Next week’s USD/JPY market: I’ve boldly speculated—will it break 149.133?

Good evening~

The market is on holiday today

You don’t have to publish by 9 a.m. this morning

I slept in and took my time thinking

The USD/JPY has been rising during Tokyo and London hours recently

and it has been retracing during New York hours

Last night’s decline was small, but it rebounded at the halfway point

What will happen at the start of the week?

I’m publishing a little early

Chart Analysis

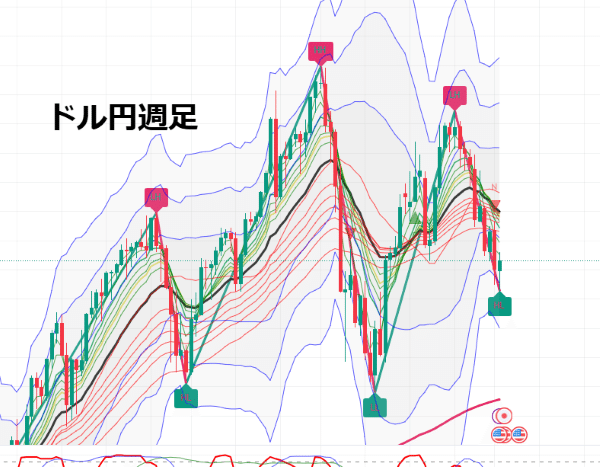

USD/JPY Weekly chart

It’s a small bullish candle after a large bearish candle

I’ll take a closer look

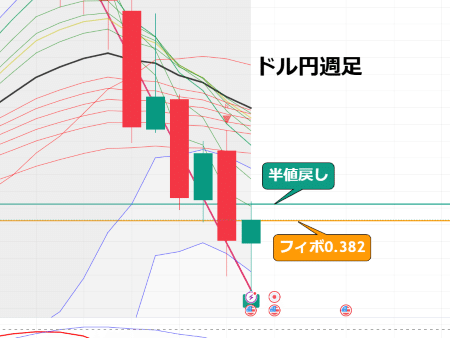

After the half retracement, it finished at the 0.382 Fibonacci retracement

This could become support and push higher again, or it may head lower

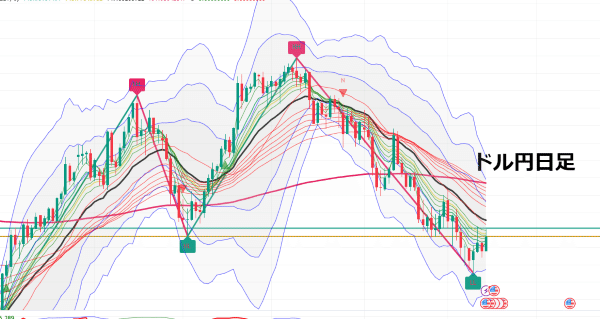

Daily chart

Downtrend, but the short-term GMMAs are starting to flatten

A double-top forms a key breakout and pullback scenario

It is below the 20 MA; will it break above and rise

Or will it be rejected and continue its decline

Under the theory of the W-top formation,

it would pull back to the green line before dropping, but…

what will happen

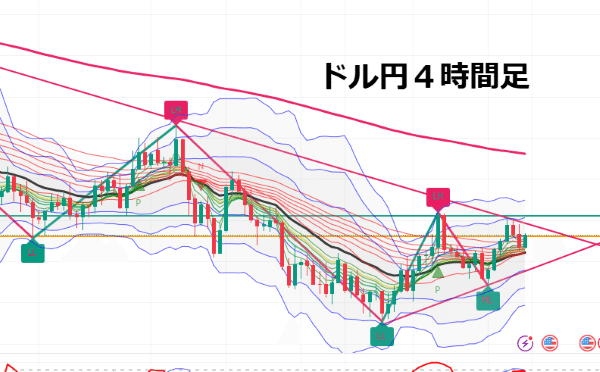

4-hour chart

It’s being held down by the downward trendline on the 4H,

has the low been stepped up, entering an uptrend?

The key is breaking the green line

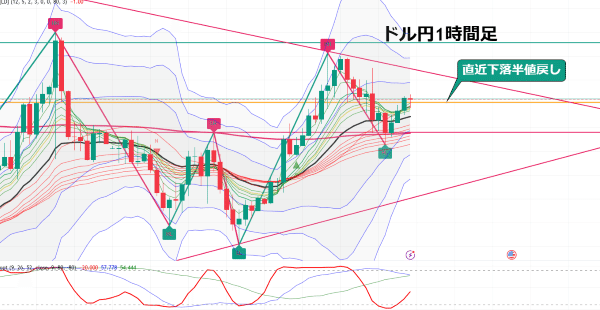

1-hour chart

With the W-bottom formation and rise, as per theory

it pulls back to a key line and then rises

The GMMAs are turning upward

Ultimately, will it break above the recent high green line and rise

If next week continues the same pattern

it may break during the day

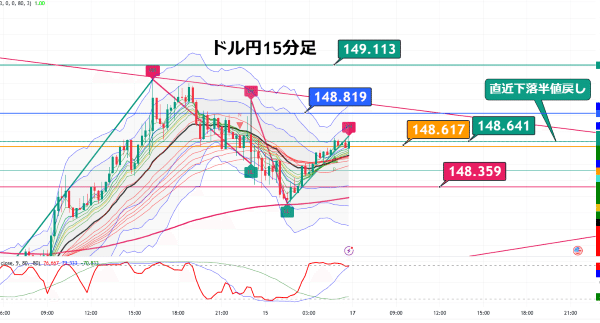

15-minute chart

To consider it in an uptrend,

it must decisively break 149.133

Before that, it must break the blue 148.819 resistance and the red downward line

I’ll publish an assumed pivot line for Monday morning

With the Nikkei futures rising as well,

Monday morning the Nikkei may also start higher

Therefore, USD/JPY may also start higher