4/4 Trump Shock: We are waiting for a breakout at 146.50 after a rebound at 144.40 in USD/JPY.

Good morning

It was a shocking mutual tariff, wasn't it

The mutual tariff was announced at 5:00 a.m. on April 3, and

the tariff rate set far exceeded what many people expected.

Perhaps in future negotiations the tariff rate could be lowered

but Japan's 24% is high. Many countries such as Taiwan, Switzerland, and Korea

have tariff rates of 32%, 31%, and 25%, which are higher than Japan's

rates.

Perhaps it appears to be determined by the ratio of the trade surplus with the United States to total exports. It is a rather

rough method, and its actual economic impacts are not being simulated in detail.

Under such circumstances, someday the Trump administration could cause a major accident.

Because the market moved quite a bit, there may also be commentary aiming to calm the situation.

At that time, positions such as USD/JPY might

rebound from short covering, so perhaps it would be acceptable to take some profits.

I thought so, and USD/JPY rose in New York time, but

it plunged from the morning.

Will today move similarly?

The occasional sharp rise is profit-taking buying,

and when that stops, it returns to decline again.

I will trade shorts on a short-term basis

and wait for a big short-squeeze timing.

Chart Analysis

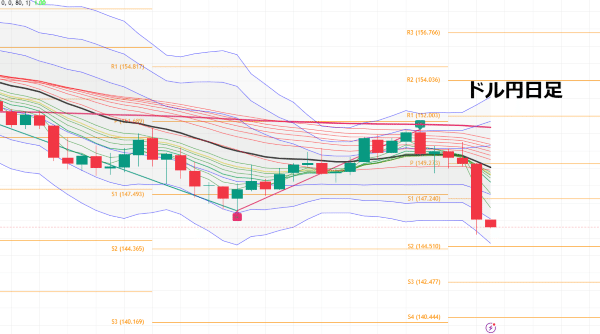

USD/JPY Daily

How far will it fall?

We refer to the pivot watched by big players

Monthly pivot S2 at 144.510 is below

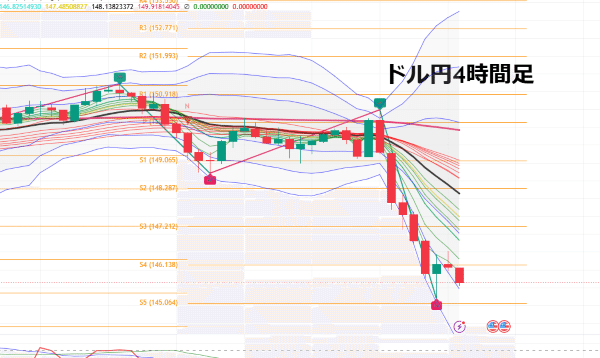

4-hour

It is rebounding at Weekly Pivot S5

Reaching here implies considerable selling pressure

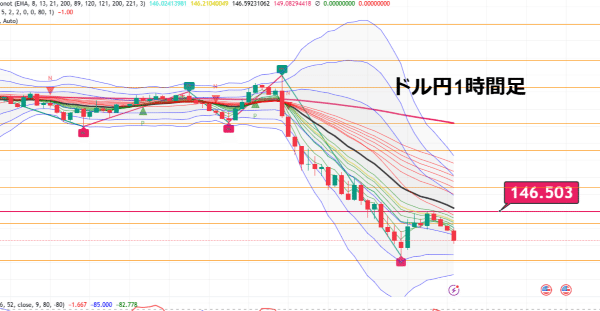

1-hour

If it turns up, it needs to break the red line,

with 20 MA nearby creating a strong wall

However, the chart pattern might become a “great bottom long?” shape

Is it going to rise slowly over time?

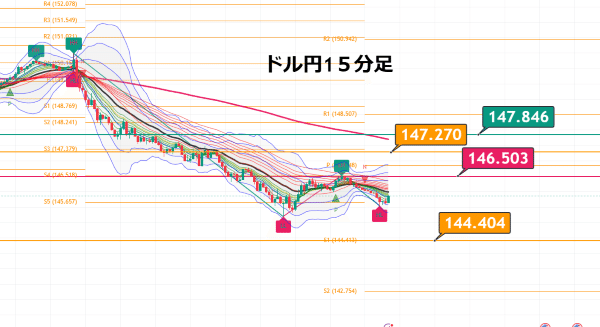

15-minute

The large drop’s 0.382 retracement is 147.270

The half retracement is 147.846; could it reach this level?

Last night’s New York time retracement high was the Daily Pivot S4

Below is today’s Daily Pivot S1 which is the orange line

Nearby is the Monthly Pivot S2

Even if it falls, it may rebound here for a moment, perhaps?