Are you ready? I will forecast the USD/JPY movement based on the release of the employment statistics indicators

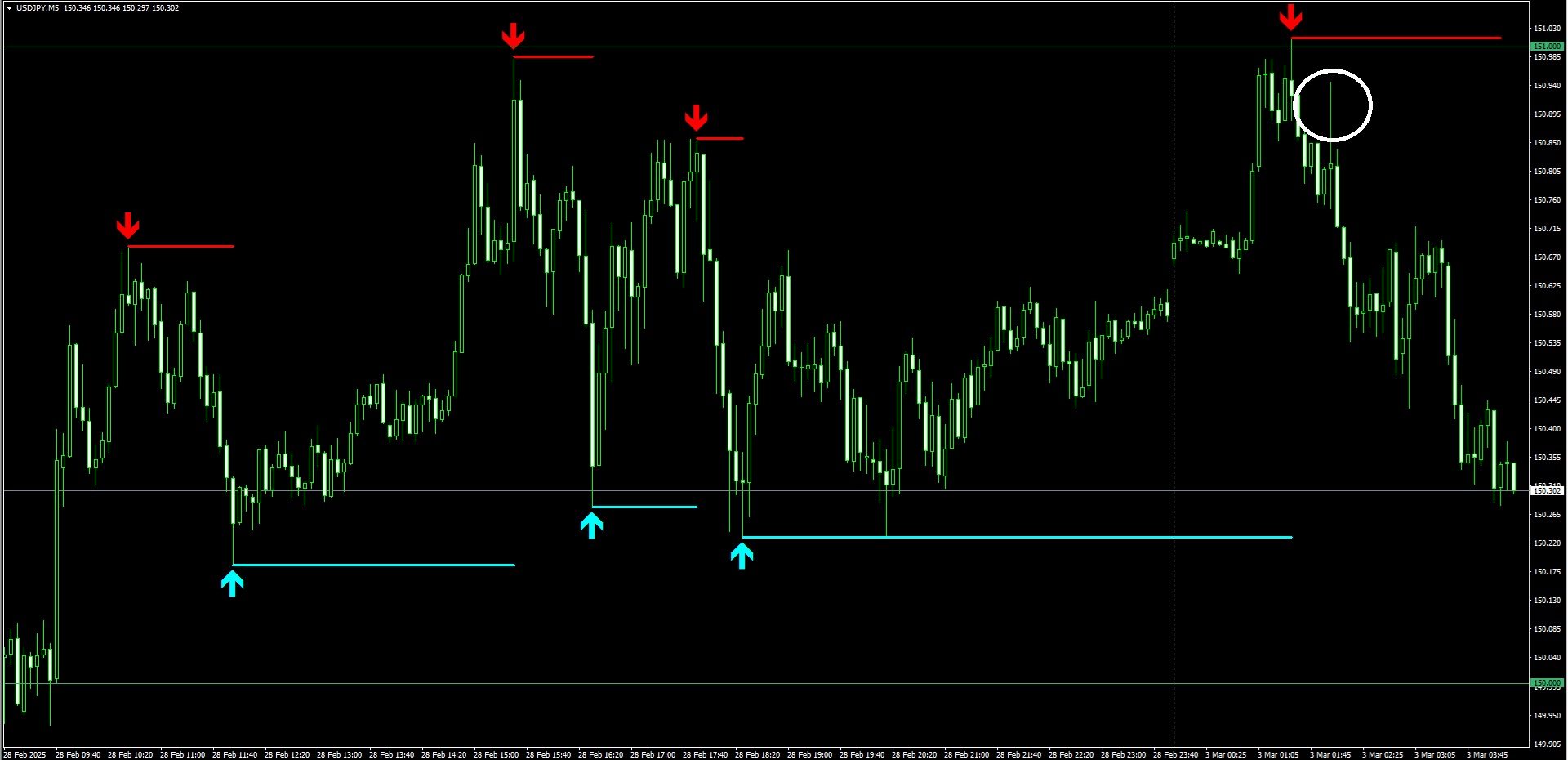

This is the USD/JPY 1-minute chart captured on March 7, 2025 at 20:28. There are 2 hours left until the employment data release.

