BBP has reached its 4th anniversary.

------------------------------------------------

Empathy level 99.9%!

What is the FX manga that is all the talk now??

↓

------------------------------------------------

■ Introduction

Our BBP has reached its 4th anniversary!

(As of September 2018)

Wow, it’s tear-jerking.

Since BBP was released,

even after about three years, profits continue to rise,

and on the day of its fourth anniversary it reached an all-time high

in profits (T_T).

Feeling a bit nostalgic,

I wrote this article^^

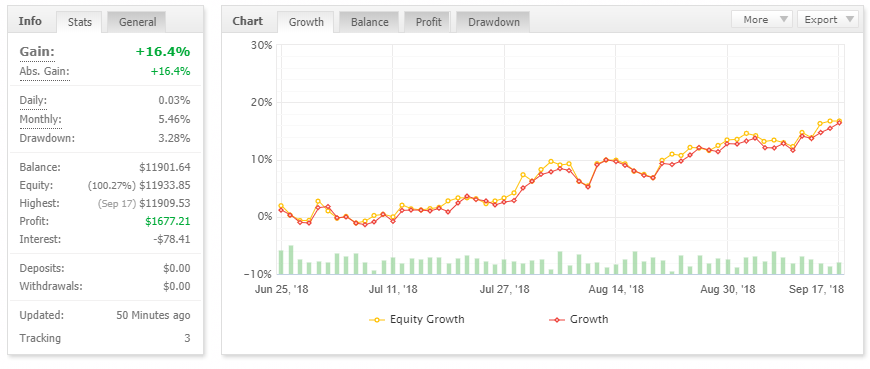

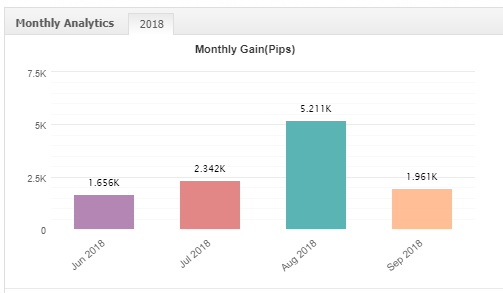

◆ Profit and loss status after the Type-R introduction (as of September 17, 2018) ◆

BBP is also celebrating its 4th anniversary!

That said, first, let's report the current situation.

BBP was introduced in June 2018 with the Type-R series,

and has undergone a major evolution.

Let’s look at the forward performance for about three months after the Type-R introduction.

■ BBP 6EA All-Portfolio Profit and Loss Graph

There are no notable drawdowns, and it has a very clean upward trend.

I mean, this isn’t exactly the kind of EA designed to chase such a profit curve, but it seems to be performing quite well (^^;)

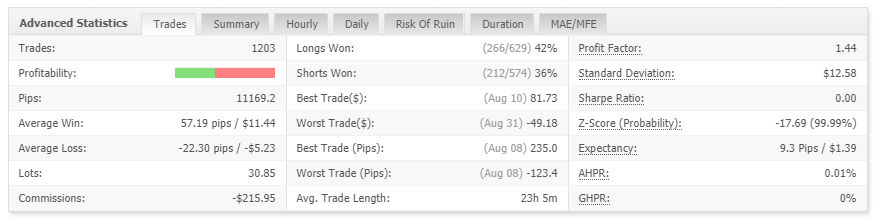

<Number of trades>

Total trades exceed 1,200 in a little under three months (lol)

Although it’s a sum of 6 EAs, it trades far more frequently than typical EAs.

With this, IB cashback might be expected as well!

<Acquired PIPS>

FX is not measured in PIPS!

I know that’s how people want to phrase it, but since it serves as a reference, please allow me to mention it lol

A positive of 11,169 PIPSwould be the figure.

The numbers are huge, so you might not quite grasp them (^^;)

But it’s not a lie, I’m merely stating the true numbers.

Rather, I’m conveying the records from Myfxbook itself.

<Profit Factor (PF)>

“1.44”

This indicates a fairly strong performance on average.

I think it will gradually revert to the mean, but

be sure to take profits when you should.

◆ Few EAs can run long-term ◆

I’ve outlined the forward performance roughly, but an EA isn’t just about recent results.

For three years since release, despite twists and turns, it has continued to generate profits as a long-run EA.

There are few EAs that can run long-term.

Backtests being good is natural.

”In short, can it generate profits in forward testing?”

In this straightforward merit-based world, only a few EAs can maintain profits over the long term.

In that context, celebrating the 4th anniversary by updating to an all-time high is truly joyful^^

◆ In high-expectation strategies, a steady, long-term operation is essential ◆

BBP continues to set all-time highs at the 4th anniversary, but during its three years of forward operationdrawdownshave occurred many times.

Sadly, many would stop due to these transient drawdowns, letting their psychology crumble.

Thenit would be a waste.

Stopping just because of losses would be like cutting off the potential to recover, as you would have installed the EA to incur losses.

“I can’t stand the drawdown anymore!”

At the moment you think that, you often start winning again, so you should keep applying the strategy and walk away only if you must.

However,

“Believing in the EA and leaving it alone”

This action may seem accessible to anyone, but it’s not something many can actually do.

◆ Drawdown periods are when a trader’s true skill is tested ◆

Trading is all about wins; during that time, you feel elated,“joy”and a wonderful momentthat feels amazing.

But the real test is how you handle the drawdown period.

During losses, that is when a trader’s true skill is displayed.

Many people think,

“A trader’s skill is to make profits”

and that’s partly true.

Choosing a profitable strategy and making profits is important, but that alone is insufficient.

Even during drawdowns, the key is whether you can continue trading without wavering,

and that is the trader’s true power, perhaps...

Well, when you bring up the topic of “being a trader,” there are many opinions.

But what I can say is that I’ve carried out BBP trading with the above values, and now we have the all-time high.

◆ Recommendation for Scientific Trading Strategy ◆

BBP is scientific trading.

There is a basis for profitabilitythat supports profits.

Up until now, many have spent their valuable time trading, yet kept expending capital!

Most of them are”non-scientific trading”and wandering aimlessly in that field.

For those misguided people, a turning point may lie in the”scientific trading”I advocate.

I believe that the advantage of a trading method should be backed by objective data to prove profitability.

In contrast, most so-called trading methods in the world are

“based on no evidence, just a vibe that it might win”

and that is undeniable.

I’m not saying to deny all discretionary trading, but“the elusive edge”is often pursued.

Sure, it’s only a small number who can truly win.

Even if someone claims to have won, they may be under the illusion of a few months of profit.

A few months to a year of profits/losses is “just luck”

“Scientific trading”

allows massive amounts of testing to be done in a short time,making the edge more measurable.

Completely automated systems with high-precision edges are a very tough field, and the truly superior trading methods are“rare”.

BBP is a rare strategy that has truly established an edge.“rare”edge of high precision.

Without a high-precision edge, it would be impossible to have a steadily rising equity curve over 19 years of backtests or long-term forward performance.

The current BBP is a manifestation of that high-precision edge.

Please feel free to include it in your portfolio with peace of mind^^

And with that, BBP’s 4th anniversary lecture ends (lol)