How to win in ranging markets with trend-following EAs

I’ve summarized improvements for the “PerfectOrder_GBPJPY” that have entered a slump.

Current status and improvements for PerfectOrder_GBPJPY

“PerfectOrder_GBPJPY” is already used by many, but since June 2024 it has fallen into a slump.

As the developer, I considered what I could do and tested parameters optimized for the current market through backtesting.

The EA forward test on the product page remains at the initial settings, but the improved version’s performance can be verifiedIN REAL TRADE.

If the current range-market continues in the future, I hope you will try these parameters.

▶REAL TRADE (Start of measurement on March 6)

https://real-trade.tech/accounts/74957

EA name: PerfectOrder_GBPJPY(19558)

Optimal parameter values and their basis

I have an EA I developed called “MTF Trading USDJPY,” which uses multi-timeframe analysis.

▶https://www.gogojungle.co.jp/systemtrade/fx/49955

As you can see from the forward test of this EA, it has continued to perform well from the latter half of 2024 into 2025 even in range markets.

This EA is a trend-following EA, yet it achieves strong results even in range markets.

The reason isavoiding whipsaws.

“MTF Trading USDJPY” is characterized by a very low number of trades.

In some cases, it may hold positions for more than a month, i.e., it is an EA designed for long-term holding.

Why can a trend-following EA win in a range market?

Why is it possible to win byavoiding whipsaws?

From analyzing this result, we concluded thatit enters only in the trend direction when a big wave forms, ignoring small waves.

In other words, in a back-and-forth market likea heavy back-and-forth market, being misled by small waves increases the risk of losses.

“MTF Trading USDJPY” ignores small waves and relentlesslywaits for the big wave.

Would the same logic apply to the other trend-following EA “PerfectOrder_GBPJPY”?

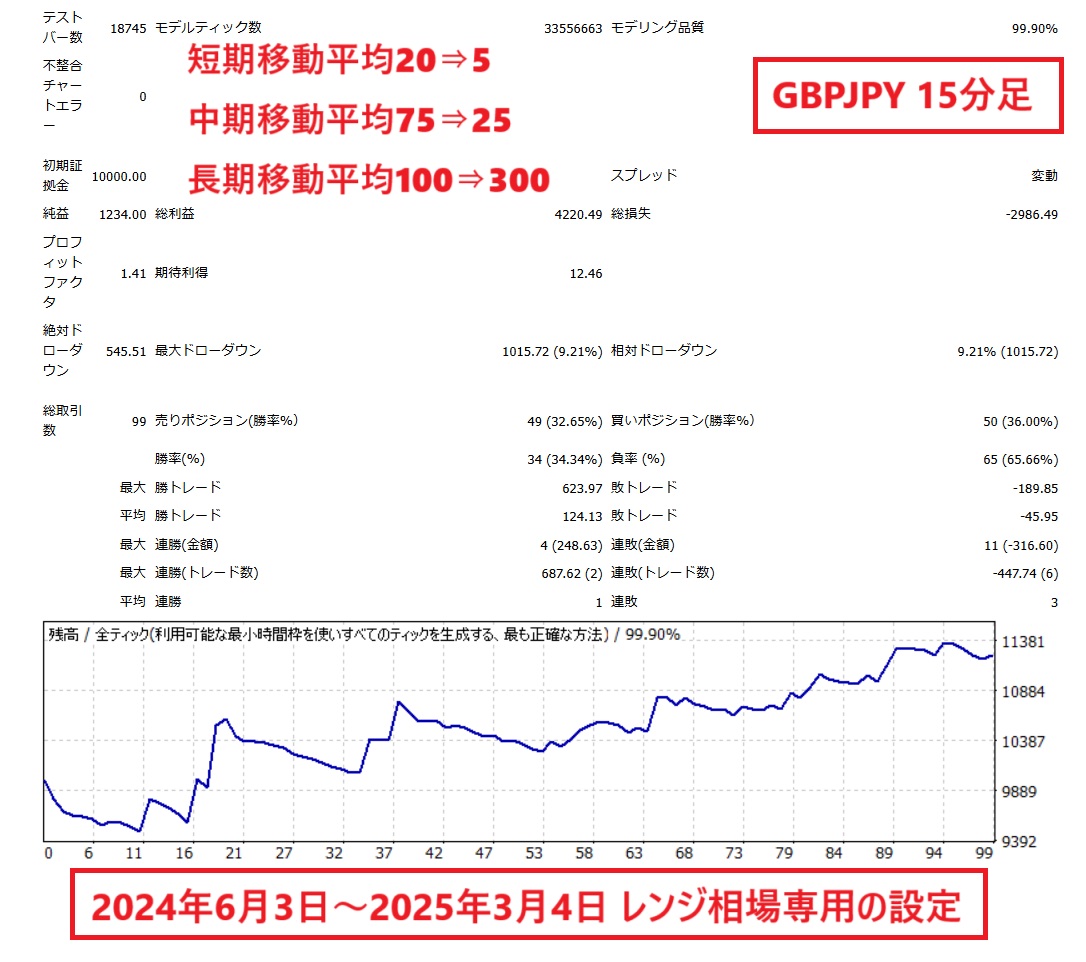

Optimization of PerfectOrder_GBPJPY

“PerfectOrder_GBPJPY” uses three moving averages to determine the trend.

Shortening the moving average periods increases responsiveness but makes it more susceptible to whipsaws.

Conversely, lengthening the moving average periods makes responsiveness slower but reduces being misled by whipsaws.

Backtests show thatlengthening the long-term moving average period while shortening the mid- and short-term moving averagesallows profit in range markets.

As a rough idea, it behaves similarly to anEA that uses golden crosses and dead crosses.

Best settings for range-market only

Backtest results

Default settings from 2024-06-01 to 2025-03-04

- Number of trades:171

- Profit factor:0.77

Range-market only settings from 2024-06-01 to 2025-03-04

- Number of trades:99

- Profit factor:1.41

Range-market only settings from 2007-01-02 to 2025-03-04

- Number of trades:2807

- Profit factor:1.12

※ Trade count isreduced by about 40%and the EA is less susceptible to being manipulated by a back-and-forth market.

※ In long-term backtests, environments with prolonged flat periods are limited, but these settings are optimized for recent markets.

We appreciate your continued support for “PerfectOrder_GBPJPY.”