Dollar-yen: Try 160 again before President Trump’s birth?

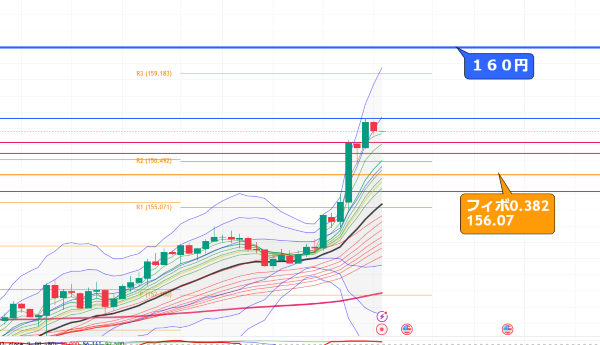

This is the USD/JPY 15-minute chart.

It surged sharply, didn't it?

It seems to be driven by the FOMC and Bank of Japan results.

I was waiting for a squeeze in anticipation of Ueda's hawkish comments, but

there was nothing of that, and it rose strongly.

The fervor has cooled for the time being, reaching a level where verbal intervention is in mind.

It was said to head to 155 yen,

but now it’s aiming for 160 yen.

This is a place where I’d like a pullback for now.

Could there be profit-taking sales around noon today with verbal intervention in mind?

Maybe around 10:00?

Just imagining it.

On the 4-hour chart

There is still some way to go to 160 yen.

Until then, intervention is strongly anticipated.

The 50-period moving average is turning up.

Will it come near the 156.0 area around Fibonacci 0.382?

There is still more than 1 yen to go.

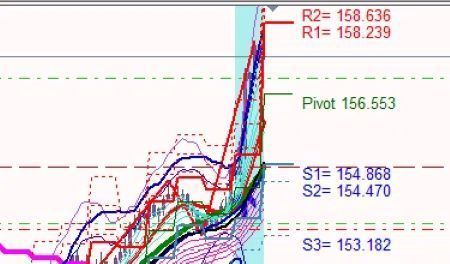

This is the 1-hour chart.

There is a red resistance-support line before that.

Would it come near around 157.0?

This area also serves as a mid-point pullback line from the recent rise.

Today, everyone aims for a pullback.

What is the target?

Trade while being aware of where losses would be cut.

For reference, pivot lines.

The upper target seems to be around 158.23 for the time being.

At yesterday's FOMC, a 0.25% rate cut was decided,

Regarding further rate cuts in the coming years,

the market seems to have judged that there will be little to none.

The dot plot indicates two rate cuts by the end of 2025,

but the market sees that only one cut will keep rates at 4%.

Neutral rate has shifted higher, and those who opposed rate cuts (Hammock,

President of the Cleveland Fed) were also present,

and essentially the sentiment is that rate cuts have paused.

On the other hand, the BOJ did not change policy,

and their press conference remained dovish.

With the yen weakening,

there is a risk that inflation would rise,

as mentioned in a November Nikkei interview,

but this time the rise in import prices year-over-year is

expected to be somewhat limited.

There is no sense of a January rate hike, and they are hawkish,

When considering the FOMC together, the dollar-yen

risks of rising have increased.

Before President Trump’s inauguration, it might try again to reach 160 yen.

It might try again.

× ![]()