Be cautious of the 1/22 dollar/yen headline and aim for a short-term pullback selling opportunity

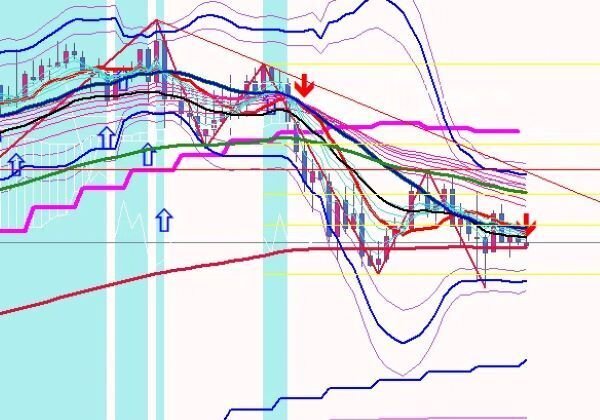

USD/JPY 4-hour chart

This is the swing chart view

There are signs of a downside move,

but we won't go short right away

We are aiming for a pullback

Whether it can be pulled toward near the green 75 EMA line (156.26)

has yet to break through the red 200 EMA line (155.38),

and even if it breaks, it is being pulled back

This is a downtrend

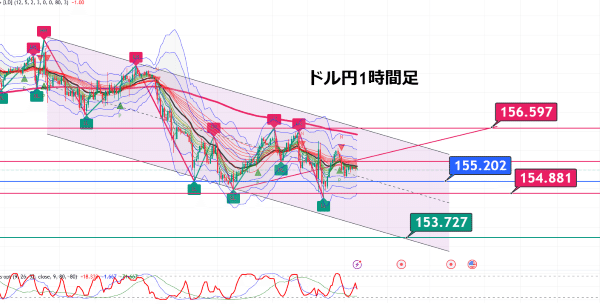

Looking at the 1-hour chart

Inside a descending channel

The range is between the red lines 154.881 and 156.597

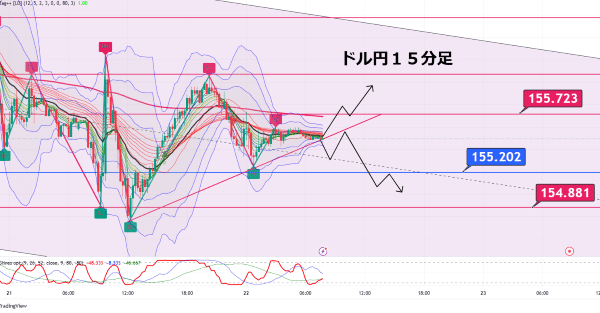

When viewed on the 15-minute chart

The image is to look for selling on a pullback after breaking the short-term uptrend line

Then see whether it breaks the blue line and extends

The resistance at 155.723 seems thick above, but breaking it could lead to extension

Today, will we see movement influenced by headlines as well?

If any, it would be upward

Trump Inauguration Speech

In President Trump’s second term,

the inaugural address differed from the first term, becoming quite

specific in its content

However, in terms of market reaction, it was not as much as on the inauguration day

when WSJ reported that new tariffs would be postponed on the first day

and the dollar/yen surged.

But yesterday morning, it was reported that Canada and Mexico would face 25% tariffs on February 1,

and the market swung strongly in the opposite direction again.

If President Trump imposes tariffs eventually,

the euro/dollar would be sold on retracements, and dollar/Canada

is likely better bought dollar-wise.

That said, Trump’s tone has softened compared with the campaign,

which is also noteworthy. There is a possibility of tariffs on China or Canada without warning,

but for now, it is a matter of reviewing progress up to now,

and this seems prudent.

If so, it would be dangerous to push for too aggressive a trading approach. The momentum may still be fading.

It still may be possible to react even after the noise has completely passed.

With the U.S. holiday behind us and looking toward the BOJ, is today the start of real trading?

However, headlines must be watched, so

I will stick to short-term trading