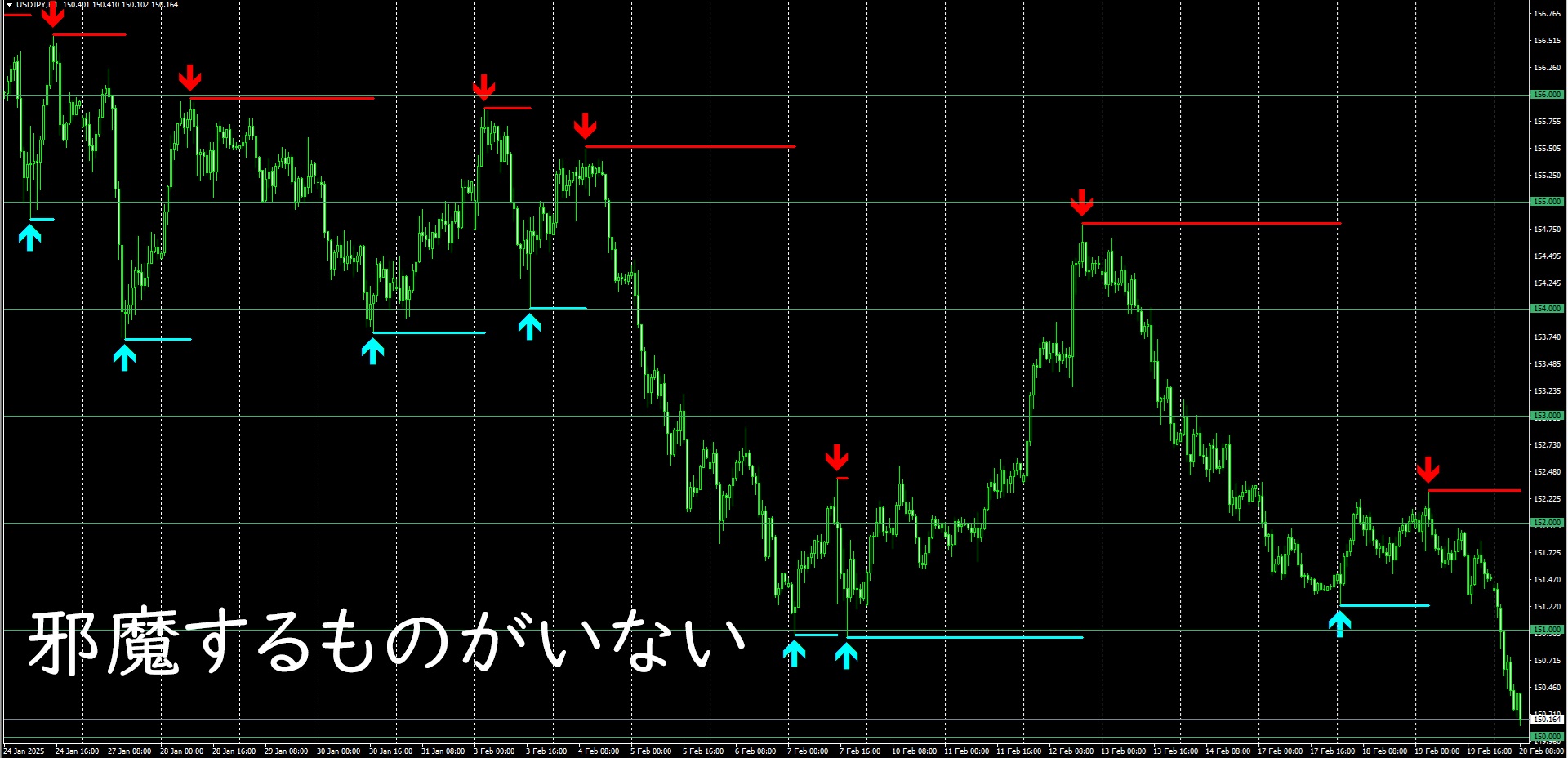

Dollar-Yen forecast hit! On the 4-hour chart, it will swing wildly around the 150 yen area

In past videos, I predicted that at the 4-hour level the price would swing around with 150 yen as a pivot, as shown in early December, and that forecast is coming true.

