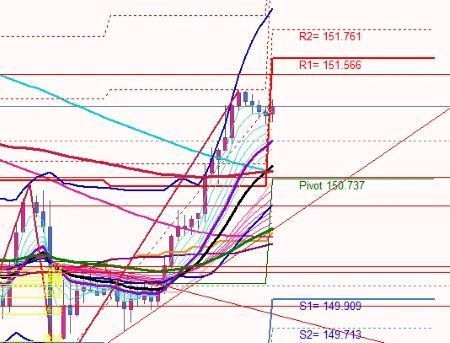

Before the US CPI, the USD/JPY range is perhaps around 150.737 to 151.566.

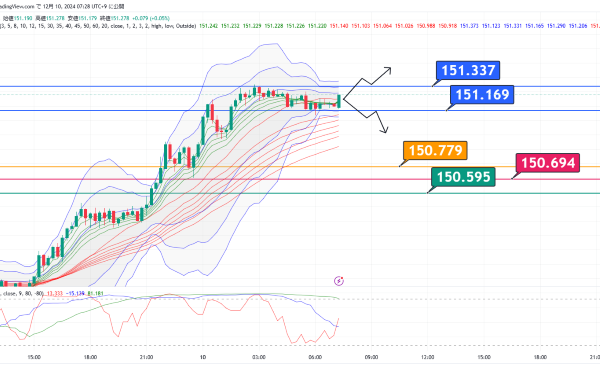

In the short term

151.337 Break Long

151.169 Break Short

The orange line below is the Fibonacci 0.382 (Pivot line is nearby as well)

Red is the resistance/support line

Green is the half-fib retracement line

How far will it push down if it does?

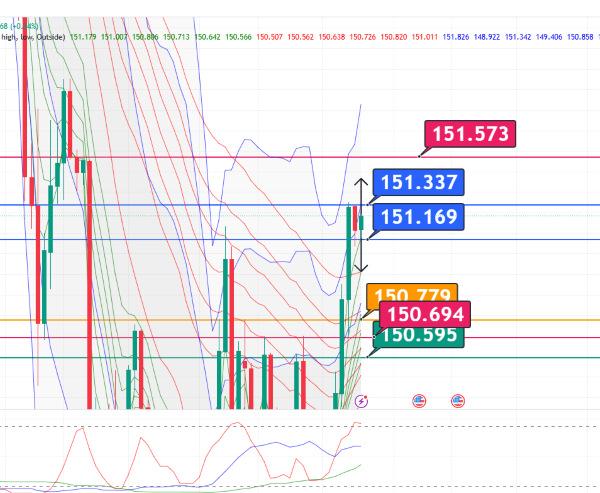

Looking from the 4-hour chart,

Around 151.537 is a resistance/support line

Will it go up to the next higher high?

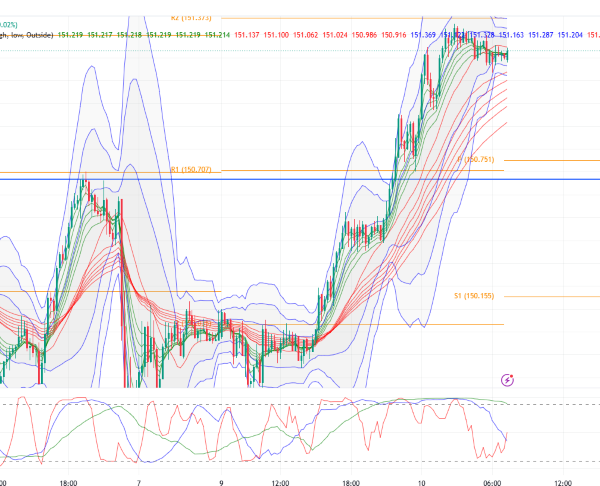

Viewed on the 15-minute USD/JPY chart from a distance

It forms a clean bottom-long chart pattern

How far will it go?

From the pivot line, it may reach around 151.761

In the New York foreign exchange market

, with China signaling stronger stimulus, risk-on mood rose,

commodity currencies such as the Australian dollar, New Zealand dollar, and Norwegian krone were bought

while currencies considered safe assets were sold

The yen fell to the low 151s against the dollar. As U.S. time began,

a gradual decline expanded.

The Bank of Japan’s rate hike expectations for December appear to be fading

since the Bank of Japan policy meeting is scheduled the day after the FOMC results are announced,

there is a growing view that Japan would find it difficult to raise rates immediately after U.S. rate cuts

If U.S. rate cuts occur,

Japan would likely also refrain from hiking,

leading to expectations that the USD/JPY would struggle to move lower

since they want to hold off on rate hikes to prevent a further yen depreciation

if so, at the current level around 150 yen

it would mean the ace cannot be used

Yesterday's headline

“USD/JPY will it break out of the 150.707–149.369 range?”

It has broken out, hasn't it?

Today, the range seems likely to continue, but what will happen?

× ![]()