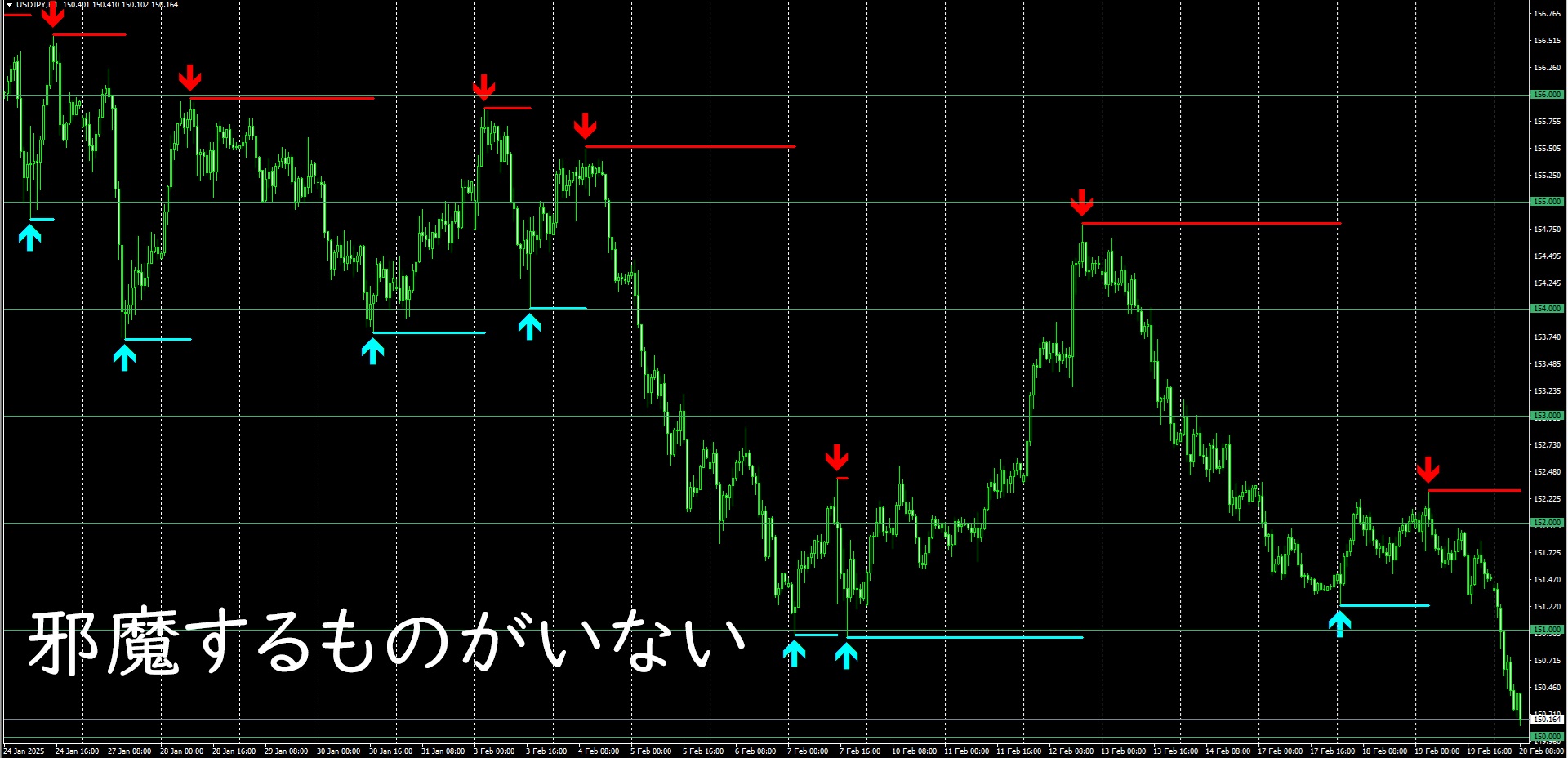

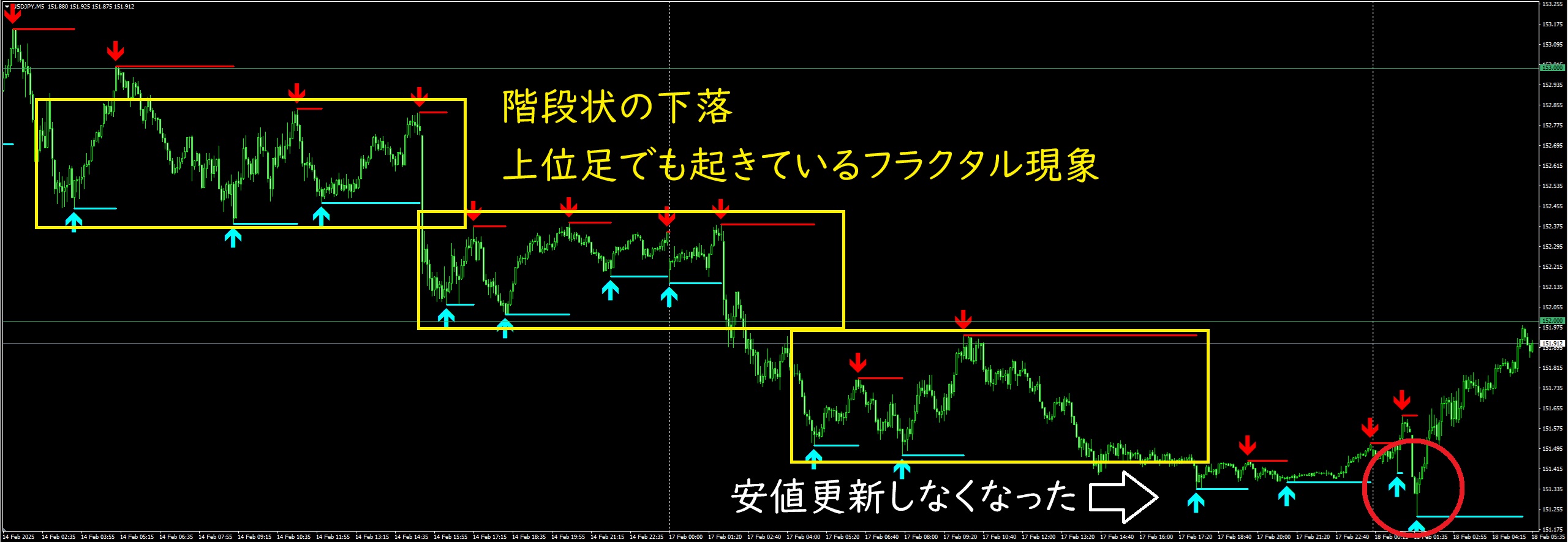

In this morning's video I talked about how the price broke out of the triangle consolidation even though there were no major indicators or important speeches, then formed a smaller triangle consolidation and moved into a fractal structure... and that small triangle consolidation also broke to the downside in the same way.

However, since this is also before the payrolls data, there wasn't an ongoing aggressive dollar buying or yen selling, and no large money came in to break technical levels, so price reacted at the recent low and retraced.

For traders who do not trade on indicators, I think this might have been the last entry opportunity of the week.

In fact, I also went long here and earned a little. The market environment isn’t one where profits can be extended.

