EA「Zix」 Long-term backtest since 2005 (AUDJPY 1H to 15M)

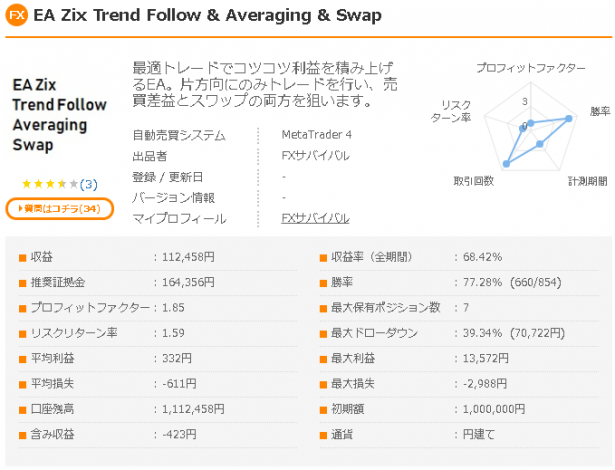

The EA "Zix" that has been undergoing forward testing at GoGoJungle since late February is continuing to steadily increase its profits even in its 10th month of operation. Due to the nature of its trading method, drawdowns tend to be relatively large, but it is achieving good results with win rate of 77.28%, a profit factor of 1.85, and a reward-to-risk ratio of 1.59.

EA "Zix" is a versatile EA that does not restrict currency pairs or timeframes.

Today we present long-term backtest results for AUDJPY from April 2005.

First, let's review the AUDJPY market since 2005.

The AUDJPY pair had a high of 107.85 in 2007 and a low of 55.08 in 2008, and since then the highs and lows have not been updated.

Since EA "Zix" takes positions in only one direction, whether it can withstand the sharp drop of 2008 is the key point.

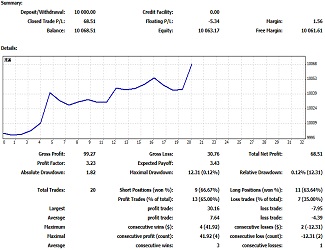

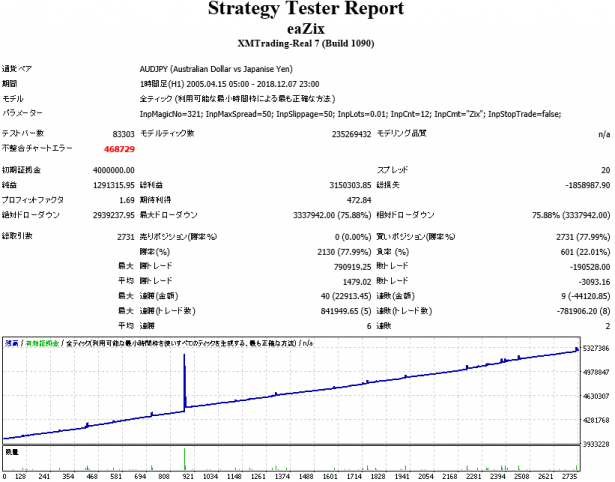

First, results on the 1-hour chart.

EA "Zix" AUDJPY 1-hour, buy, backtest from 2005

The maximum drawdown is very large, but trades are still possible. At this time it held 10 positions. The software design allows up to 12 positions, so there is still headroom.

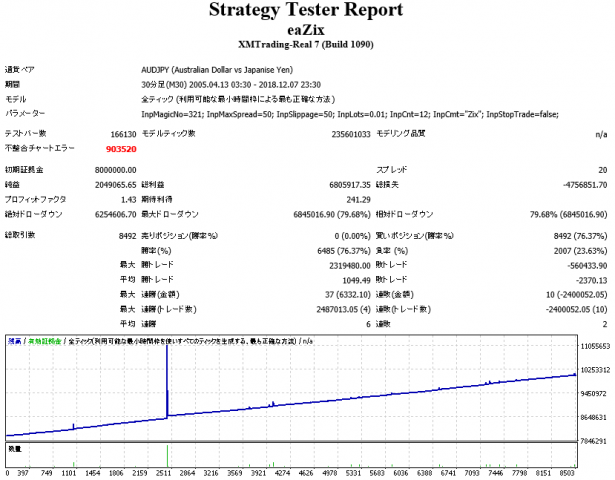

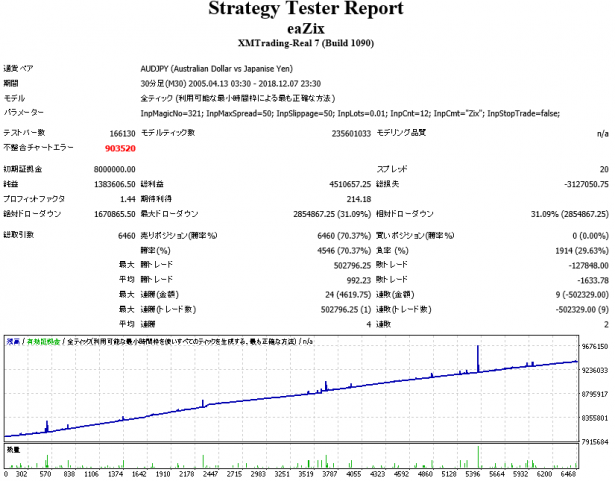

Next, results for the same period on the 30-minute chart.

