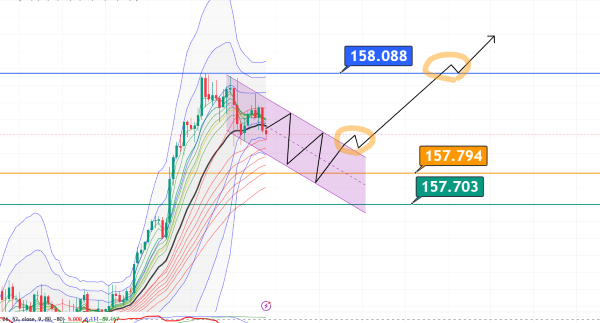

I want to wait for a pullback near 157.8 yen per dollar

This is the USD/JPY 15-minute chart

A decline after climbing into the 158 yen range

Will there be a pullback up to the orange line at the 0.382 Fibonacci level?

The green line is the half retracement

If a flag forms and it rises, the orange circle would be the entry point

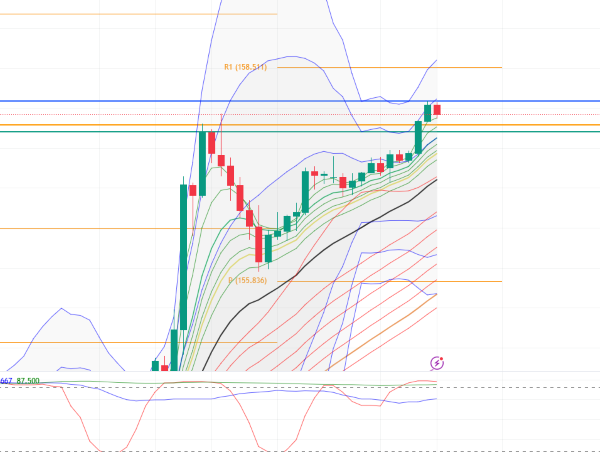

Looking at the 4-hour chart

The previous high area around 157.703–157.794 acts as a resistance

If it breaks above the high of 155.088 and rises

it may aim for the pivot line at 158.511

Santa Claus Rally

Yesterday, the UK market was closed for Boxing Day

The US market traded as usual

On the 25th, Ueda's speech to Keidanren was

extremely neutral in content.

After the BOJ policy meeting on the 19th, the USD/JPY surged

but there were no words to halt the yen’s weakness

During year-end and New Year, Japan will be closed,

and tightening comments or market intervention to curb yen weakness

seem unlikely. With the US in transition to the Trump administration,

and with Yellen indicating possible intervention,

we cannot know how the Trump administration would react

or what the response would be

from them.

Therefore, the year-end and New Year market may see the USD/JPY

rise further.

Many expect a test of 160 yen while keeping long positions

as a possibility.

U.S. initial jobless claims unexpectedly rose to a multi-year high,

while continuing claims remained elevated at around 3-year highs

the market reacted and the USD/JPY rose

the market tends to bake in favorable information

On the other hand

“The BOJ’s assessment shows that rate hikes won’t push debt into default even at 2% policy rate.”

There was no reaction to this

However,

as the USD/JPY pulled back from its elevated level,

there may be a scenario where some reason is given to push it down

× ![]()