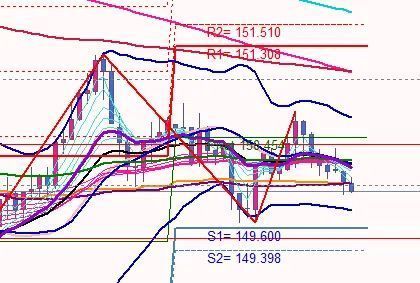

Employment statistics before: Is the USD/JPY in the 149.608~150.72 range?

This is the USD/JPY 1-hour chart today

Anticipating the movement inside the Purple Gene ahead of the employment statistics

First, a triangular consolidation is forming,

and which direction it will breakout

If it breaks to the downside, it could fall sharply

It might even break through 149.624

Above, the Fibonacci 38.2% and the black 25 MA line overlap, making a thick wall

Even by yesterday's pivot line,

it was between S1 and R1

Today149.608~150.728is narrowing

There is also speculation that the employment data could be strong

There may be upward movement before the release, or attempts to sell

If the Bank of Japan raises rates as planned, the yen would weaken, so December

Otherwise, the market is beginning to think January

So now, it may be better to go short after it rises

Therefore, if the employment data rises, I will aggressively target shorts

I think it could rise by 50–100 pips

Nakamura: “I am not against rate hikes”

The Jiji Press and MNI reported that at the December meeting,

a rate hike would be delayed,

and the USD/JPY and cross rates were all bought back in one swoop

With the hawkish Nakamura’s speech

they expect that it will be a hawkish content that does not oppose rate hikes

and thus a yen selling and dollar buying sentiment

led to a yen-selling, dollar-buying lead

“I am not against rate hikes”

in the Q&A, and temporarily

the USD/JPY plunged to around 149.65

Whether the Bank of Japan raises rates in December,

or in January, is gradually becoming ambiguous

Therefore, if the yen had been weakening, they would choose to raise rates,

but if it is moving toward stronger yen,

they may refrain from raising rates

The upside limit is reached, and the downside limit is as well. In conclusion,

it would be an uninteresting outcome, but it is the usual pattern

not to reach the level of the BoJ chief's FOMC,

and with limited yen depreciation, selling on rallies is probably better

so targeting returns from selling on rallies is best

given the yen’s limits

which makes selling on rallies favorable

× ![]()