I have a bullish view on USD/JPY but I’d like a pullback to around 153.30.

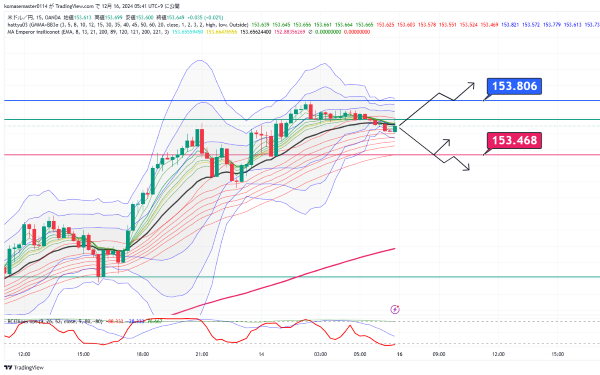

Dollar/Yen 15-minute chart

In the short term, it seems it may create a temporary pullback

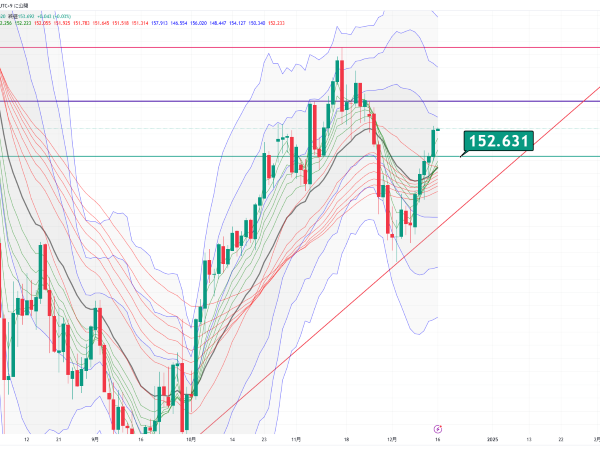

This is the 1-hour chart

Long-term GMMA is rising

Will it come to the black 25-period moving average line or the recent rebound line?

The half-line of the daily chart is 152.631

Before the FOMC, surely it won’t come to this level?

But you never know what lies ahead in the market

Policy of the FOMC and the Bank of Japan

The Bank of Japan will inevitably align its timing with changes in the U.S. policy

and set it against the U.S. timing

so that

when the U.S. is cutting rates, it makes sense

If the U.S. does not cut rates and the BOJ raises rates alone

the impact will still be small

As for the U.S., there is still a 4.75% range of rate cuts available

There is quite a lot of ammunition left

On the other hand, for Japan, almost none of this rate-hiking ammunition remains

Even if they say it would be 1%,

we are currently at 0.25%, so only three more moves remain

Whether those three moves can be made

Each move carries increasingly heavy weight

Therefore, ideally, Japan would like to act at the same time as the U.S. policy change

Hence, there is talk that perhaps the BOJ might not move in December this time

There is even speculation that perhaps the U.S. might not either

I want to believe, but I also have some doubts

“If the BOJ’s rate hike is postponed, maybe the FMC’s rate cut could be postponed as well

to be postponed as well?”

From the statements of participants before the FOMC blackout, such thoughts arise

This evening, I will let my imagination run based on tonight’s and tomorrow’s index releases

× ![]()