The dollar/yen pair remains in a buy-the-dip stance, waiting for a break below 157 yen

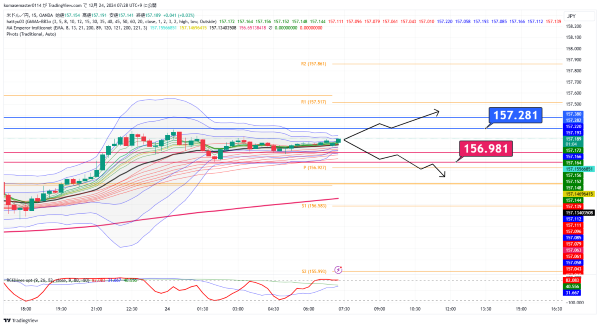

Dollar/Yen 15-minute chart

The bias is bullish, but

we want a pullback

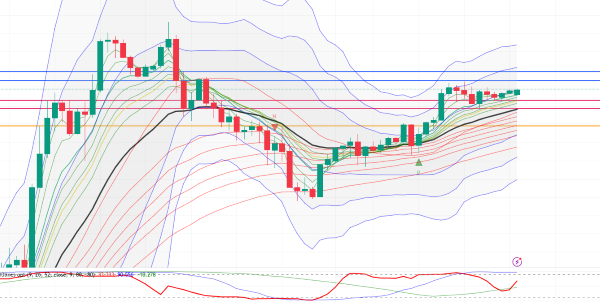

looking at the 4-hour chart

this is the image

a rise after forming a descending flag

when viewed on the 1-hour chart

there is a wall around 157.0

whether to break this and push a bit more

the week of Christmas

We have entered the week of Christmas.

there are many holidays in overseas markets,

there are times when trading is not possible.

we should be careful about spreads

tomorrow, the 25th, is Christmas. Most markets outside Japan are closed.

for the market as well, from Japan time evening

until the morning of the 26th, effectively

trading will be unavailable, so be careful.

the 26th is Boxing Day,

and many Christian countries, including the UK, are closed.

therefore, the market is expected to fully resume on

the 27th (Fri) or the following week?

in this context, last week there was a dovish

remarks by Governor Ueda that led to a yen depreciation,

and at the 27th (Fri) the Bank of Japan Policy Meeting

“main opinions” will be released.

there is a possibility of mild yen strengthening.

also, as I mentioned yesterday

on the 25th (Wed) Governor Ueda will give a speech.

Even across the year, the market's most ill-timed moments for speeches are

rarely at times where a hawkish tone could cause some reaction,

and this time might elicit a reaction, unlike last week.

while hoping for Governor Ueda’s Christmas present

the dollar/yen remains in a pullback-buy stance.

× ![]()