Dr. Iida-tchi’s "Yūyū" End Price Trade | Episode 2 Perfect Pattern ② [Dr. Iida-tchi]

Mr. Iidacchi Sensei Profile

Former tutor at a prior preparatory school. A professional FX trader who loves hot springs and holds a hot spring sommelier qualification. He has trained many excellent traders using a method called the “End-of-day Trading Method,” and in his online study groups participants from nationwide ranges—from the elderly to students—learn together. The chart analysis method that emphasizes the “close price” is popular among part-time traders as a trading method that doesn’t require concentrating on 24 hours of the market.

Blog:The Big Comeback from 1,000,000 Yen! FX Trader Iidacchi BLOG

※This article is a republication/edit of an article from FX Strategy.com, December 2018. Please note that the market information written in the main text may differ from current market conditions.

Appearing almost every week. This is the spot-on pattern!

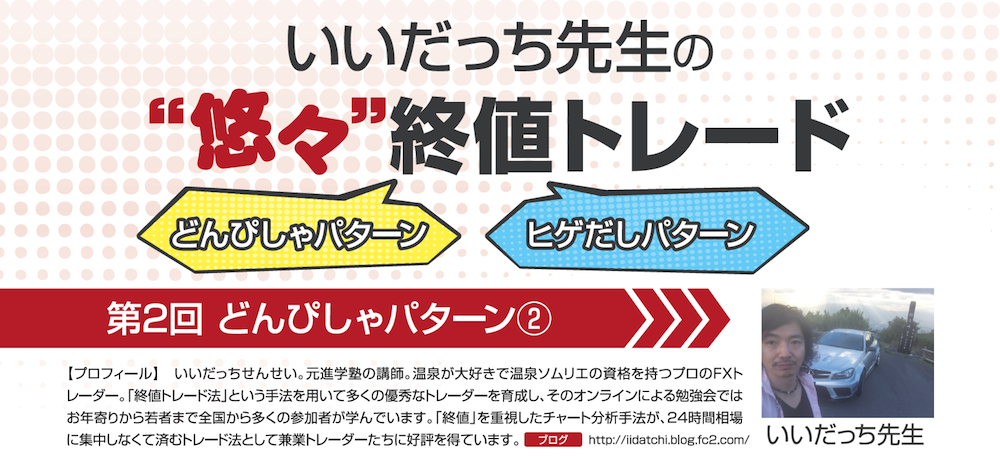

Hello, Iidacchi-sensei here. Last time I wrote about “the importance of the close.” And right away, after receiving many responses, this familiar “spot-on pattern” (Figure 1) had many of Iidacchi-sensei’s students earning heavily again this month.

Iidacchi-sensei always starts by making his students rule out whether the price will go up or down. In other words, he recommends trading based on chart pattern analysis. The reason for eliminating forecasts is that they are often unreliable.

The Difference Between Gambling and Trading That No One Has Talked About

I think many of you have heard expressions like “Investing and trading are gambling!” However, you should approach it with the understanding that “trading is not gambling!” This difference between gambling and trading is not explained clearly by many people.

So what exactly is the difference between gambling and trading? Is trading gambling if you perform high-level analysis? Then would horse racing or pachinko stop being gambling if you perform high-level analysis? Is it because the odds are high? Or because you use leverage? What really is the case?

Many people do not have a clear recognition, but a “chōhō bakuchi” (coin-toss gamble) or “one-shot gamble” is gambling. For example, predicting heads or tails of a coin is gambling (Figure 2). In short, predicting whether it will rise or fall is generally gambling.

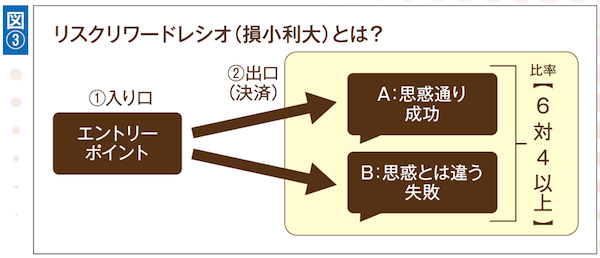

Then what exactly is non-gambling trading? To put it another way, assign “+60 points for heads” and “−40 points for tails” to a coin toss and tally the points as they come up. As you repeat it, the probability of heads and tails converges to 50%, and the total points will eventually be positive.

Trading works the same: when you take a position, you determine in advance that if things go as you expect you’ll have “+60 points,” and if not you’ll have “−40 points.” It is important to establish this in advance (Figure 3). This is what is known as risk-reward being favorable. It’s also called the “risk-reward ratio.” In other words, trading is not about predicting up or down, but about having a system where losses are kept small and gains are large.