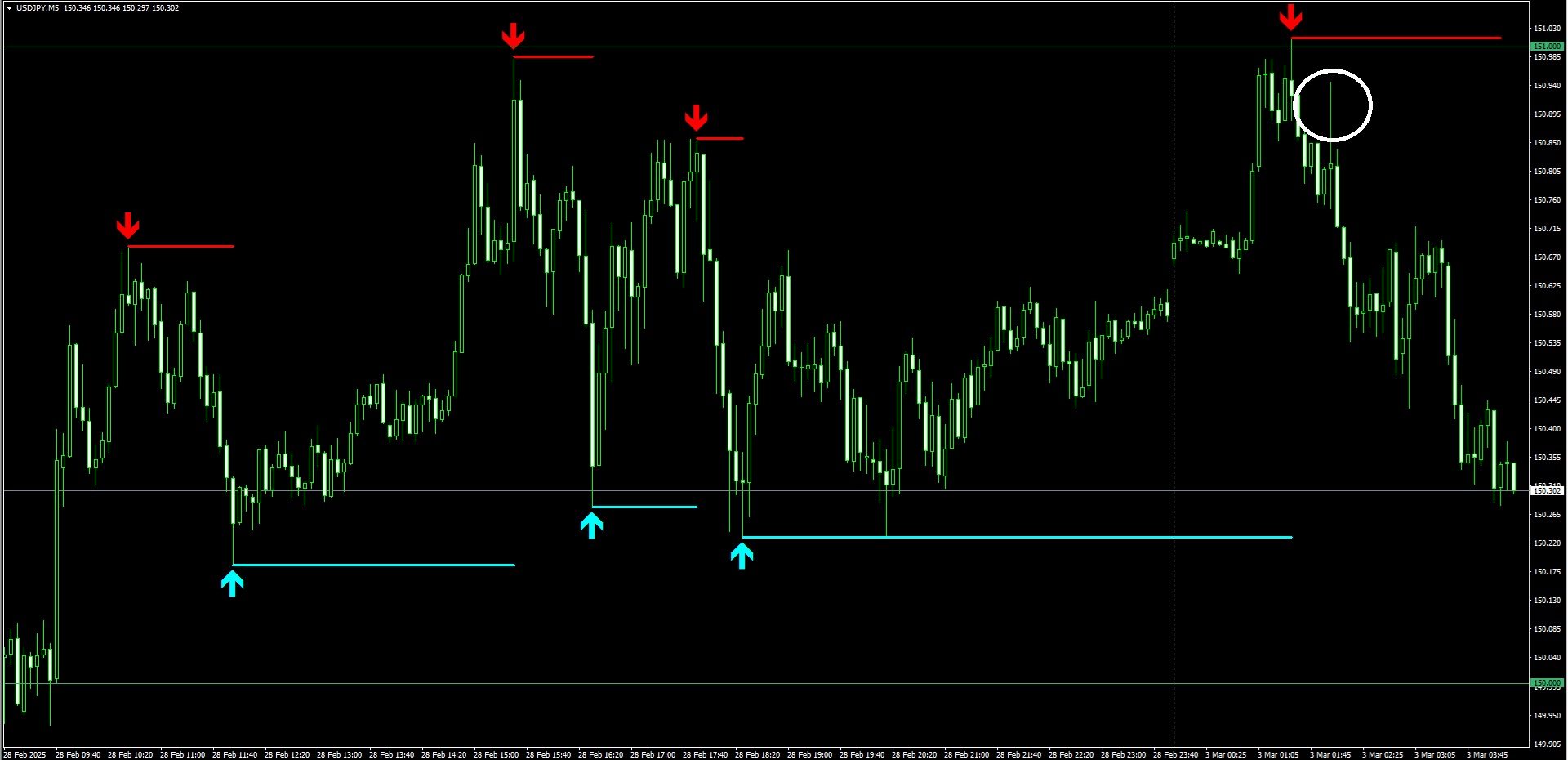

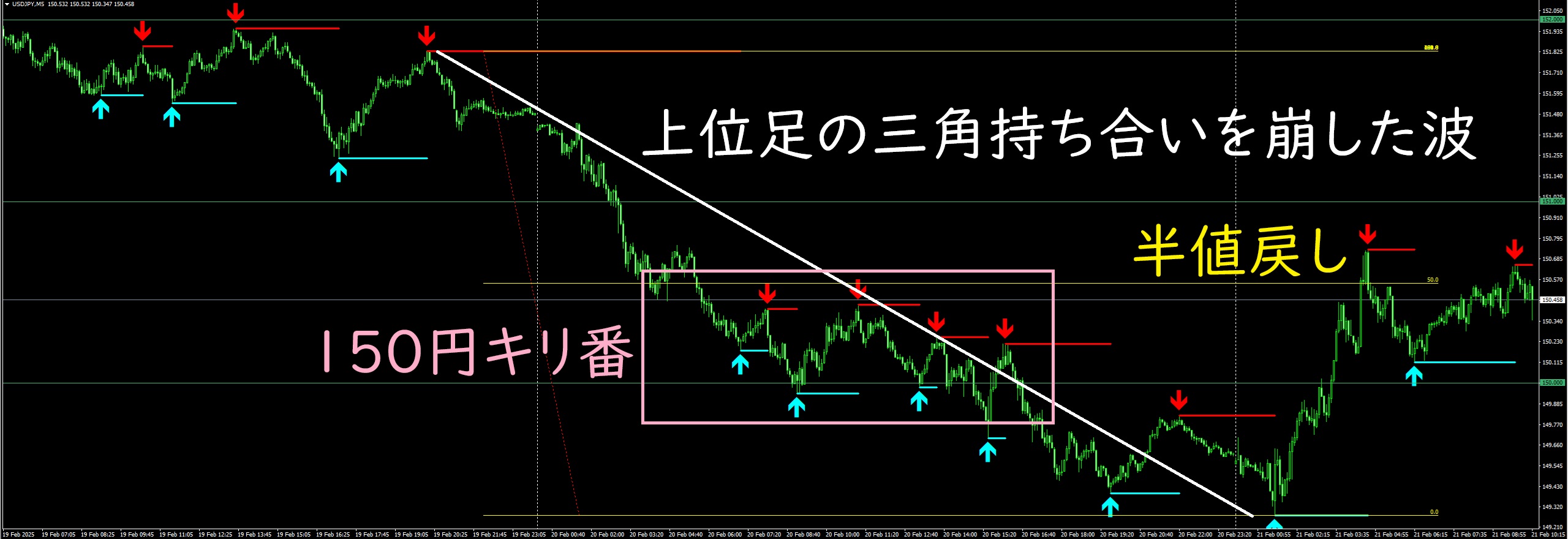

And this is the current (February 21, 2025, 17:30) USD/JPY 5-minute chart.