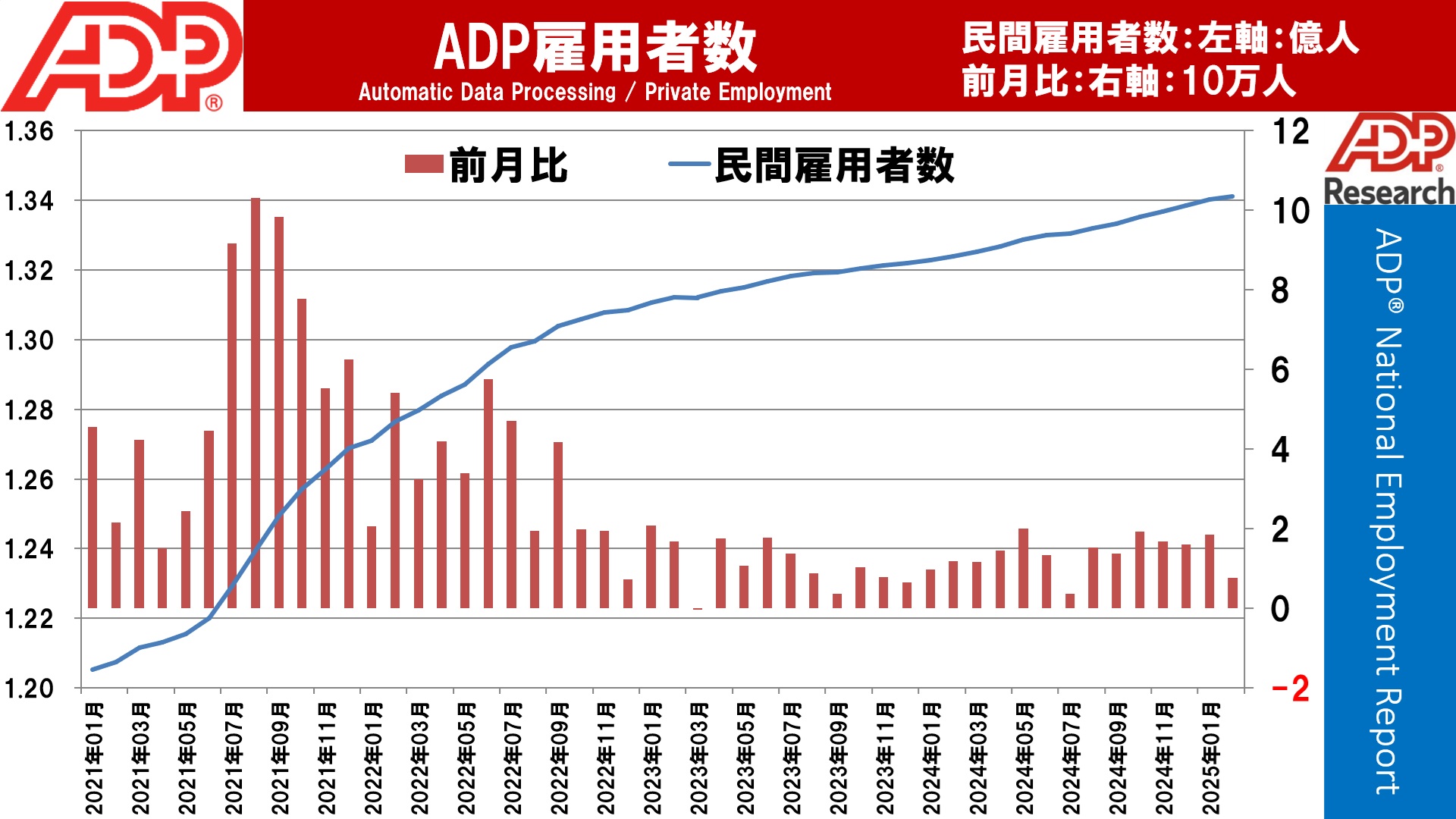

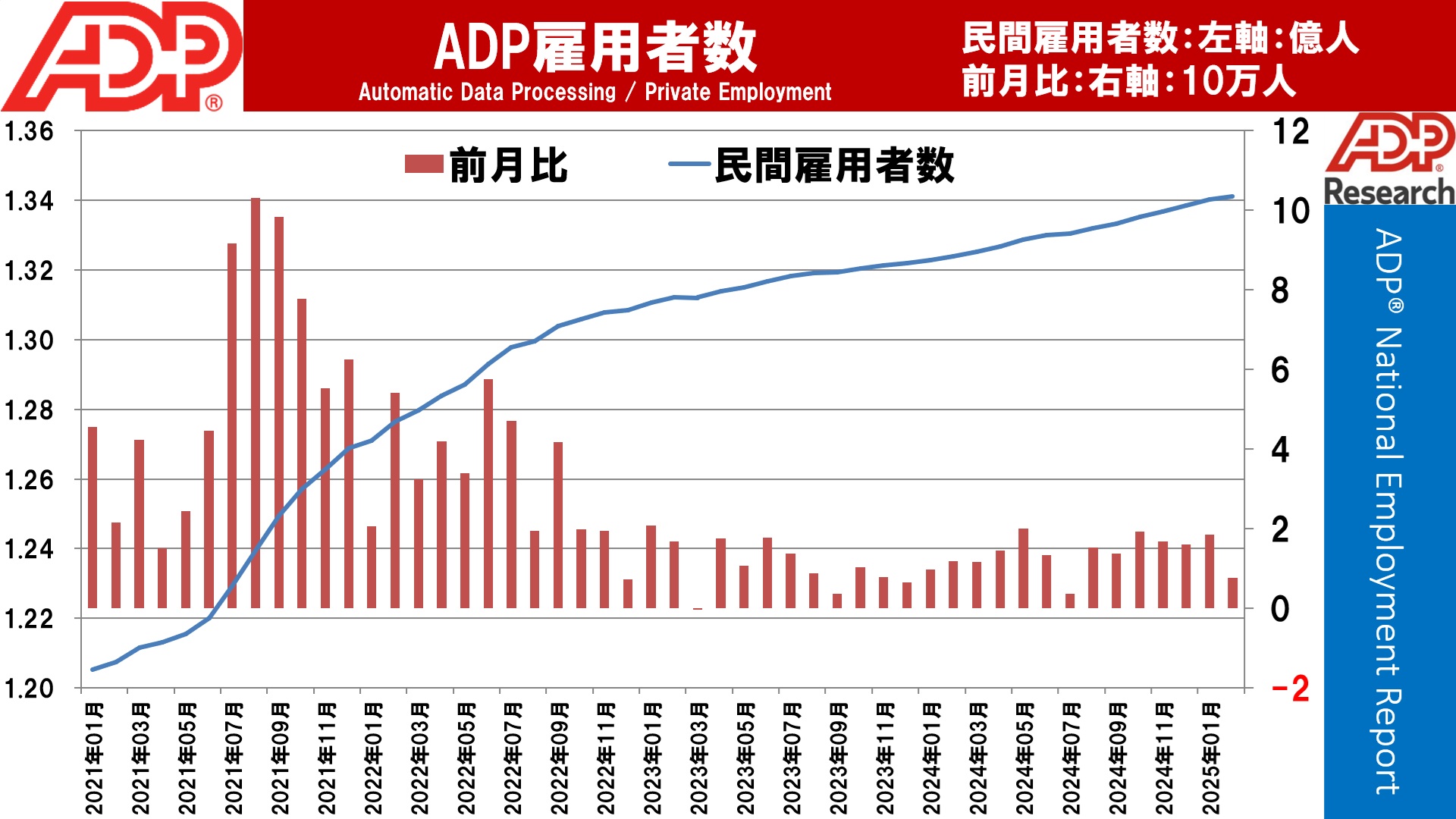

Now, I don’t intend to participate in today’s festival (the payrolls data), but if the leading indicators such as ADP payrolls and ISM Manufacturing employment data hold true, the increase in nonfarm payrolls announced later may not be much to expect.

In other words, if a result that defies those expectations is released, a big move is anticipated. Conversely, if a big move occurs even without disappointing results, that would be a contrarian trading opportunity.

