[Anybody can understand trading signals] Using the cycle shown by three moving averages: Moving Average Major Cycle Analysis [Shun Hirose]

Understand the stage from the arrangement of three exponential moving averages, and use that cycle to enter and exit trades. While aiming for large profit margins, the loss-cutting range can be kept shallow, enabling trades with small losses and large profits.

Table of Contents

1. Shun Hirose Profile

2. Strategy Points

3. Trading Procedure

4. Trade Explanation

5. Point 1|Environment Analysis with three moving averages

6. Point 2|Six kinds of stages and the basic large cycle

7. Point 3|Learn the movements when a trend occurs

8. Point 4|What is ATR (Average True Range)

9. Entry|Wait at the trend entry, then GO on signal

10. Exit|Designed to be a trade with small losses and large gains

11. Trade Example ①|Riding the rise from a double bottom (GBPUSD 1-hour chart April 6, 2018 to April 18, 2018)

12. Trade Example ②|Successful breakout of consolidation (GBPJPY 1-hour chart April 26, 2018 to May 8, 2018)

13. Trade Example ③|Beautiful uptrend after inverse head and shoulders (USDJPY 1-hour chart May 10, 2018 to May 23, 2018)

14. Trade Example ④|Big down candle but loss is shallow (NZDJPY 1-hour chart May 3, 2018 to May 15, 2018)

●Character count: 2997 characters (including headings)

●Images: 11

※This article is a re-edited version of an article from FX Trading Guide.com, August 2018

※“Strategy Points” and the main text assume a rising market scenario (long). In a falling market (short), the opposite rules apply.

Shun Hirose Profile

Actor and investor—the “Investing Actor.” Active on stage and screen both domestically and internationally, while also investing to break the cycle of needing to rely solely on acting for income. Studied under Kojiro, a senior instructor from Waseda University’s Theater Research Society, becoming his top pupil. Maintains a proactive trading blog day and night. Specializes in swing trading using a 1-hour chart and in making desserts.

Strategy Points

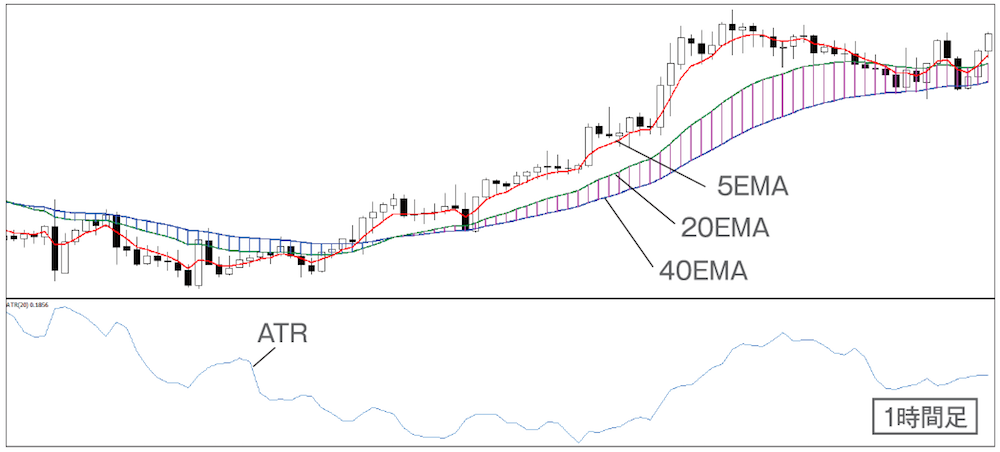

- Technical: Exponential Moving Averages (5, 20, 40), ATR (20)

- Trading Time Frame: 1-hour chart

- Target Currency Pairs: Cross JPY and major-to-near-major USD pairs

- This strategy’s benefits: Visual clarity and low psychological strain

Trading Procedure

New Trade

- From the perspective of large-cycle analysis, look for Stage 6. It’s better if you can also check for trend reversal signals

- Enter when Stage 6 transitions to Stage 1 (the moment of transition is OK, not the close)

Stop Loss

- When Stage 3 transitions, exit at market price. Also place a stop order at twice the ATR value below (the last line of defense)

Take Profit

- Take profit at Stage 3 (use a trailing stop at twice the ATR value)