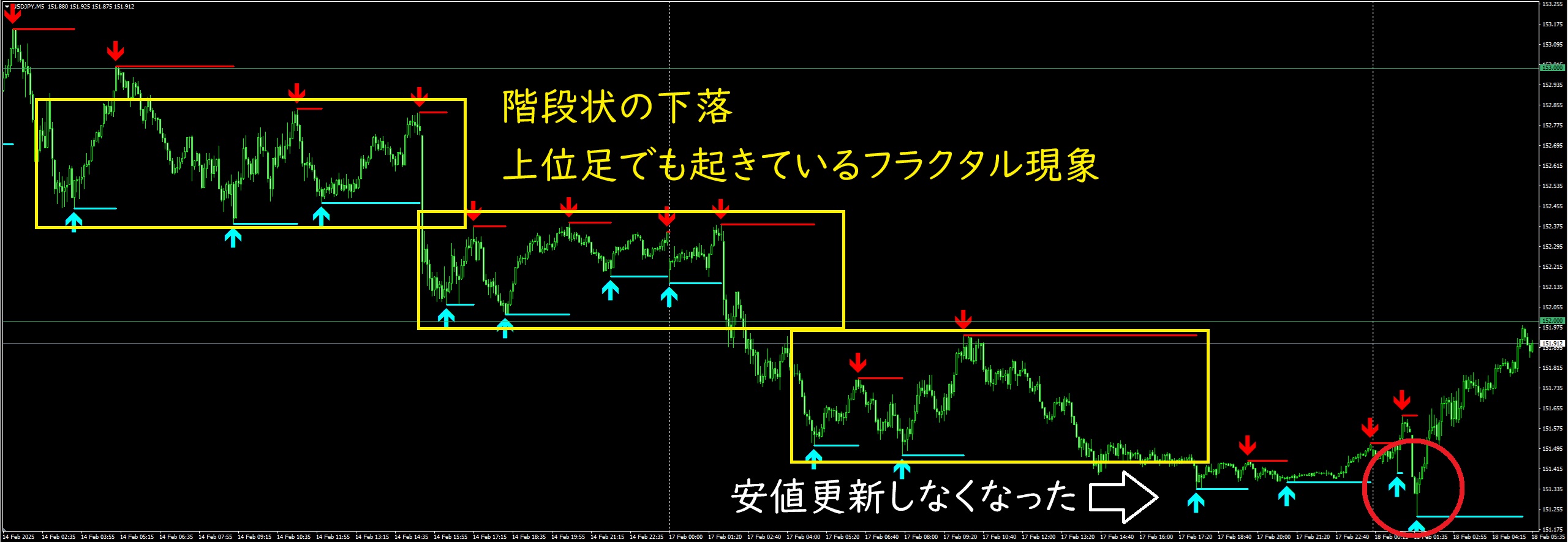

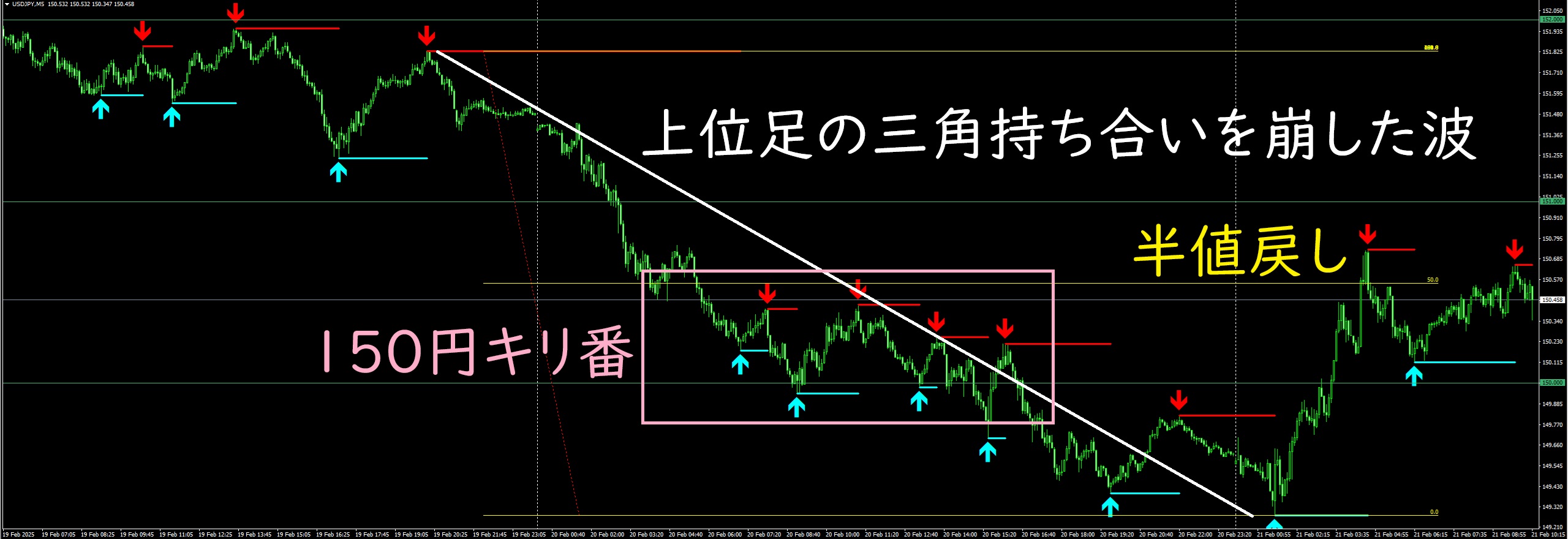

On February 20, Tokyo time, it broke the long-standing triangle consolidation at the 1–4 hour levels and, as planned, dropped smoothly to the next milestone at 150 yen.

At that 150 yen (pink box), there was a period of struggle, and then the sellers gained the upper hand and it fell further.

Today began with a pullback to that downward move, and while it stopped at the half-way retracement as theory suggests, the speed of the rebound was fast.

After that, energy depleted and volatility converged... a small triangle consolidation began forming.

Today there are the highly watched US PMI and existing home sales ahead, so until then active buying and selling are unlikely to occur.

Also, since today is Friday, the weekend tendency for somewhat unusual price movements is expected.

The original indicator I use is available for free download.

↓ Download here

And this is the current (February 21, 2025, 17:30) USD/JPY 5-minute chart.

On February 20, Tokyo time, it broke the long-standing triangle consolidation at the 1–4 hour levels and, as planned, dropped smoothly to the next milestone at 150 yen.

At that 150 yen (pink box), there was a period of struggle, and then the sellers gained the upper hand and it fell further.

Today began with a pullback to that downward move, and while it stopped at the half-way retracement as theory suggests, the speed of the rebound was fast.

After that, energy depleted and volatility converged... a small triangle consolidation began forming.

Today there are the highly watched US PMI and existing home sales ahead, so until then active buying and selling are unlikely to occur.

Also, since today is Friday, the weekend tendency for somewhat unusual price movements is expected.

The original indicator I use is available for free download.

↓ Download here

× ![]()