1/23 USD/JPY rises before tomorrow's Bank of Japan policy deliberations meeting; whack-a-mole strategy

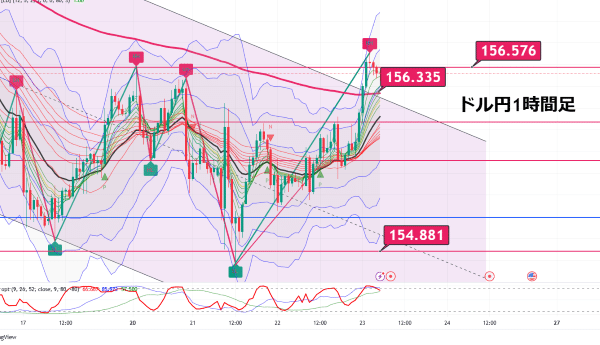

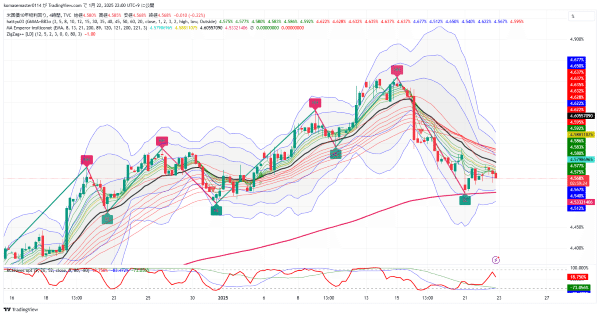

Dollar/Yen 1-hour chart

It broke the range I pointed out yesterday during NY hours

Also broke the downtrend channel

If aiming for a pullback, probably around 156.3

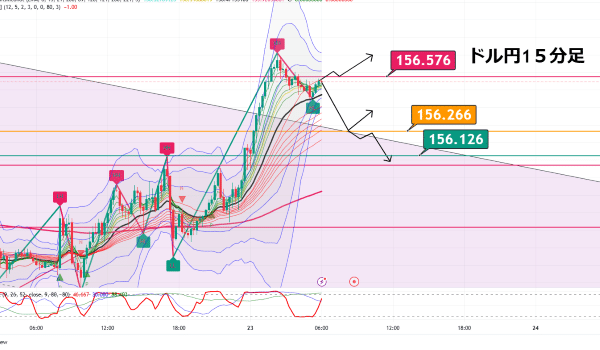

This is the 15-minute chart

From a short-term view, the 200 MA on the hourly chart

and the recent rise’s 0.382 pullback is around 156.266

There is a resistance here; will it rebound

or break and head toward half of that, 156.126

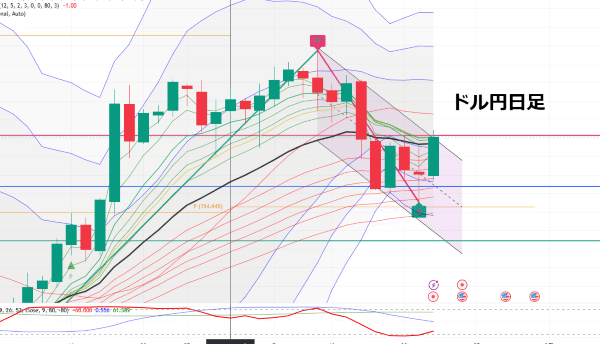

On the daily chart,

There is a strong bullish candle from the bottom to the top of the range

but it can still be viewed as within a downtrend channel

With tomorrow’s BOJ rate hike widely anticipated

there doesn’t seem to be energy to push USD/JPY higher unless

there are strong headlines

On the 4-hour chart, a W-bottom is forming, but now it’s a moment of whether it can breakout and rise

Even if it rises, given the positions, it may go only to around 157.0

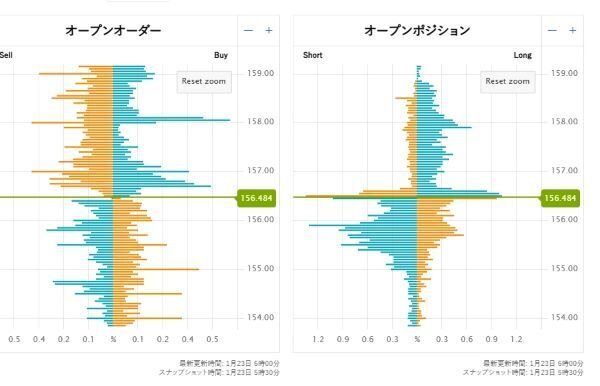

And

The traders who have been buying up to now, at some point, will start to adjust their positions somewhere?

They will be hammered by the market

Longs should be cautious

Next focal point: BOJ Policy Meeting

After President Trump’s inauguration concludes,

many executive orders have been issued

A new era begins, but

the market’s attention is on tariffs.

So far, the market doesn’t seem to fear as much as

it would be quickly adapted.

However, this is also a matter of President Trump’s mindset.

If on February 1st he taxes Canada, Mexico, and China as rumored,

the market would be shaken, wouldn’t it

Currently, market participants seem to be focusing on the positive aspects of the Trump administration, but

with time, that will be lost.

In particular, if Mr. Trump himself issues his own cryptocurrency

and pursues personal gain,

no matter how one excuses it, it will be harsh.

U.S. yields have remained low, but

if U.S. long-term yields resume rising, the market will become unsettled

In a medium-term view, the USD/JPY pair

may be near its highs.