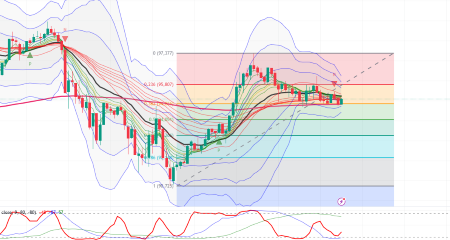

Today I’m aiming for a pullback sell after another move into the 152 yen range.

This is the USD/JPY 15-minute chart; I’ve left yesterday’s scenario in place as well.

We saw a reversal and decline in the purple zone that was broadcast mid-stream.

Today, will it break through the wall around 151.953 and aim for 152.462?

If it breaks below 151.377, a move to the 150s is possible.

Today is Black Friday in the United States.

Pay attention to the moves after yesterday’s Thanksgiving.

Many market participants are on holidays, so it could be a day with low volatility.

Yesterday, dollar settlement was not possible, so there was less demand at the Tokyo Fix, lacking momentum.

What about today?

Is the expectation for the start of next week on Monday?

Won’t there be some position adjustments and a recovery in buying as well?

U.S. 10-year yield hourly chart.

It’s in a downtrend; it has bounced back a bit.

There may be a short-term rebound, but for a while I will assume the USD/JPY will move downward.

As an aside, BTC/USD 1-hour chart.

It’s around the 38.2% fib pullback.

Shall we start buying soon?

Thanksgiving does not move markets

Yesterday was Thanksgiving. As in previous years, this day tends to be almost no-move.

Today’s market is also prone to be quiet, and

the liquidity of the market will not return in earnest until

next week or later.

The USD/JPY experiences a large adjustment.

The main reason is likely position adjustments ahead of Thanksgiving, but

there is also a sense that risk-off yen strength has somewhat returned.

The EUR/USD has also rebounded. In particular, the EUR/USD

from the more hawkish-than-expected remarks by ECB Executive Board member Schnabel

led to expectations of a 0.5% rate cut being less likely

and reduced risk. That is seen as contributing to the sharp rebound in EUR/USD.

From after Thanksgiving, full-scale trading is expected to resume.

When that happens, will U.S. rates rise again and the dollar strengthen,

or will U.S. rates continue to fall, leading to dollar weakness?

This is a difficult situation to judge.

There may be a change in the long-standing yen depreciation trend that has continued for more than two years.

× ![]()