP/JPY

■ Advantages / Disadvantages

- Advantage: No need to stay glued to the chart. Trading can be done with just a smartphone

- Disadvantage: You need to cancel orders at 00:00

■ Cautions

- Profitability must be viewed in the long term

- Resilience to a losing streak is important