1/17 Will USD/JPY break below 155? Even with a range of 155.075–156.30, it remains a good area to sell on rallies.

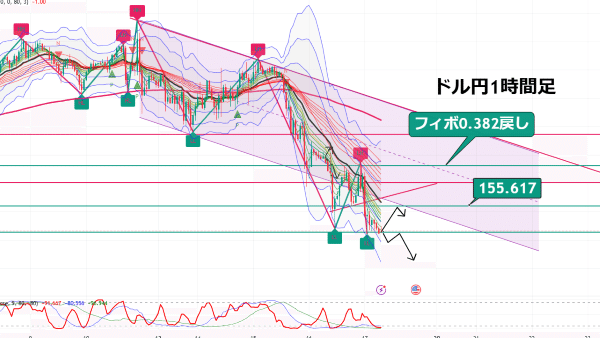

USD/JPY 1-hour chart

It retraced to 0.382 of the decline from the US CPI drop

Nice timing? With retail sales

and

Philadelphia Fed manufacturing index

I fell sharply

It seems the Philadelphia Fed index drew more attention

breaking successive levels and in a strong downtrend

Now it is rebounding at the point of making a new low

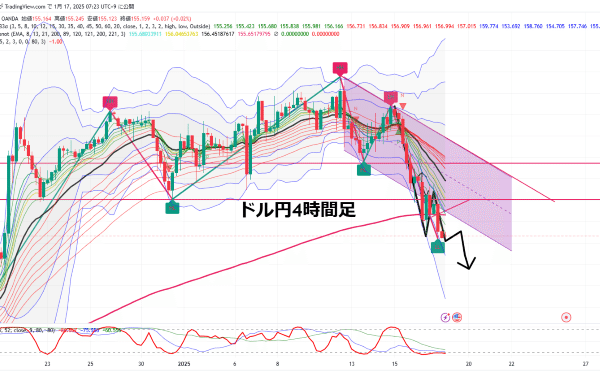

4-hour chart

The key is the recent low break

In lower timeframes it often breaks and continues down

Even if it rises in the short term, will the view stay bearish?

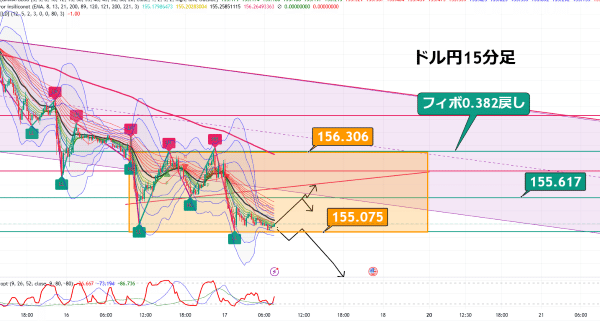

15-minute chart

The decline is slowing,

it might form a cup-with-handle bottom for a long entry

With the inauguration approaching, trading may be restrained,

so I expect a rebound to form an orange range

Whether it breaks below 155 yen is the key

Dollar/yen falls on expectations of BOJ rate hike

US CPI shows a softening in the

year-over-year core CPI,

leading to dollar selling pressure.

Euro/dollar and especially pound/dollar

had been building positions

and were bought back,

but ultimately

with expectations of BOJ rate hikes,

the result is a cross-yen downmove.

There was renewed talk of BOJ rate hikes,

and dollar/yen fell to the high 155s

but

With President Trump's inauguration on January 20 approaching,

we don't know what kind of remarks the President will make

on that day,

so position adjustments are quick.

Last night’s US retail figures

[US] Retail Sales MoM (Dec) [0.7%]

Forecast: 0.6%

Result: 0.4%

[US] Philadelphia Fed Manufacturing Index (Jan) [-16.4]

Forecast: -5.0

Result: 44.3

[US] Retail Sales Ex Auto MoM (Dec) [0.2%]

Forecast: 0.4%

Result: 0.4%

These numbers moved the market up and down violently,

showing the market’s indecision,

but in the end the dollar/yen declined

It feels like a downtrend has developed

With Trump’s inauguration early next week, a rebound is anticipated

and some buying may come from position adjustments, but