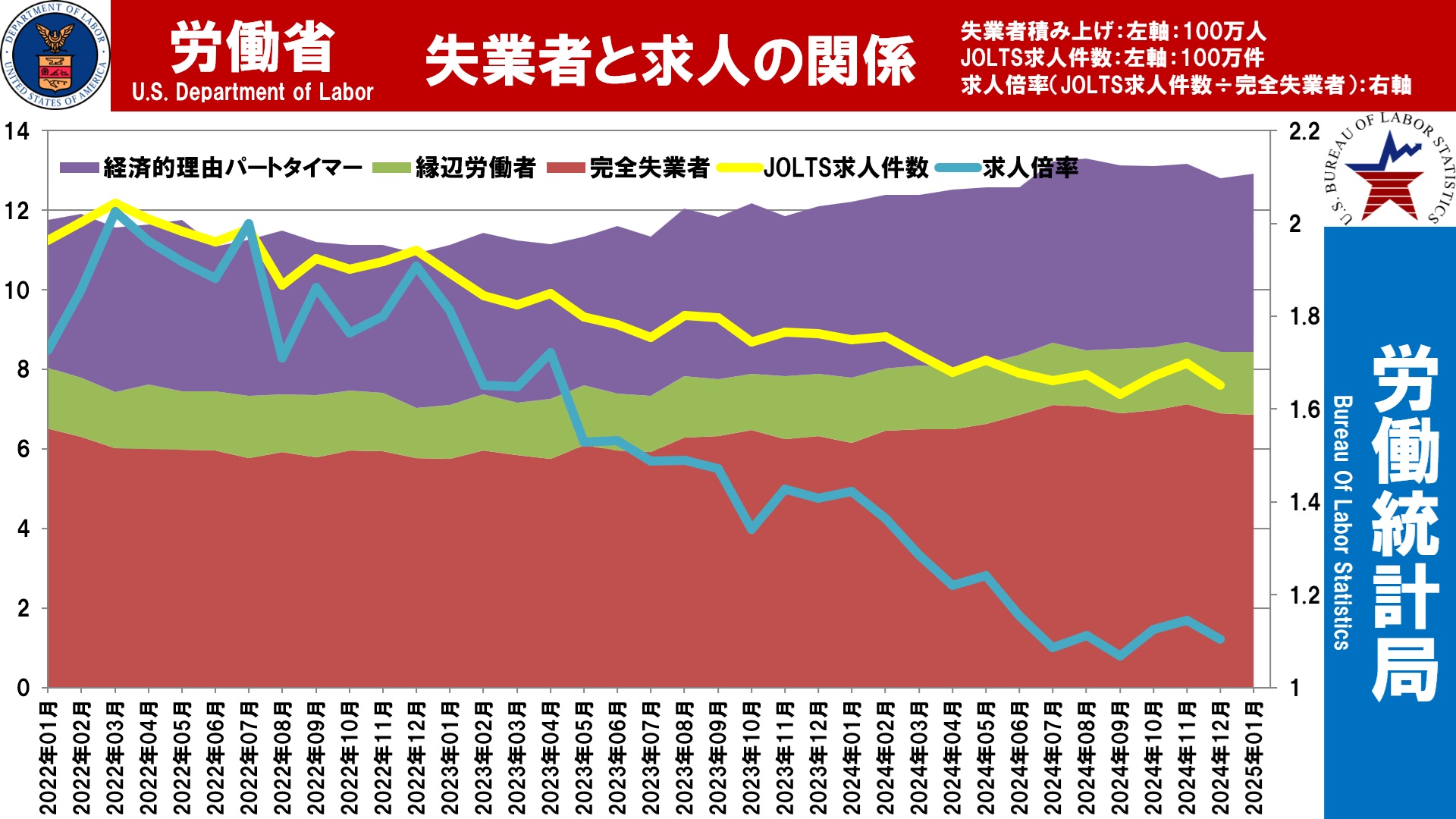

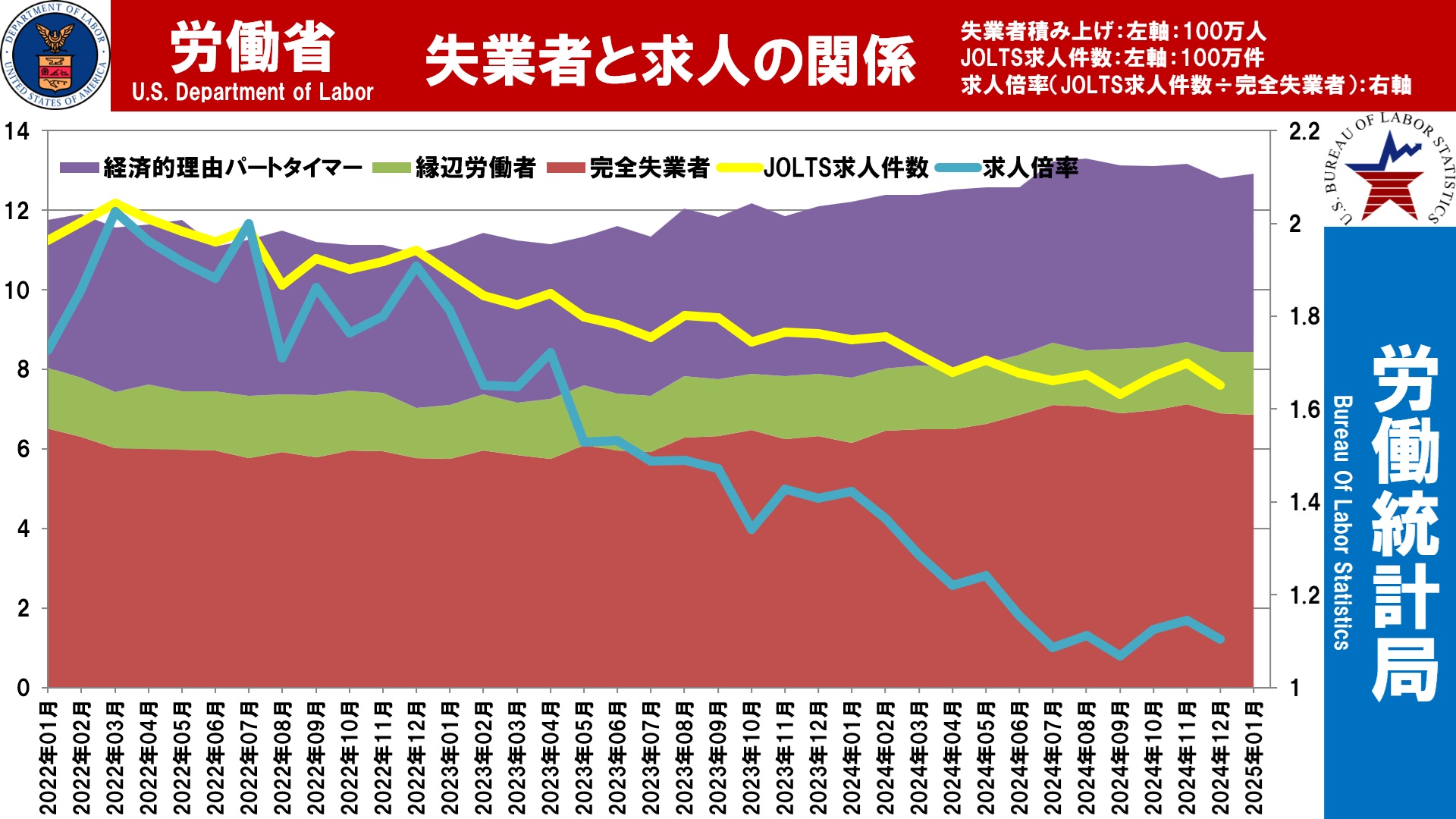

Also, the JOLTS job openings data (for January), which is used as a reference for the unemployment rate, will be released after this month's employment data (for February).

The JOLTS job openings data is delayed by a couple of months... and this is already late as it is.

