I fully envisioned the dollar-yen for the beginning of next week

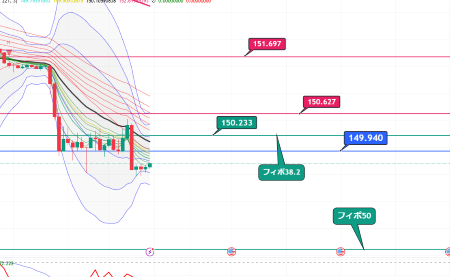

This is the USD/JPY 15-minute chart

Is a falling knife starting to roll?

It looks like it may form a flag and rise

There is a thick wall near 149.94 on the blue line

I’m assuming there will be a rebound and drop here

If a breakout to the upside occurs, viewed on the daily chart

It might aim for around 150.233 near the 0.382 fib

On the daily chart, if the decline continues, 148.175 would be the retracement line

Around 150.233 there is the red 200MA as well, so the wall seems strong

Four-hour chart

GMMA is in a downtrend

150.233 is the most recent high,

If this breaks and rises, it could go higher

One-hour chart

Short-term resistance level is near 149.94 on the blue line

This might be a good spot to target a short scalp

Also considered is a five-minute chart

In the short term, a shape of a long from a major bottom could form

After a rise forming a flag (purple channel)

there could be a sharp drop from around the blue line

Trend read from the chart

Looking at it with a different view, on the four-hour chart

After a strong downward pressure emerged

the pressure is gradually easing

Right now we are mid-wave 3

Another drop could occur

Even if it rises,

the pressure may become even smaller

(Numbers are for reference, please interpret as an image)

Tokyo Metropolitan Area CPI, 2.2%, above expectations

The Tokyo CPI rose to

2.2%, beating the expected 2.1%,

leading to dollar selling and yen buying

Black Friday the day after Thanksgiving in the US,

usually a thin, uneventful market

turns out to be volatile

Even before the data release, the USD/JPY had been breaking down

there is speculation that the leak of information may have occurred

is circulating

This is something that could happen in Japan

Immediately at the release, there was a flood of selling,

and it seems odd for the moves of overseas traders who should be resting

somehow suspicious

At the BOJ policy meeting next month,

the possibility of additional rate hikes

is rising

The Overnight Index Swap (OIS), reflecting market expectations for policy,

prices in about a 60% chance of a December rate hike,

about an 80% chance by January next year

The main driver of USD/JPY selling is overseas players.

They have accumulated

long USD/JPY positions and are now closing them

and turning into outright shorts

With a new president and new finance minister decided,

the dollar is being sold,

perhaps this is a new trend

It was a Saturday filled with various fantasies

Looking forward to next week

× ![]()