I imagined a whole week starting from 12/16 to the fullest~

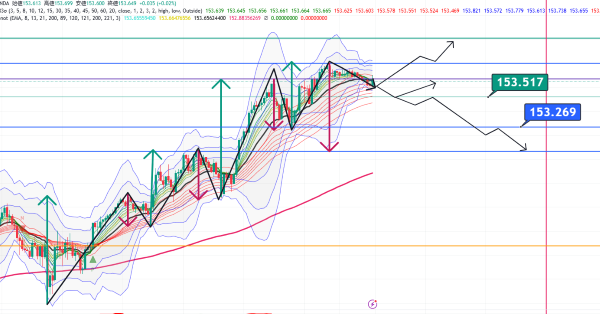

Dollar/Yen 15-minute chart

Currently aiming for a pullback within an uptrend

From a short-term perspective

the buying pressure seems to be weakening a bit

Conversely, selling pressure appears to be gradually strengthening

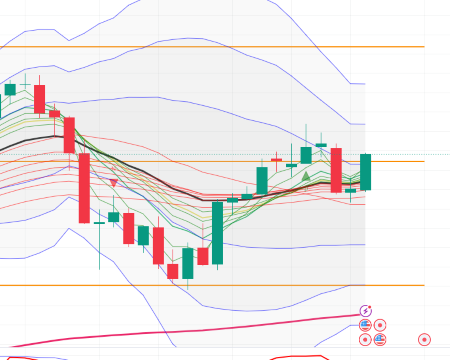

On the weekly chart, strong upward movement after a strong bearish candlestick

On the 4-hour chart

There are views that it’s rising toward the 155 yen level

Currently at the position of the major downside Fibonacci retracement 0.618

From here, a pullback would be desirable for an upward move

The recent upward counter-move is around 153.5

On the hourly chart

It is clearly in an uptrend

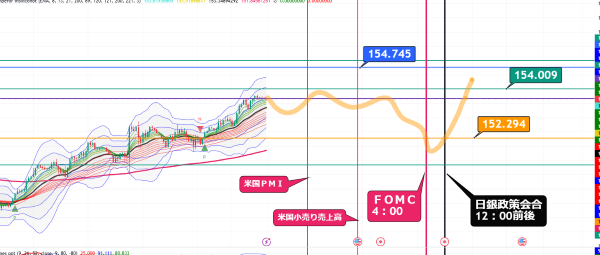

The week starting on the 16th is filled with data releases

The orange line is an assumed image

Before the FOMC, I think the positions will be unwound by more people

Although already priced in, a fall followed by a rise is expected after the FOMC announcement

In reality, the market’s probability of a 0.25% rate cut at December FOMC is

around 96.4% near noon on Friday, December 13,

and a rate cut is highly expected.

Although US rate cuts are expected,

what about Japan’s Rate hike?

Similarly, looking at market expectations,

the probability of a rate hike at the January meeting next year is 72.2%,

but the probability of a rate hike at this December meeting is only 16.2%, which is quite low.

In other words, the market is pricing in a rate hike not for this December but for January next year.

A rising yen depreciation implies a rate hike after all

which would cause a crash, so beware

Whether it will be as the market expects or if there will be some turbulence.

Pay close attention to the movements of U.S. and Japanese financial authorities next week

The Bank of Japan's Quarterly Outlook Report was slightly better than expected,

but it did not justify a rate hike

JGBs rose to around 1.03% on short-covering (yields fell).

At the FOMC, a 0.25% rate cut will occur,

but the dot plot and other details are expected to be hawkish,

leading to a dollar strength, higher U.S. rates, and selling of safe-haven currencies

such as the Swiss franc and

the yenas the flow continues.

So-called risk-on.

In the near term, this trend may continue

× ![]()