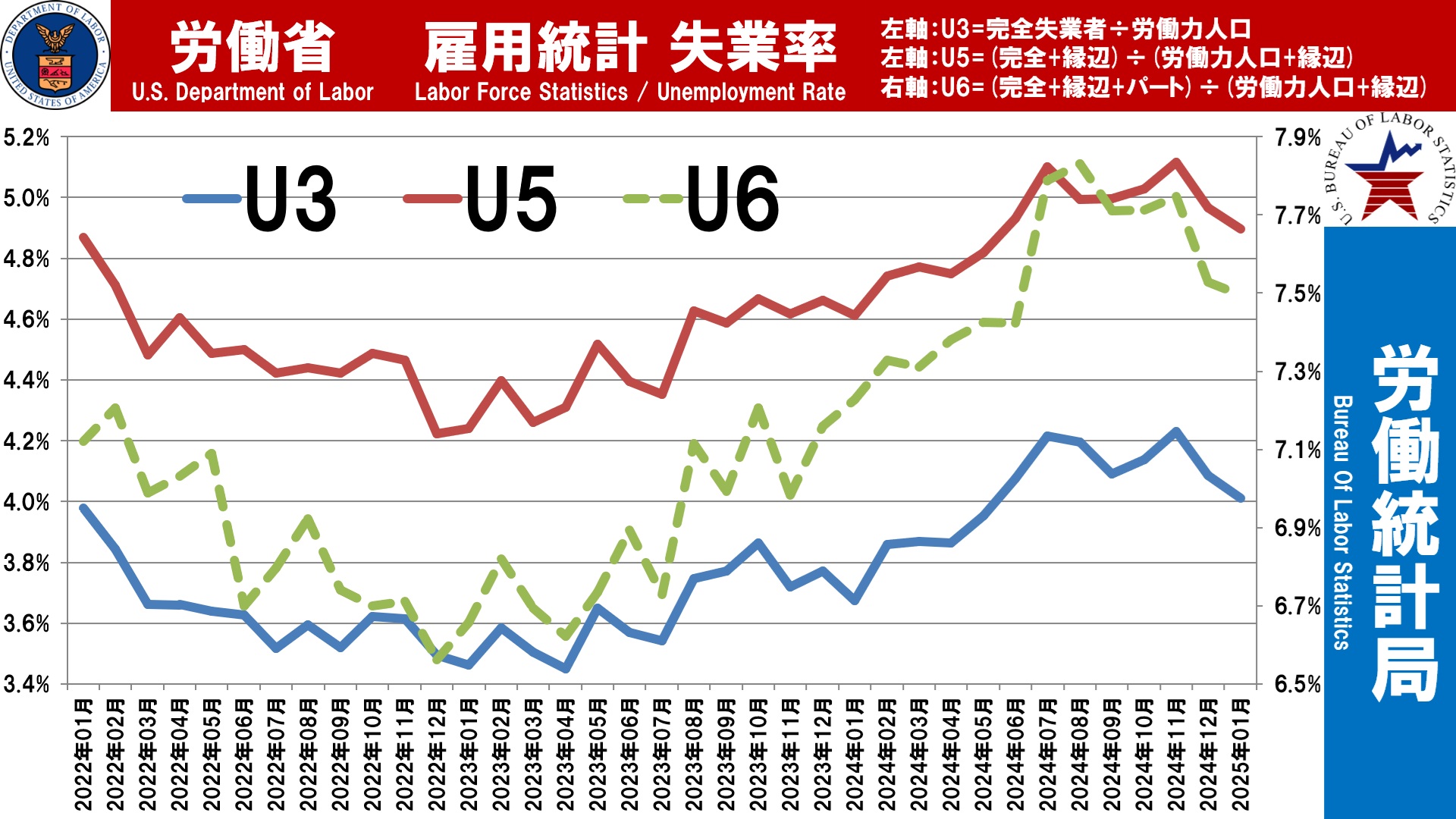

For reference, I’ve included a correlation chart of JOLTS job openings and unemployment up to December.

