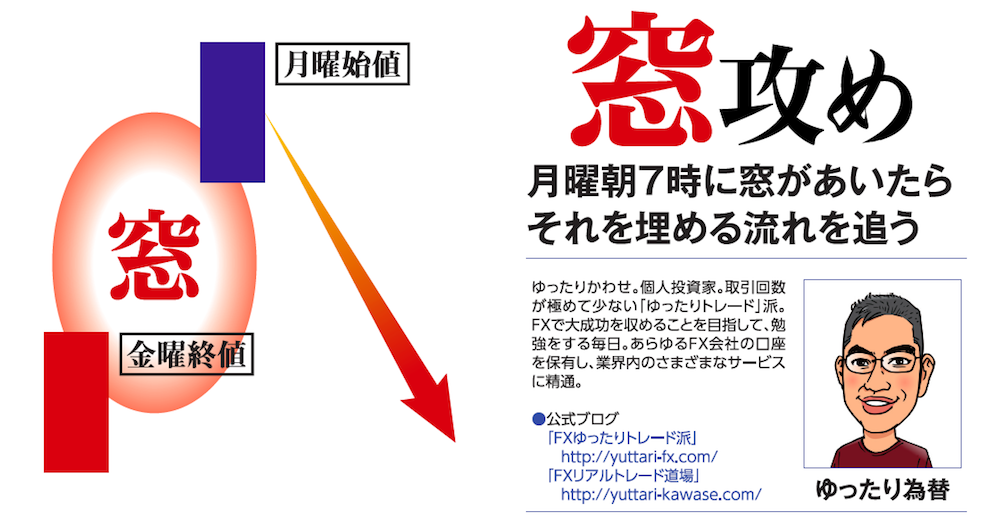

[Anyone Can Understand Buy Signal] ~ Window Attack ~ If the window opens at 7 a.m. Monday, we follow the flow to fill it [Relaxed Forex]

To win in FX, many traders are convinced that technical analysis is indispensable, but that is a misconception. There are trading ideas that can be profitable without technical analysis.

In this article, we asked Yuttari-Kawase to share such highly useful tactics. They are all easy to replicate, so please give them a try.

Table of Contents

1. Yuttari-Kawase Profile

2. Key points of this method

3. Techniques to steadily increase assets

4. Easy but with limited opportunities

5. What is a window?

6. Why do windows open?

7. A case of a window opening on a Monday

8. Caution! The same window can form in different ways

9. How to know price movement before 7 a.m. on Monday?

10. Steps of window attack trading

11. Save steadily or take the amount? Two separate strategies

12. Window attack trade example ① — USD/JPY 15-minute chart / Monday, April 16, 2018

13. Window attack trade example ② — USD/JPY 15-minute chart / Monday, April 23, 2018

14. Performance in the last year (May 2017–April 2018) / 52 trades: 11 wins, 4 losses (205 pips gained, 95 pips lost)

● Characters: 3159 characters (including headings)

● Images: 7

※This article is a re-edited version of an article from FX Strategy.com, July 2018 issue

Yuttari-Kawase Profile

Individual investor. A “relaxed trading” advocate with a very small number of trades. Studying daily with the aim of achieving great success in FX. Holds accounts with various FX companies and is familiar with a range of services in the industry.

● Official blog “FX Relaxed Trading Style”

● Official blog “FX Real Trade Dojo”

Key points of this method

■ Trading steps

- From a little before 7:00 on Monday, check whether a gap is likely to open

- If the gap is 10 pips or more, enter in the direction that fills it

- Stop loss: same value as take profit / Take profit: close price of the previous Friday (or the day’s close)

■ Favorable currency pairs

- Dollar/Yen and Euro/Dollar with narrow spreads are recommended

■ Pros/Cons

- Pros: can decide whether to trade at 7:00 on Monday. Easy to make it a routine

- Cons: win rate is not high, about 60%, and consecutive losses can occur

■ Important notes

- ・Mondays occur about 50 times a year, and 30–40% of those openings are 10 pips or more. In other words, trading opportunities are few

- ・Understanding expected value is essential

- ・Your psyche will be tested during losing streaks

- ・Because you want to trade exactly at 7, you need familiarity with tools and quick reflexes