When you shorten the timeframe, profit per trade and averaging distance shrink, turnover increases and profits rise, but risk also increases.

EA "Zix" AUDJPY 30-minute, buy, backtest from 2005

Here too it trades without collapsing until the end, but the maximum drawdown is very large. The number of positions at this time was 12, reaching the software design limit. Also, the final position’s entry price was 57.320. Considering the market’s lowest price, the trades were valid.

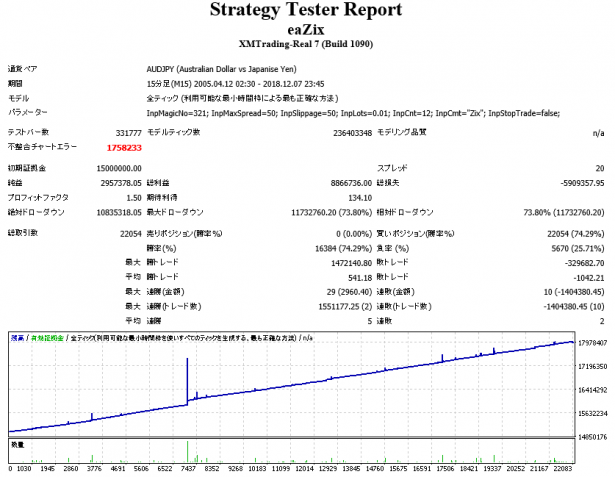

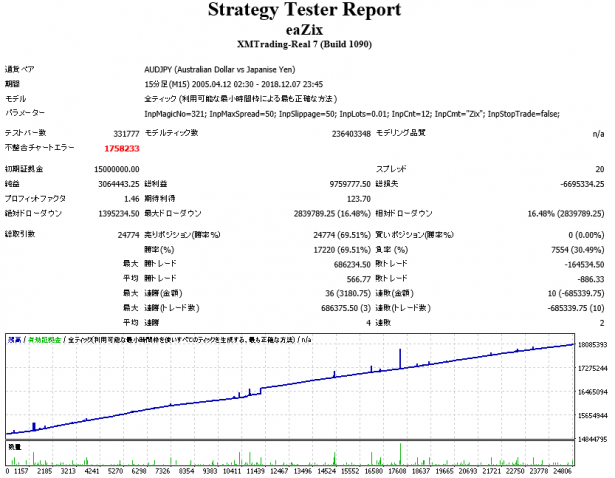

Next, the backtest results on the 15-minute chart.

This also continued trading to the end, but during the 2008 decline, the number of positions reached the maximum 12, and the final position’s entry price was 76.380. Since the market fell to the 55 range, the trades were essentially just holding while collecting swaps, which is not ideal as trading.

From these three patterns, the conclusion is that if you want to withstand a market like the Lehman shock, a 30-minute chart or longer is appropriate. However, given the current market around the 80 range, operating on a 15-minute chart does not immediately imply danger.

EA "Zix" assumes positive swaps, but it can operate with negative swaps as well.

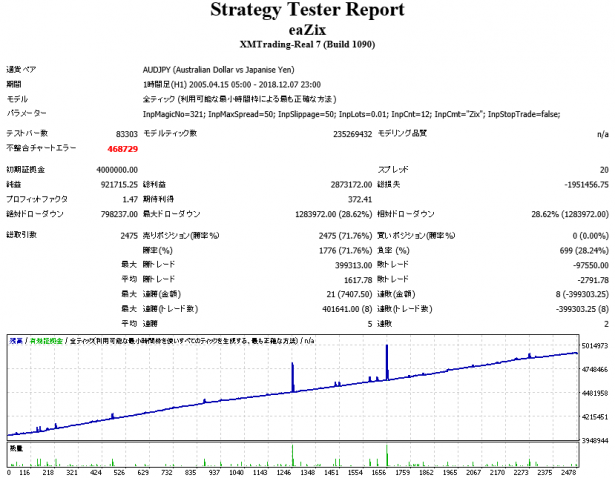

Below are backtest results for AUD selling on 1-hour, 30-minute, and 15-minute charts.

EA "Zix" AUDJPY 1-hour, sell, backtest from 2005

EA "Zix" AUDJPY 30-minute, sell, backtest from 2005

EA "Zix" AUDJPY 15-minute, sell, backtest from 2005

By running negative swaps on the same account in parallel with positive swaps, you can increase profits without increasing margin. However, position holdings become long-term, and the accumulation of negative swaps can exceed the program’s expected profit from trading. In such cases, you settle including swaps at break-even, so the profit factor is lower than with positive-swap operation.

↓ EA "Miw" is also performing well.

This article is an excerpt from the blog "Watching and freely setting up, the market becomes the source of wealth." from which part is excerpted.