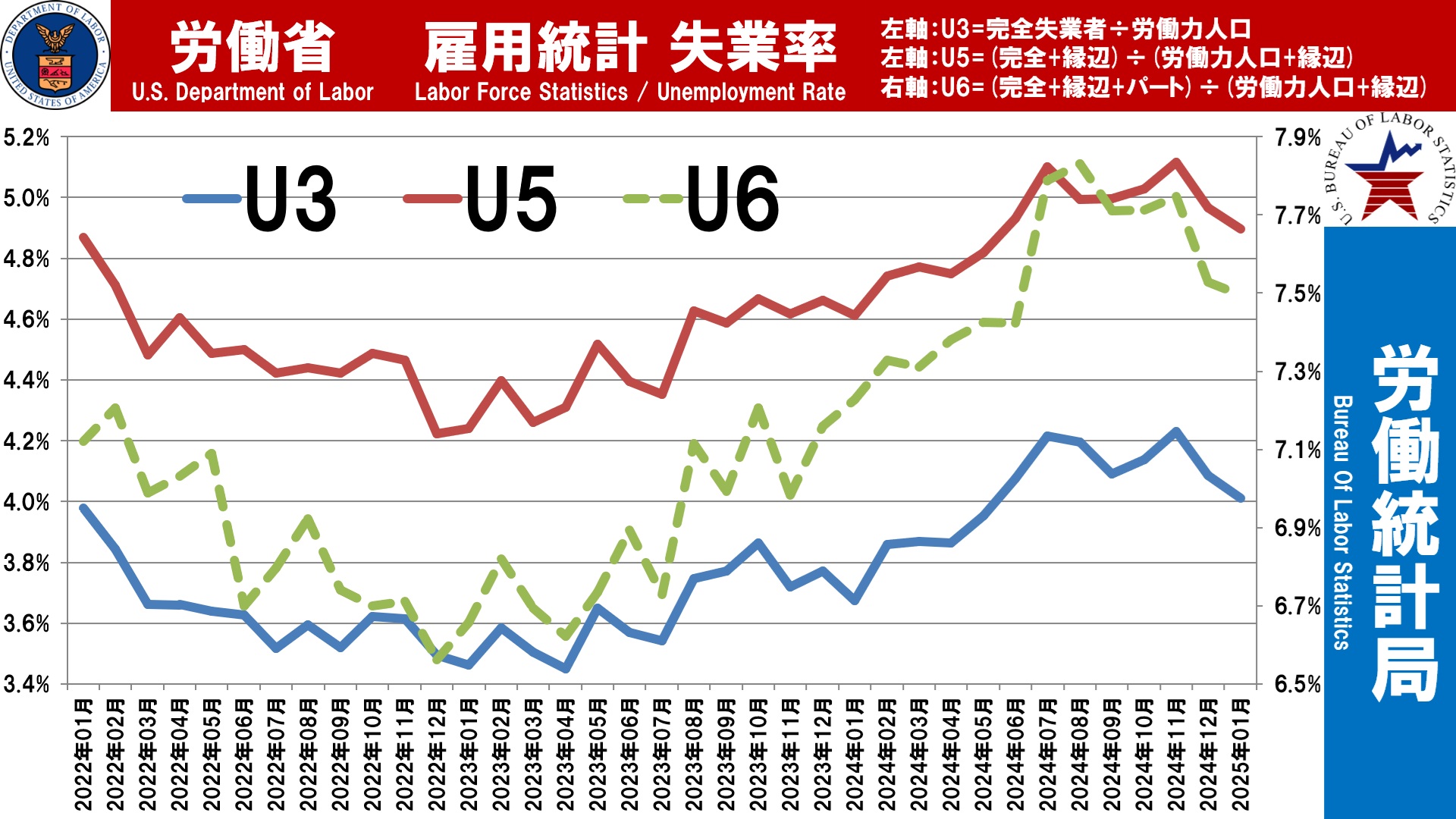

This is the unemployment rate up to the previous release. Rather than getting excited or downhearted from each monthly result in isolation, the key is to view the data in the context of the overall trend for fundamental analysis.

The original indicator I use is available for free download.

↓ Download here

In this morning's video I talked about how the price broke out of the triangle consolidation even though there were no major indicators or important speeches, then formed a smaller triangle consolidation and moved into a fractal structure... and that small triangle consolidation also broke to the downside in the same way.

However, since this is also before the payrolls data, there wasn't an ongoing aggressive dollar buying or yen selling, and no large money came in to break technical levels, so price reacted at the recent low and retraced.

For traders who do not trade on indicators, I think this might have been the last entry opportunity of the week.

In fact, I also went long here and earned a little. The market environment isn’t one where profits can be extended.

Now, I don’t intend to participate in today’s festival (the payrolls data), but if the leading indicators such as ADP payrolls and ISM Manufacturing employment data hold true, the increase in nonfarm payrolls announced later may not be much to expect.

In other words, if a result that defies those expectations is released, a big move is anticipated. Conversely, if a big move occurs even without disappointing results, that would be a contrarian trading opportunity.

Also, the JOLTS job openings data (for January), which is used as a reference for the unemployment rate, will be released after this month's employment data (for February).

The JOLTS job openings data is delayed by a couple of months... and this is already late as it is.

For reference, I’ve included a correlation chart of JOLTS job openings and unemployment up to December.

This is the unemployment rate up to the previous release. Rather than getting excited or downhearted from each monthly result in isolation, the key is to view the data in the context of the overall trend for fundamental analysis.

The original indicator I use is available for free download.

↓ Download here

× ![]()