[Buy Signal Everyone Can Understand] Confirm the medium-term trend with the 40-period moving average! Using the Heikin-Ashi fake-out for day trading [Tomoyuki Hirano]

Determine the trend direction with the 40-period moving average, and enter when the Heiken Ashi color change (whipsaw) occurs. While the trend continues, multiple entry opportunities arise, and it is possible to earn profits in succession.

Table of Contents

1. Profile of Tomo Nishino

2. Strategy points

3. Trading steps

4. Trade explanation

5. Point 1|How Heiken Ashi is formed

6. Point 2|Visual characteristics of Heiken Ashi

7. Point 3|Understand the basics of moving averages

8. Point 4|Set take-profit width to 1.5 times the stop-loss width

9. Entry|Enter when the original color returns

10. Exit|Place orders in the order of stop-loss first, then take-profit

11. Point|Moving averages behave differently by period

12. Trade Example 1|Easily profit in an uptrend! (EUR/USD 1-hour chart, April 10, 2018)

13. Trade Example 2|Two profit-taking exits on a short (USD/JPY 1-hour chart, May 23–24, 2018)

14. Trade Example 3|Temporary large movement leads to stop loss (EUR/USD 1-hour chart, April 26, 2018)

● Character count: 2919 characters (including headings)

● Images: 11

※ This article is a re-edited version of FX攻略.com August 2018 issue

※ The “Strategy Points” and body assume a rising market (long). In a falling market, the opposite rules apply for shorts.

Profile of Tomo Nishino

Graduated from a university in the United States, worked in overseas exchange-related roles before joining Himawari Securities. Engaged in FX operations, a dealer in the proprietary trading division, broadcasting FX and Nikkei 225 information from the Investment Information Office, and served as a seminar lecturer. Currently independent, established Trade Time Co., Ltd. Continues to provide information to FX companies and run seminars while engaging in proprietary trading, investment education, and support for individual investors.

Strategy Points

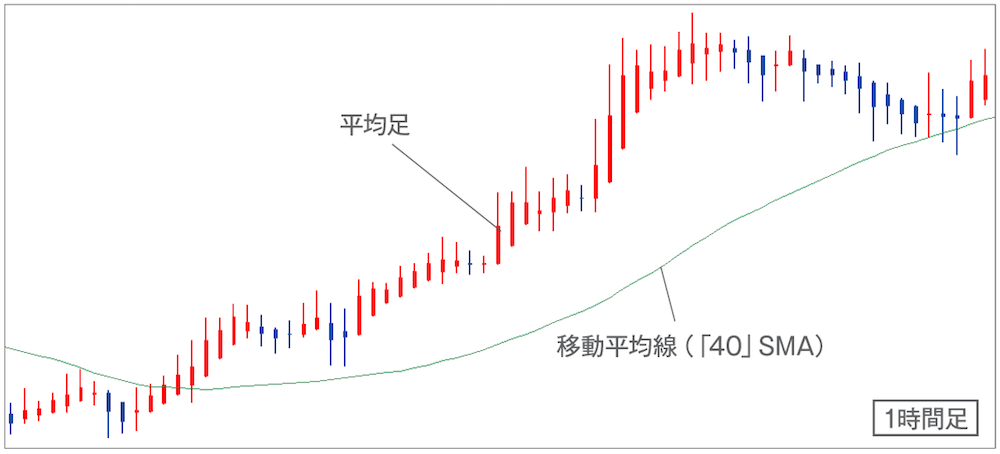

- Technical: Moving average (40 SMA), Heiken Ashi

- Trading time frame: 1-hour chart

- Target currency pairs: Dollar/yen, Euro/yen, Euro/dollar, and other major currencies

- Benefits of this strategy: Clear entry and exit, consistent risk-reward ratio

Trading Steps

New

- Check the relationship between the 40-period moving average and the Heiken Ashi; fix the direction to buy if Heiken Ashi is up, or sell if down

- If the Heiken Ashi color reverses (whipsaw) and then returns to the original color, enter

Stop-Loss

- A few ticks beyond the low of the whipsaw price range

Take-Profit

- Width 1.5 times the stop-loss width