As expected, it’s a USD/JPY position adjustment plus long-side hunting.

Good morning

This is the scenario as of 5 a.m.

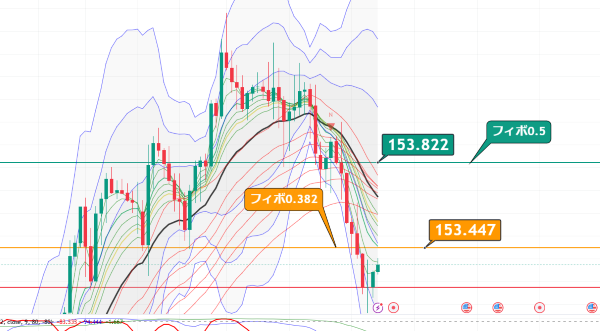

This is the USD/JPY 4-hour chart

It was pushed up by US retail sales, wasn’t it?

Still, looking at the 4-hour chart, it isn’t that large

Around the 0.236 Fibonacci level

We can still imagine lower levels, but

for now, it’s a retracement phase

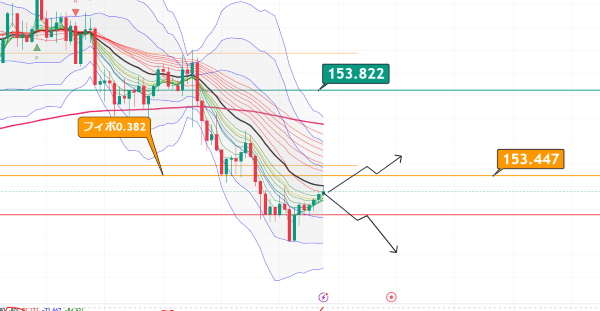

On the 1-hour chart

The 0.382 Fibonacci retracement was achieved while I was writing this

From the 15-minute chart, it looked like this, though…

The dollar is strong, isn’t it?

When I look at my MT4 5-minute chart

Huh—could this be

The blue 1-hour MA is below,

If we can break through here

a major bottom long?

I’ve explained the major bottom long here

https://www.gogojungle.co.jp/tools/ebooks/52653?via=users_products

This is the image

I wonder what will happen?

Right now, the 1-hour MA is holding the top

November US retail sales showed solid growth

Notably the increases in autos and online shopping,

while other sectors were mixed in strength

【US】 Retail Sales (ex-auto) MoM (November) [0.1%]

Forecast: 0.4%

Actual: 0.2%

【US】 Retail Sales MoM (November) [0.4%]

Forecast: 0.5%

Actual: 0.7%

With this result, will there be a fall of about 1 yen or more?

FOMC, awaiting BOJ

FOMC, and the Bank of Japan policy meeting

and other major events will continue to follow

and we are in a waiting state for those events.

The market isn’t moving much

In the USD/JPY case, since the market was

short, gradually

the short-cover pushed the market higher

Now it’s the turn for long positions to take profits

to enter the phase.

In particular, with no catalysts, it’s just

pushing to wipe out short-term traders’ positions

× ![]()