To English (keeping HTML format, no code block, no line breaks): Eventually dollar appreciation? USD/JPY seems to rebound around 153.9~

Good morning

This is the morning meeting on 12/17

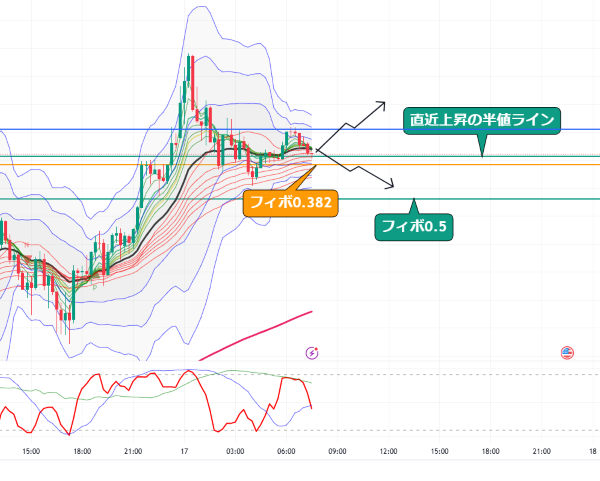

USD/JPY 15-minute chart

In December, the US Manufacturing PMI fell to 48.3. Services PMI rose to 58.5

In response, the USD/JPY also rose; it is currently near a rebound after breaking through the 0.382 Fibonacci retracement line from a major rally

around the mid-point retracement

For a while, I think it will trade in a range between the blue line and the orange line, but

which will break first remains to be seen

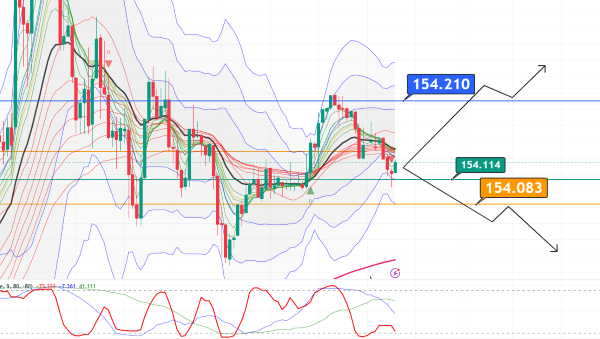

Viewed on a 5-minute chart

Long-term GMMA is pointing up

We will see if it can break below 154.0

Looking at the hourly chart from a distance

Even if it falls, a rebound around 153.96 could be seen

Looking at the pivot line

There is a wall around 153.97

Tonight's US retail sales will be watched, but

as it has been rising, it could serve as a trigger for position adjustments before the FOMC

Even if the result is strong, initially there may be selling?

I am imagining such a scenario

Ultimately, I am secretly expecting dollar strength

Almost daily“No rate hike from the Bank of Japan”

is the expectation in reports, and long yen position holders

are being forced to cut losses by overseas hedge fund players

making USD/JPY firmer

At the FOMC, a 0.25% rate cut is viewed as certain, but

there is talk of signaling a slow pace of rate cuts

from Chair Powell

I also anticipate a hawkish Powell

More attention is on the dot plot than the rate cut; compared to September it appears to shift higher

If the dot plot shifts higher, USD/JPY will

have a harder time falling

USD/JPY may fall for a moment but then drift higher again

.

× ![]()